- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): Examining Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

If you’ve been watching CoreWeave (CRWV) lately, the stock’s recent move probably caught your attention. There wasn’t a single headline-driving event or massive product announcement, yet shares have moved enough in the past month to stir debate among investors. Sometimes shifts like this are just noise, but they can also signal changing expectations beneath the surface. That is always worth a closer look.

Looking at the past year, CoreWeave’s shares have rallied more than 130%, even with a sharp dip of 20% in the past month. This pattern is common for fast-growing tech firms. Momentum surged earlier in the year and then cooled for reasons investors are still dissecting. In that context, the current price fluctuations might be testing whether CoreWeave can justify a higher valuation or simply reflect healthy profit-taking after a strong run.

The big question now, after this year’s growth and the recent pullback, is whether CoreWeave is undervalued based on future prospects, or if the market already sees the road ahead clearly priced in.

Price-to-Sales of 12.8x: Is it justified?

CoreWeave is currently trading at a Price-to-Sales (P/S) ratio of 12.8, which is significantly higher than the US IT industry average of 2.3. This suggests that the stock is valued much higher relative to its sales compared to peers in the sector. As a result, some questions may arise about whether the company’s future growth prospects fully justify the premium.

The Price-to-Sales ratio measures how much investors are willing to pay per dollar of sales. This is a useful metric for fast-growing technology companies where profits may not yet reflect underlying momentum. In CoreWeave's case, a high P/S can signal strong revenue growth expectations or excitement about the potential for business model expansion.

A premium valuation like this may often mean the market is betting on substantial future gains. Investors should consider whether current fundamentals and forecasts can support such a multiple, or whether enthusiasm may be outpacing near-term realities.

Result: Fair Value of $92.38 (OVERVALUED)

See our latest analysis for CoreWeave.However, rapid revenue growth may slow, or persistent losses could raise concerns. These factors may potentially challenge the market’s current optimism around CoreWeave’s valuation.

Find out about the key risks to this CoreWeave narrative.Another View: Discounted Cash Flow Tells a Different Story

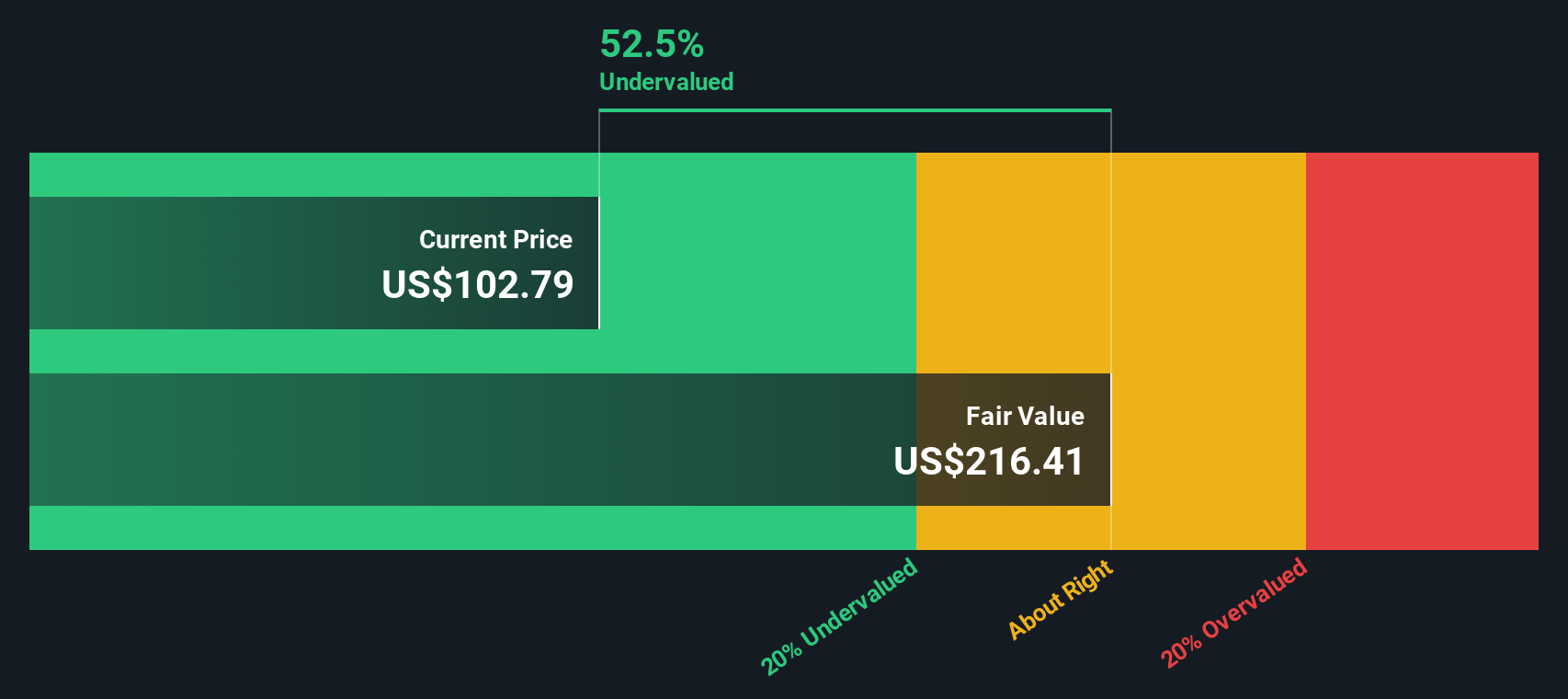

While the sales multiple paints CoreWeave as expensive, our DCF model suggests the shares are actually undervalued. This method examines projected future cash flows and offers a very different perspective. Which view is closer to the truth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you see things differently or would rather dive into the numbers yourself, you have the option to quickly craft your own perspective. Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Don’t settle for just one opportunity when you could be building a portfolio that’s ahead of the curve. Make your next move count with these handpicked stock ideas. Take charge and steer your research where the action is hottest:

- Target high-yield potential and put your cash to work with stocks offering

dividend stocks with yields > 3%. - Seize early growth opportunities by searching the market for penny stocks with strong financials that are making waves with robust financials.

- Pounce on undervalued gems that the crowd may be missing right now using our screen for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives