- United States

- /

- Software

- /

- NasdaqGS:CRWD

Is It Too Late To Consider CrowdStrike After Its 359% Three Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether CrowdStrike Holdings is still worth buying at these levels, or if the easy money has already been made, you are not alone. That is exactly what this breakdown will unpack.

- Despite a choppy few weeks, with the stock down 7.8% over the last 7 days and 7.0% over the past month, shares are still up 37.5% year to date, 36.0% over the last year, and a huge 359.3% over three years. This naturally raises questions about how much upside is left.

- Recent price swings have been driven by ongoing enthusiasm around cybersecurity demand and CrowdStrike's role in high profile threat prevention, alongside broader shifts in investor sentiment toward high growth software names. At the same time, recurring headlines about rising cyber attacks on enterprises and governments keep pushing CrowdStrike into the spotlight as a perceived must have platform.

- On our framework, CrowdStrike currently scores a 0/6 valuation score, suggesting it does not screen as undervalued on any of our standard checks. Next, we will walk through the main valuation approaches behind that result and introduce a more nuanced way to think about what the market is really pricing in by the end of this article.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back to the present. For CrowdStrike Holdings, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $1.1 billion and uses analyst forecasts for the next few years, then extrapolates further growth.

Analysts and model estimates see free cash flow rising to roughly $4.7 billion by 2030, with intermediate projections stepping up steadily as the business scales. All of these future cash flows, expressed in $, are discounted back to today and combined with a long term terminal value to arrive at an estimated intrinsic value of about $441.91 per share.

Compared with the current share price, this DCF suggests the stock is about 8.1% overvalued. This is a relatively small gap and well within the normal margin of error for long range forecasts.

Result: ABOUT RIGHT

CrowdStrike Holdings is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

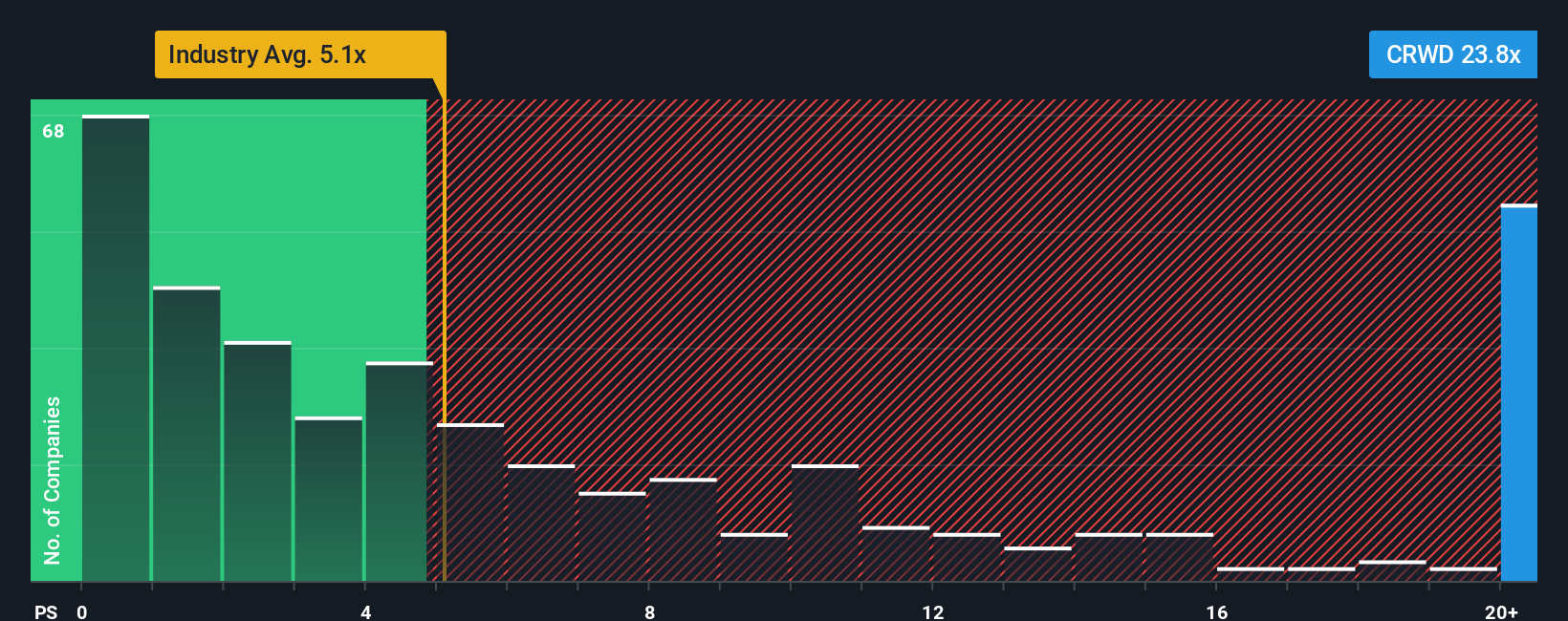

Approach 2: CrowdStrike Holdings Price vs Sales

For high growth software businesses that are reinvesting heavily, price to sales is usually a more reliable yardstick than earnings based metrics, because revenues are less distorted by near term investment and stock based compensation. Investors typically accept a higher sales multiple when they expect stronger long term growth and see the business model as relatively low risk, while slower or riskier names usually trade at lower ratios.

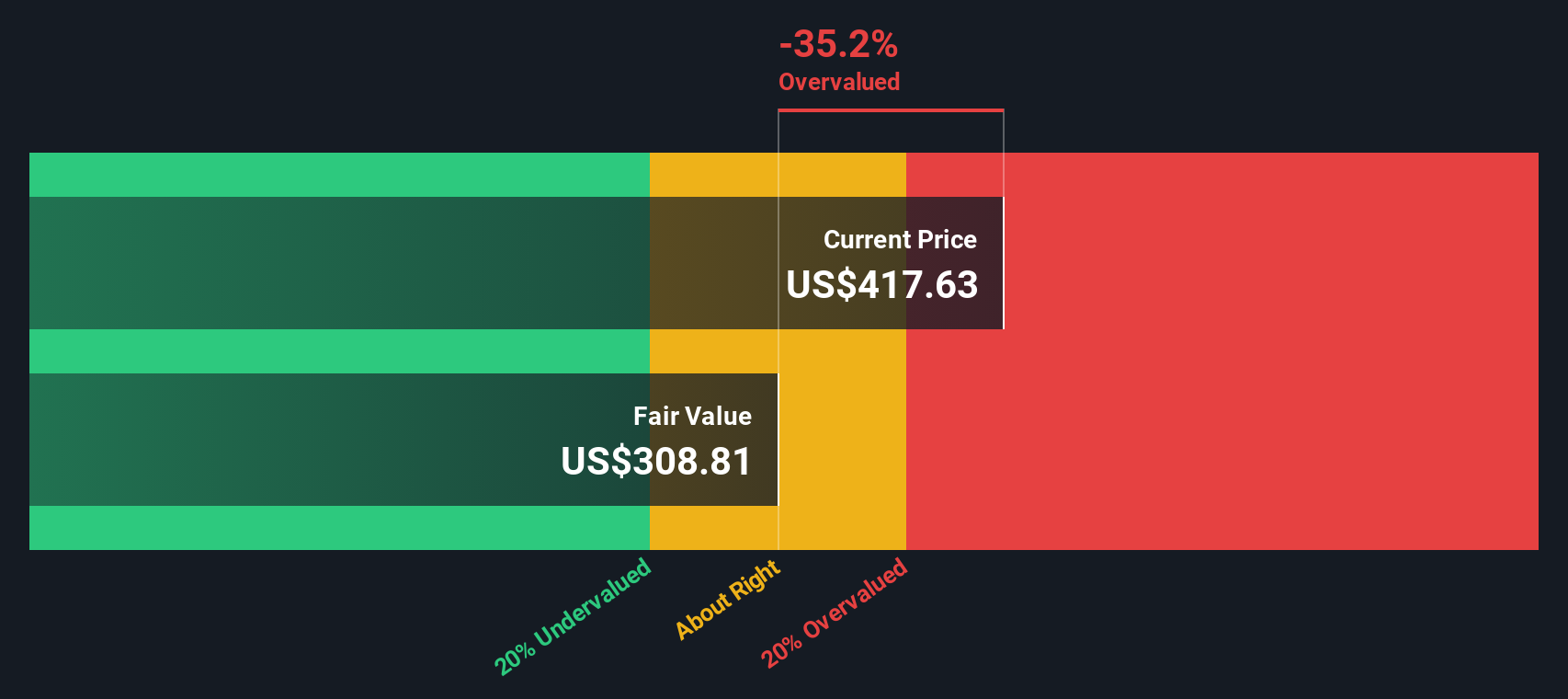

CrowdStrike currently trades on a price to sales multiple of about 26.4x, which is well above both the broader Software industry average of roughly 4.9x and the peer group average of around 11.9x. On those simple comparisons alone, the stock looks expensive. However, Simply Wall St’s proprietary Fair Ratio framework estimates that, given CrowdStrike’s growth profile, margins, industry positioning, size and risk factors, a more appropriate price to sales multiple would be closer to 15.3x.

Because the Fair Ratio incorporates company specific fundamentals rather than just comparing against broad averages, it offers a more nuanced benchmark. With the current 26.4x multiple sitting materially above the 15.3x Fair Ratio, the shares screen as significantly overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your CrowdStrike Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company with the numbers behind it. A Narrative is the story you believe about CrowdStrike Holdings, including how fast revenue can grow, what margins might look like and what a reasonable fair value could be, all captured in a structured forecast. Narratives link three key pieces: the business story, the financial projections that flow from that story and the resulting fair value that drops out at the end. On Simply Wall St, millions of investors build and share these Narratives on the Community page, where they are easy to explore and adjust, rather than starting from a blank spreadsheet. They help you compare each Narrative’s Fair Value to the current share price, and they update dynamically as new news, earnings or guidance come in. For example, some CrowdStrike Narratives currently see fair value closer to around $330, while others are nearer $610, reflecting very different expectations for growth, profitability and risk.

For CrowdStrike Holdings however we will make it really easy for you with previews of two leading CrowdStrike Holdings Narratives:

🐂 CrowdStrike Holdings Bull Case

Fair value: $533.26

Implied undervaluation vs last close: approximately 10.5%

Forecast revenue growth: 21.55%

- Sees Falcon Flex, AI capabilities like Charlotte and a broadening product suite as catalysts for stronger customer adoption, higher margins and durable revenue growth.

- Assumes revenue can compound at more than 20% annually with margins turning solidly positive, supporting a higher long term earnings base and premium valuation multiple.

- Highlights risks around execution, competition and reliance on newer products, but ultimately concludes that current pricing does not fully reflect CrowdStrike’s AI and platform optionality.

🐻 CrowdStrike Holdings Bear Case

Fair value: $431.24

Implied overvaluation vs last close: approximately 10.7%

Forecast revenue growth: 18.0%

- Argues that while Falcon’s cloud native, modular platform and strong ARR momentum make CrowdStrike a high quality business, much of this strength is already embedded in the share price.

- Assumes robust but moderating revenue growth and improving profitability, yet concludes that today’s valuation implies very high returns expectations relative to underlying free cash flow.

- Views the stock as attractive closer to or below its fair value estimate, where projected long term returns would better compensate for competitive, execution and valuation risks.

Do you think there's more to the story for CrowdStrike Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion