- United States

- /

- Software

- /

- NasdaqGS:CRWD

Will CrowdStrike (CRWD) Partnerships Reveal a Lasting Edge in the Battle for AI Security Leadership?

Reviewed by Sasha Jovanovic

- In recent days, CrowdStrike announced it was named one of three inaugural partners in the Google Unified Security Recommended program and formed a new technology alliance with F5 to integrate advanced AI-powered security into network and cloud platforms.

- These developments highlight CrowdStrike’s expanding recognition for its AI-native security capabilities and deeper integration across leading cloud and infrastructure partners, further strengthening its industry relevance.

- To assess the impact of these updates, we’ll examine how CrowdStrike's selection as a Google Unified Security Recommended partner shapes its overall investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CrowdStrike Holdings Investment Narrative Recap

To be a CrowdStrike shareholder, you need conviction in the company's ability to capitalize on AI-driven security trends, scale its platform advantage, and maintain strong client partnerships despite a competitive and evolving cyber threat environment. The recent selection as a Google Unified Security Recommended partner elevates CrowdStrike’s visibility and market reach, but does not fundamentally alter the primary short-term catalyst, adoption of the Falcon Flex subscription model, or offset the ongoing risks from rising operational costs and margin pressures linked to competition and innovation.

Among the latest announcements, the F5 technology alliance stands out for its clear potential impact on CrowdStrike’s growth narrative. By embedding Falcon Sensor into F5 BIG-IP solutions and offering advanced threat hunting at the network edge, this integration specifically advances the company’s goal of extending security coverage beyond endpoints, a direct response to both client needs and the competitive imperative highlighted among CrowdStrike’s main catalysts.

By contrast, investors should be aware that even as partnerships expand, the challenge of sustaining margin growth in the face of...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' narrative projects $7.9 billion in revenue and $691.1 million in earnings by 2028. This requires 22.1% yearly revenue growth and an increase in earnings of $988.1 million from the current level of -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $518.96 fair value, a 6% upside to its current price.

Exploring Other Perspectives

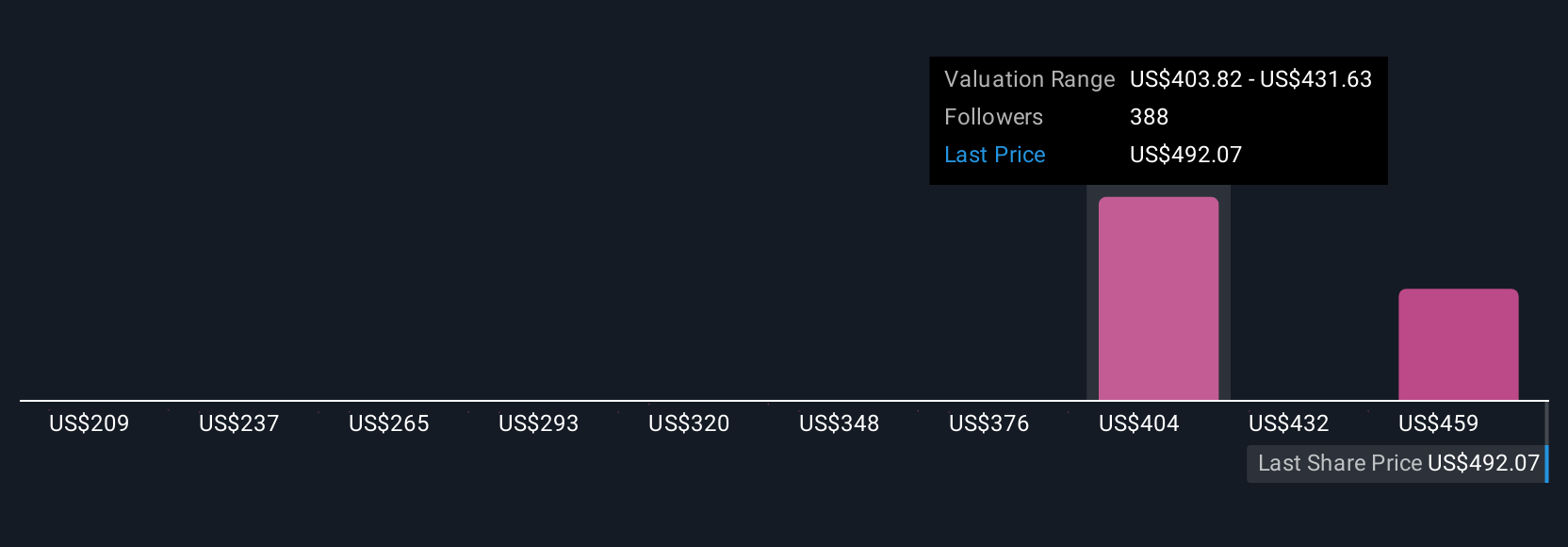

Simply Wall St Community members offered 26 fair value estimates for CrowdStrike, ranging from US$300 to US$600,500, with some seeing significant upside while others are far more cautious. This diversity of views unfolds as the company’s competitive costs and product innovation continue to shape its performance, so take the time to explore multiple viewpoints.

Explore 26 other fair value estimates on CrowdStrike Holdings - why the stock might be worth 39% less than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives