- United States

- /

- IT

- /

- NasdaqGS:CRWV

Growth Companies With High Insider Ownership And Up To 67% Earnings Growth

Reviewed by Simply Wall St

As U.S. markets navigate a period of uncertainty marked by concerns over tariffs and economic outlooks, investors are keenly observing the performance of major indices like the S&P 500 and Nasdaq Composite, which recently experienced setbacks after a brief rally. In such an environment, growth companies with high insider ownership can be particularly appealing, as they often signal confidence from those who know the business best and may offer substantial earnings growth potential despite broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (VCTR) | 10.1% | 32.4% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 66.9% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Chemung Financial (CHMG) | 19.9% | 78.3% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 23.5% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

Let's dive into some prime choices out of the screener.

CoreWeave (CRWV)

Simply Wall St Growth Rating: ★★★★★☆

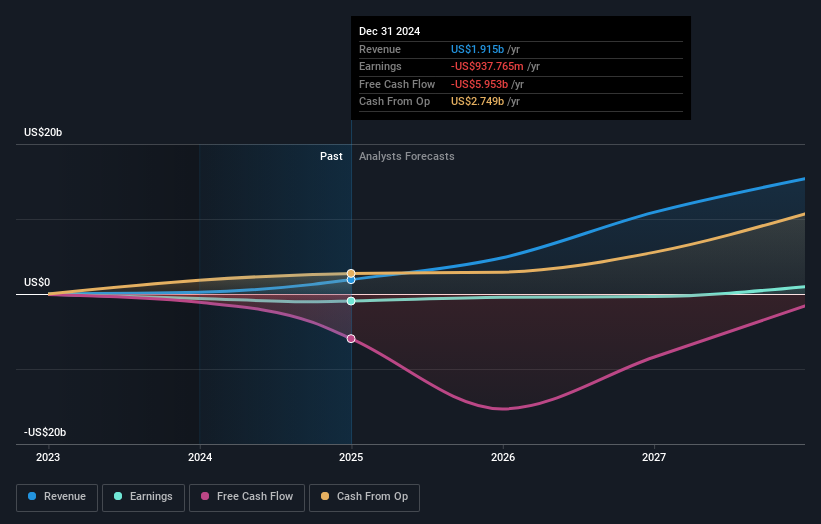

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI, with a market cap of $50.88 billion.

Operations: The company's revenue segment includes Data Processing, generating $2.71 billion.

Insider Ownership: 29.7%

Earnings Growth Forecast: 67.3% p.a.

CoreWeave's substantial insider ownership aligns with its aggressive growth trajectory, marked by a 367.5% revenue increase last year and forecasted annual revenue growth of 37.2%. The company is trading at a significant discount to estimated fair value and is expected to become profitable within three years. Recent financing activities, including a $2.6 billion term loan, bolster its AI infrastructure investments, while partnerships like the $4 billion deal with OpenAI enhance its market position despite high volatility and limited cash runway.

- Take a closer look at CoreWeave's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that CoreWeave is trading beyond its estimated value.

Hesai Group (HSAI)

