- United States

- /

- Software

- /

- NasdaqGS:CRWD

Will Legal Win And New AWS Launch Change CrowdStrike’s (CRWD) Narrative?

- The U.S. District Court of Western Texas dismissed a consumer class action against CrowdStrike related to the July 2024 airline software outage, citing federal preemption under the Airline Deregulation Act and removing potential regulatory complications for the company.

- CrowdStrike introduced Falcon for AWS Security Incident Response at AWS re:Inforce 2025, strengthening its cloud security product portfolio and integration within the AWS ecosystem for AI-powered threat detection and streamlined procurement.

- We'll examine how the legal win, reducing liability from the airline incident, shapes CrowdStrike's investment narrative and future outlook.

CrowdStrike Holdings Investment Narrative Recap

CrowdStrike appeals to investors who believe in sustained demand for advanced cybersecurity and cloud-native protection. The recent legal dismissal tied to the July 2024 airline outage resolves a significant regulatory question, but does not materially affect the company's current key catalysts or top operational risks, which remain linked to competition, innovation, and effective product execution.

Among recent developments, the launch of Falcon for AWS Security Incident Response stands out, promising to further CrowdStrike's integration into the AWS ecosystem and reinforce its position in cloud security. This aligns with ongoing catalysts around expanding cloud partnerships and rapid product adoption, supporting the company's outlook on revenue growth and customer retention.

However, in contrast to the legal clarity gained, investors should be aware that...

Read the full narrative on CrowdStrike Holdings (it's free!)

Exploring Other Perspectives

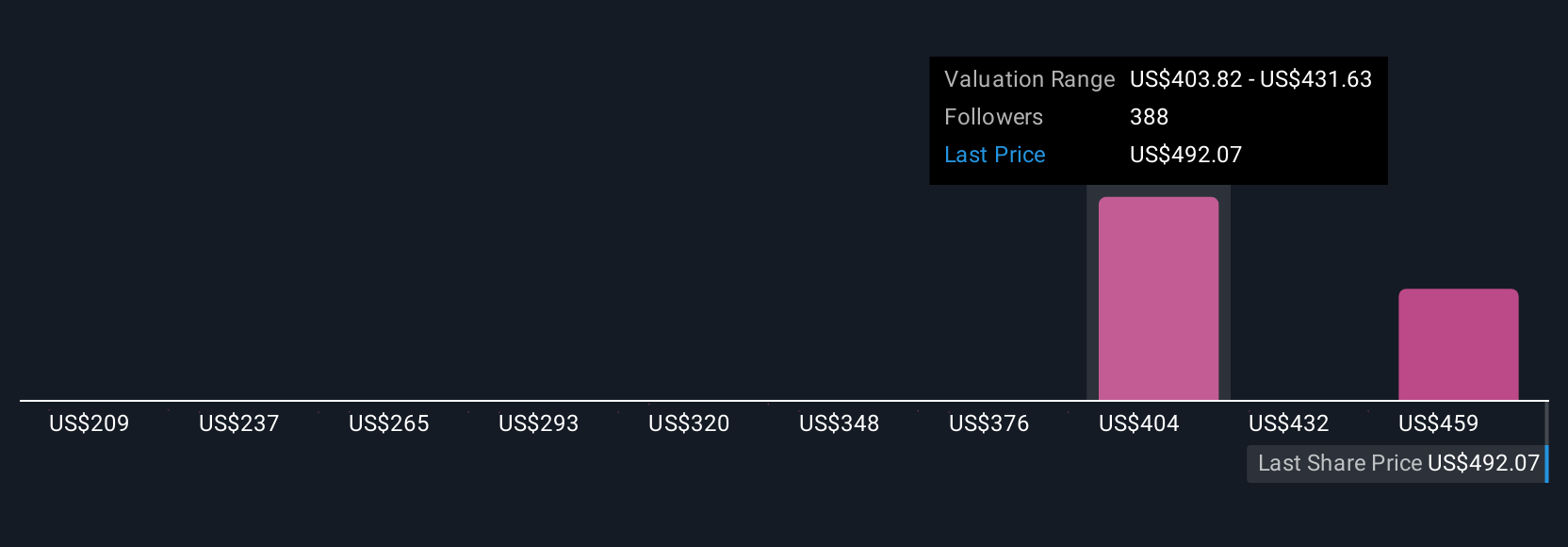

Eighteen members of the Simply Wall St Community estimate CrowdStrike’s fair value between US$209 and US$440 per share, reflecting wide-ranging views on potential. As you consider these perspectives, remember that competition and innovation in the cloud security market still represent key factors influencing CrowdStrike’s performance.

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives