- United States

- /

- IT

- /

- NasdaqGS:CRWV

Top Growth Companies With Strong Insider Confidence November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a robust upswing, with major indexes on track for their best week since June, investor confidence is buoyed by strong performances across various sectors. In this favorable climate, growth companies with high insider ownership are particularly noteworthy as they often signal strong internal confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.5% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Celsius Holdings (CELH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celsius Holdings, Inc. is involved in the development, manufacturing, marketing, and distribution of functional energy drinks globally and has a market cap of approximately $10.51 billion.

Operations: The company's revenue primarily comes from its non-alcoholic beverages segment, which generated approximately $2.13 billion.

Insider Ownership: 13%

Revenue Growth Forecast: 16.7% p.a.

Celsius Holdings is experiencing significant revenue growth, forecasted at 16.7% annually, outpacing the broader US market. Despite a recent net loss of US$61.01 million in Q3 2025, insider transactions have shown more buying than selling over the past three months. The company has initiated a US$300 million share repurchase program and strengthened its strategic partnership with PepsiCo by acquiring Rockstar Energy in the U.S., enhancing its energy drink portfolio and distribution capabilities.

- Take a closer look at Celsius Holdings' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Celsius Holdings' current price could be inflated.

CoreWeave (CRWV)

Simply Wall St Growth Rating: ★★★★★☆

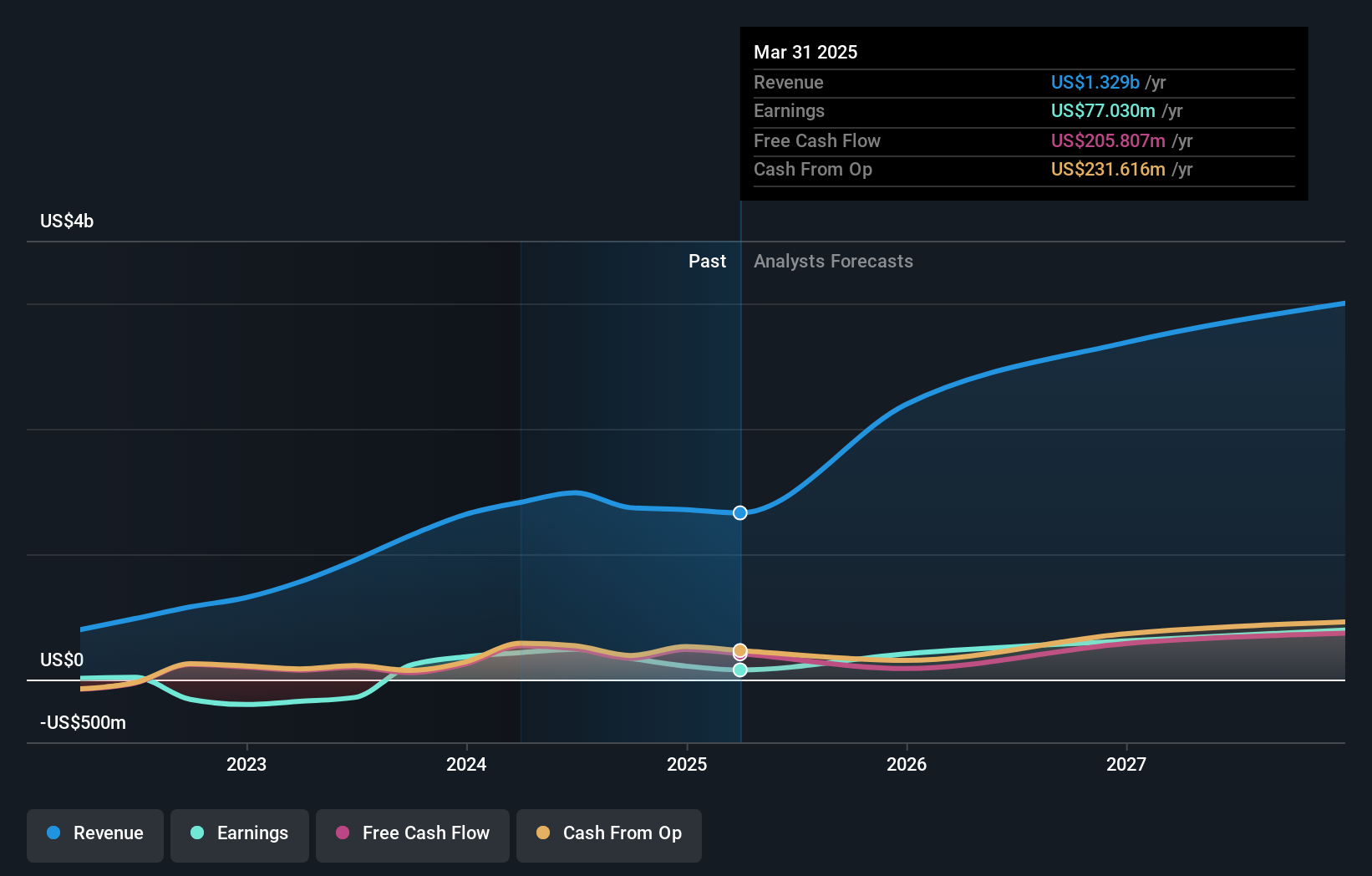

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $37.02 billion.

Operations: The company generates revenue of $4.31 billion from its data processing segment.

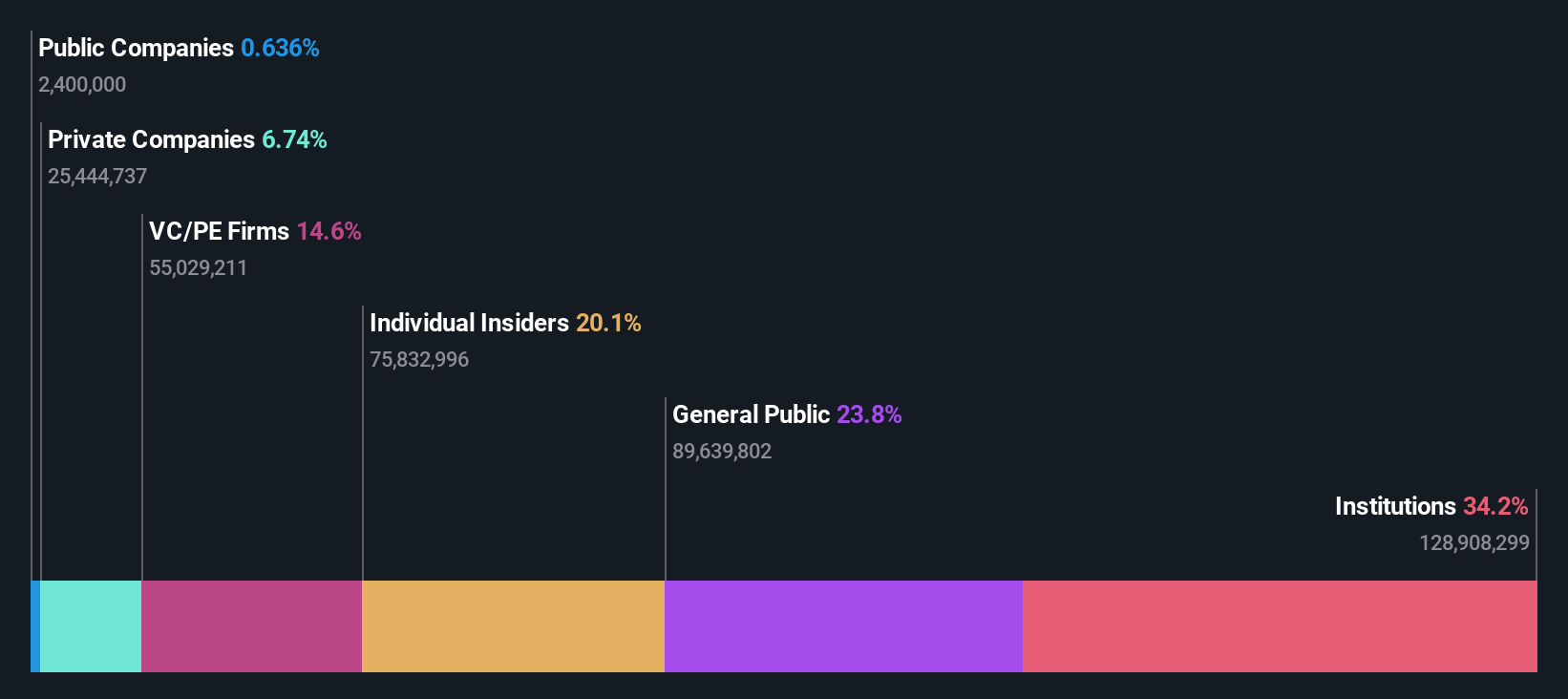

Insider Ownership: 26.9%

Revenue Growth Forecast: 40.8% p.a.

CoreWeave has demonstrated substantial revenue growth, with a 235.4% increase over the past year and forecasts predicting a 40.8% annual rise, surpassing the US market average. Despite recent losses, CoreWeave's strategic initiatives include expanding its credit facility to US$2.5 billion and launching innovative programs like Zero Egress Migration to enhance cloud service offerings. Insider transactions show more buying than selling recently, indicating confidence in its growth trajectory amidst high volatility in share price.

- Click to explore a detailed breakdown of our findings in CoreWeave's earnings growth report.

- In light of our recent valuation report, it seems possible that CoreWeave is trading beyond its estimated value.

Klarna Group (KLAR)

Simply Wall St Growth Rating: ★★★★☆☆

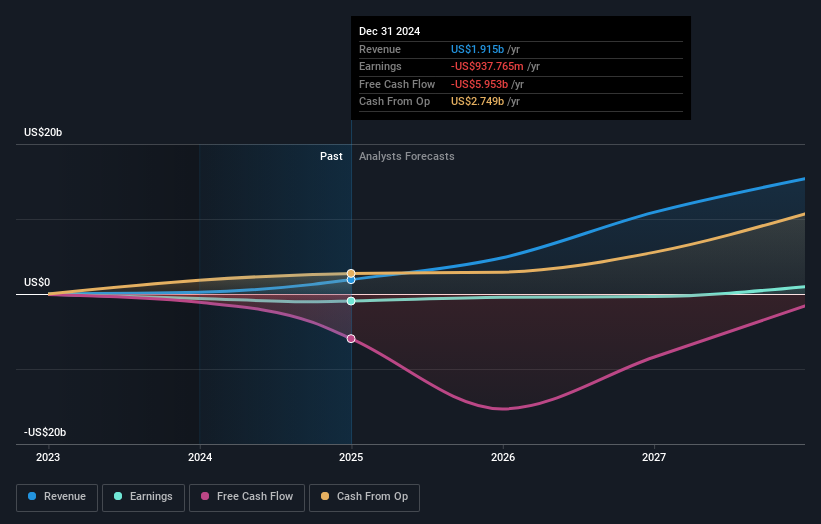

Overview: Klarna Group plc is a technology-driven payments company operating in the United Kingdom, the United States, Germany, Sweden, and internationally with a market cap of $11.68 billion.

Operations: The company generates revenue primarily from its data processing segment, which amounts to $3.21 billion.

Insider Ownership: 20.1%

Revenue Growth Forecast: 19.4% p.a.

Klarna Group has demonstrated significant growth potential, with revenue forecasted to expand by 19.4% annually, surpassing the US market average. Despite recent losses, Klarna's strategic initiatives include launching a stablecoin and expanding partnerships with major brands like Lufthansa and Qatar Airways. The company's IPO raised $1.37 billion, indicating strong market interest. While insider ownership details are limited, Klarna's innovative payment solutions continue to position it as a formidable player in the fintech space amidst evolving consumer demands.

- Get an in-depth perspective on Klarna Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Klarna Group is priced higher than what may be justified by its financials.

Next Steps

- Discover the full array of 197 Fast Growing US Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.