Simply Wall St Growth Rating: ★★★★★☆

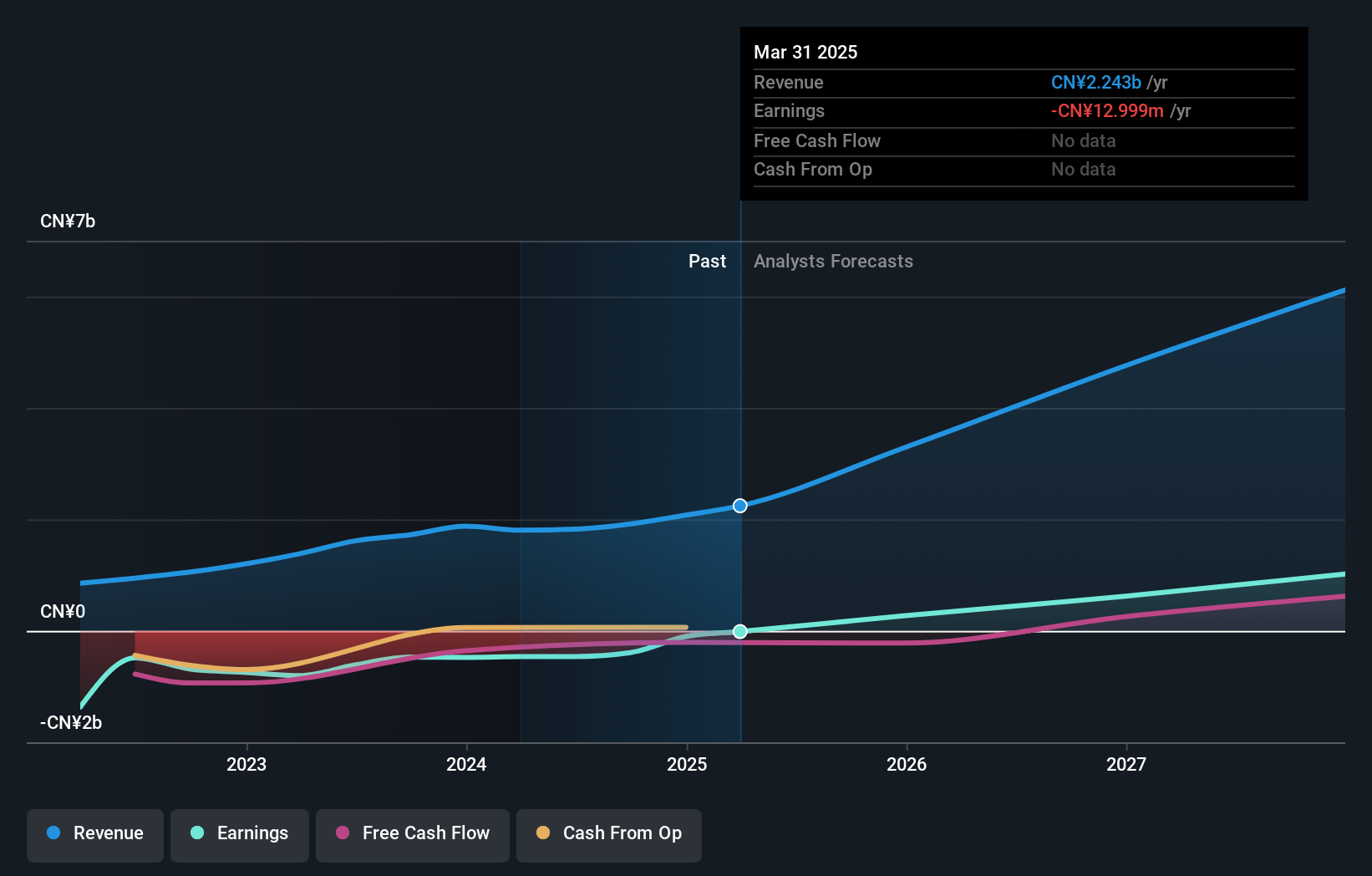

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of approximately $2.68 billion.

Operations: Hesai Group generates revenue through the development, manufacturing, and sales of three-dimensional LiDAR solutions in various regions including Mainland China, Europe, and North America.

Insider Ownership: 21.3%

Earnings Growth Forecast: 45.4% p.a.

Hesai Group's high insider ownership complements its strong growth prospects, with revenue expected to grow 27.1% annually, surpassing the US market average. Despite a volatile share price, Hesai trades at 48% below fair value and is forecasted to become profitable within three years. Recent partnerships in autonomous farming highlight its innovative lidar technology applications. Additionally, legal victories have fortified its IP position, while planned Hong Kong listing discussions indicate strategic expansion efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Hesai Group.

- Our expertly prepared valuation report Hesai Group implies its share price may be lower than expected.

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, along with its subsidiaries, operates as a retailer and lifestyle brand in the home furnishings market across the United States, Canada, the United Kingdom, Germany, Belgium, and Spain with a market cap of approximately $4.06 billion.

Operations: The company's revenue segments include Restoration Hardware (RH) generating $3.08 billion and Waterworks contributing $192 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 42.1% p.a.

RH's insider ownership aligns with its robust growth trajectory, as earnings are forecasted to rise significantly at 42.1% annually, outpacing the US market. Recent expansions in Montreal and Oklahoma City enhance its luxury retail presence, emphasizing immersive experiences. Although revenue growth is slower than the market average, RH trades at a substantial discount to fair value and boasts a high future return on equity of 61.5%, reflecting strong potential for shareholder returns amidst strategic global expansion plans.

- Get an in-depth perspective on RH's performance by reading our analyst estimates report here.

- Our valuation report here indicates RH may be overvalued.

Taking Advantage

- Click here to access our complete index of 182 Fast Growing US Companies With High Insider Ownership.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives