- United States

- /

- Software

- /

- NasdaqGS:CRWD

Is Gartner’s Visionary Nod for Falcon SIEM Changing the Narrative for CrowdStrike (CRWD)?

Reviewed by Sasha Jovanovic

- CrowdStrike has been recognized as a Visionary in the 2025 Gartner Magic Quadrant for Security Information and Event Management, highlighting its Falcon Next-Gen SIEM platform advancements with AI-powered detections and real-time streaming technology.

- This recognition signals growing industry momentum towards replacing legacy SIEM systems with CrowdStrike’s cloud-native, AI-enhanced solutions, reflecting the company’s increasing influence in enterprise cybersecurity modernization.

- We'll explore how Gartner’s recognition of CrowdStrike’s Falcon Next-Gen SIEM platform enhances its long-term positioning in the cybersecurity sector.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

CrowdStrike Holdings Investment Narrative Recap

To be a shareholder in CrowdStrike Holdings, you need to believe that the company's AI-driven, cloud-native cybersecurity solutions are set to replace legacy SIEM platforms and drive sustained demand from enterprise and government customers. The recent recognition in Gartner’s 2025 Magic Quadrant for SIEM is positive for long-term positioning, but does not directly alter the most immediate catalysts, such as adoption of Falcon Flex, or the key risks around innovation and competition, so its short-term impact appears limited.

Among recent announcements, CrowdStrike’s collaboration with Wipro to deliver the Wipro CyberShield MDR service is closely linked to enterprise adoption of Falcon-powered security operations. This aligns with the broader catalyst of expanding cloud-based offerings and partner integrations to capture market share, and reflects ongoing efforts to accelerate customer stickiness and streamline adoption of core products.

However, investors should also be mindful that, despite enterprise momentum, the risk of execution stumbles with rapid innovation and competition remains...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' narrative projects $7.9 billion in revenue and $691.1 million in earnings by 2028. This requires 22.1% yearly revenue growth and a $988.1 million increase in earnings from the current -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $495.45 fair value, in line with its current price.

Exploring Other Perspectives

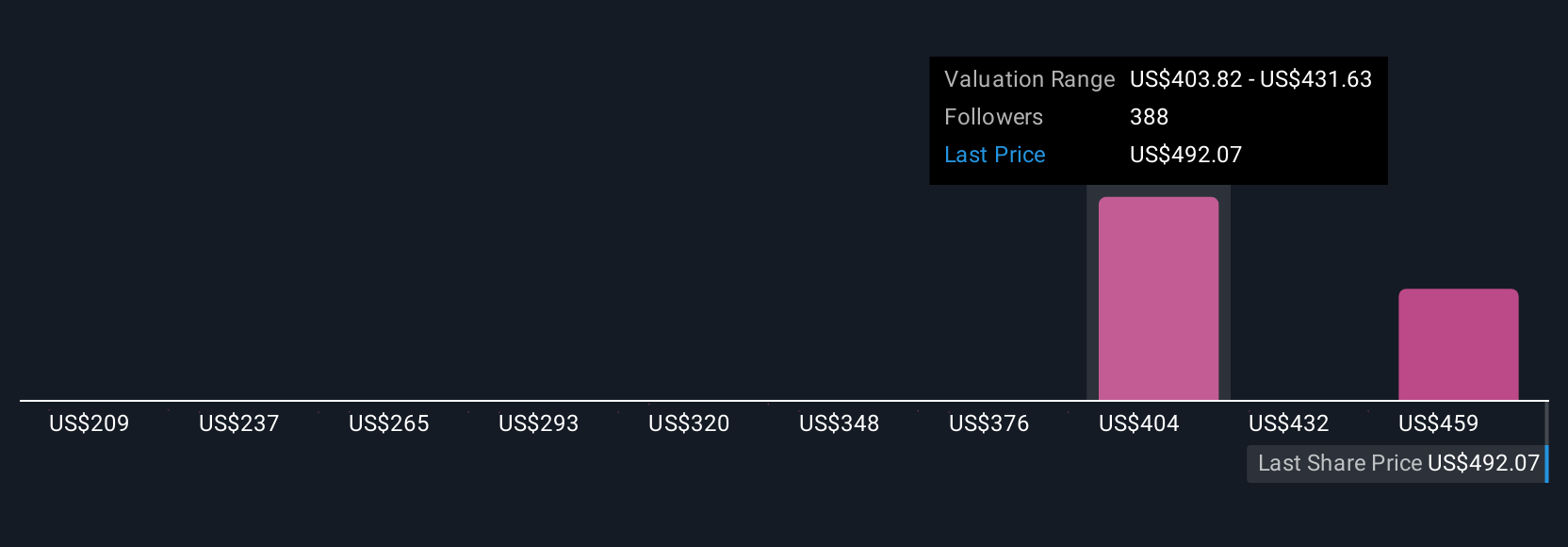

Fair value estimates from 37 members of the Simply Wall St Community for CrowdStrike range from US$200 to US$600, indicating substantial variance in outlooks. While many are optimistic about catalysts like cloud-based subscription growth, the broad spread reminds you that investor expectations for performance can diverge sharply, consider exploring these viewpoints alongside the risk of intensifying competition and rising execution challenges.

Explore 37 other fair value estimates on CrowdStrike Holdings - why the stock might be worth less than half the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion