- United States

- /

- Software

- /

- NasdaqGS:CRWD

Is CrowdStrike Still Attractive After 60% Rally and New AI Security Partnerships?

Reviewed by Bailey Pemberton

- Wondering if CrowdStrike Holdings is really worth its lofty price tag, or if this cybersecurity powerhouse still offers value? You would not be the first to ask. After the run it has had, it is a question worth digging into.

- The stock has climbed 4.3% over the past week, 12.8% in the last month, and an impressive 60.3% year-to-date. This signals strong market conviction and continued growth excitement.

- Much of this positive momentum followed news of CrowdStrike’s expanding partnerships in the AI security space and its recent inclusion in key market indices, which have further boosted investor optimism. Strategic moves like these have kept both analysts and investors focused on CrowdStrike as a leading innovator in cybersecurity.

- When it comes to valuation, CrowdStrike currently scores 0 out of 6 on the Simply Wall St value checks, so the headline numbers may not tell the whole story. Let us dive into how that figure was reached and why there might be an even smarter way to judge what the stock is really worth by the end of this article.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to their present value. This provides a way to assess whether a stock is currently trading above or below its fundamental worth based on future financial performance.

For CrowdStrike Holdings, the DCF approach uses cash flow projections spanning more than a decade. The first five years are based on analyst estimates, with subsequent years extrapolated. The company's current Free Cash Flow stands at $1.04 Billion. Analysts forecast steady growth, projecting the annual Free Cash Flow to reach $4.58 Billion by 2030. The estimates for the intermediate years reveal a consistent upward trend in Free Cash Flows, reflecting expectations of sustained expansion as CrowdStrike scales its cybersecurity platform.

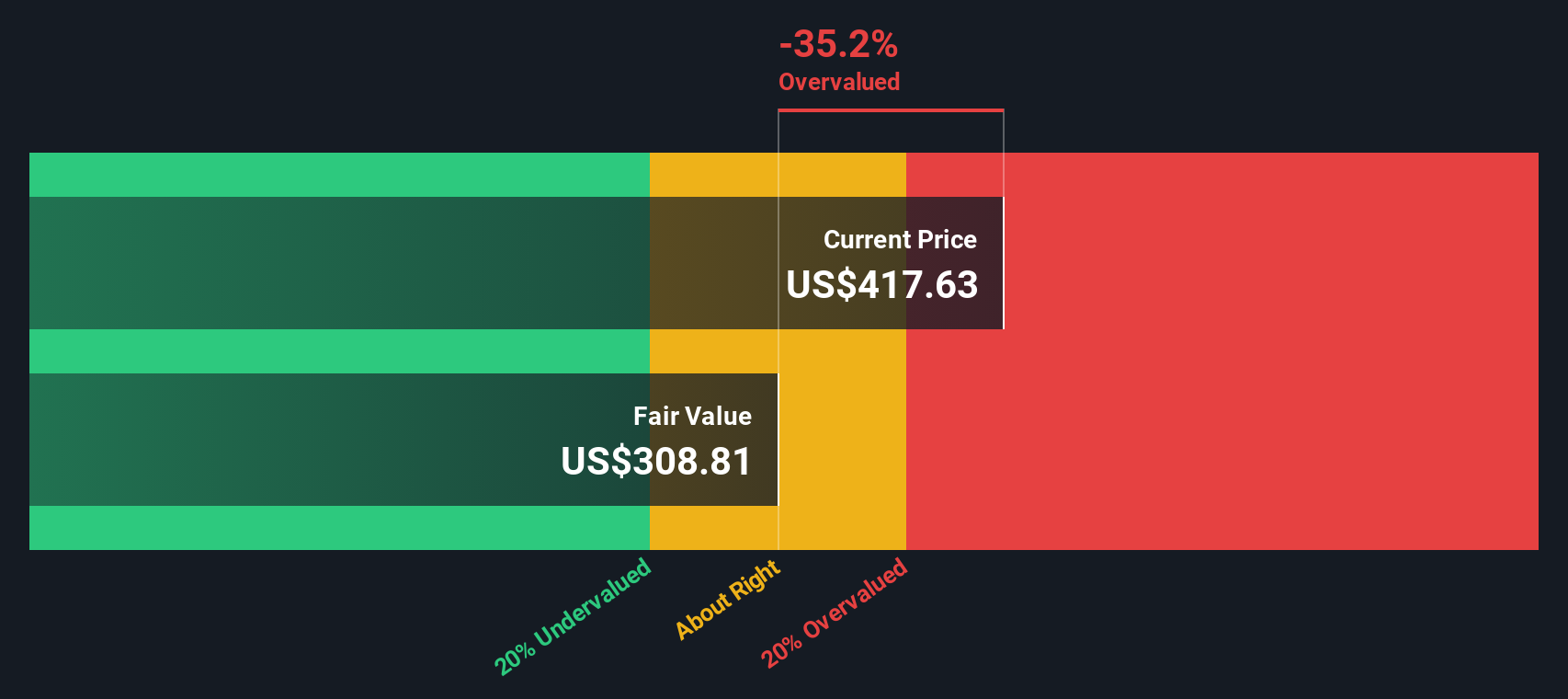

According to the DCF calculation, CrowdStrike's intrinsic value per share comes to $422.21. However, this model suggests the stock is trading at a 31.9% premium to its estimated fair value, indicating that shares are currently overvalued relative to projected cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 31.9%. Discover 869 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CrowdStrike Holdings Price vs Sales

For companies like CrowdStrike Holdings that are still ramping up profitability but show strong revenue growth, the Price-to-Sales (P/S) ratio is often the preferred lens through which to assess valuation. The P/S ratio helps investors gauge how much the market is willing to pay for each dollar of sales. This makes it particularly useful for high-growth software firms where earnings are not yet the key driver.

Growth expectations and risk play a crucial part in what constitutes a “reasonable” or “fair” multiple. High-growth companies generally command higher multiples, as investors are willing to pay more upfront in anticipation of outsized future gains. Conversely, companies with less growth or higher risk typically trade at lower multiples.

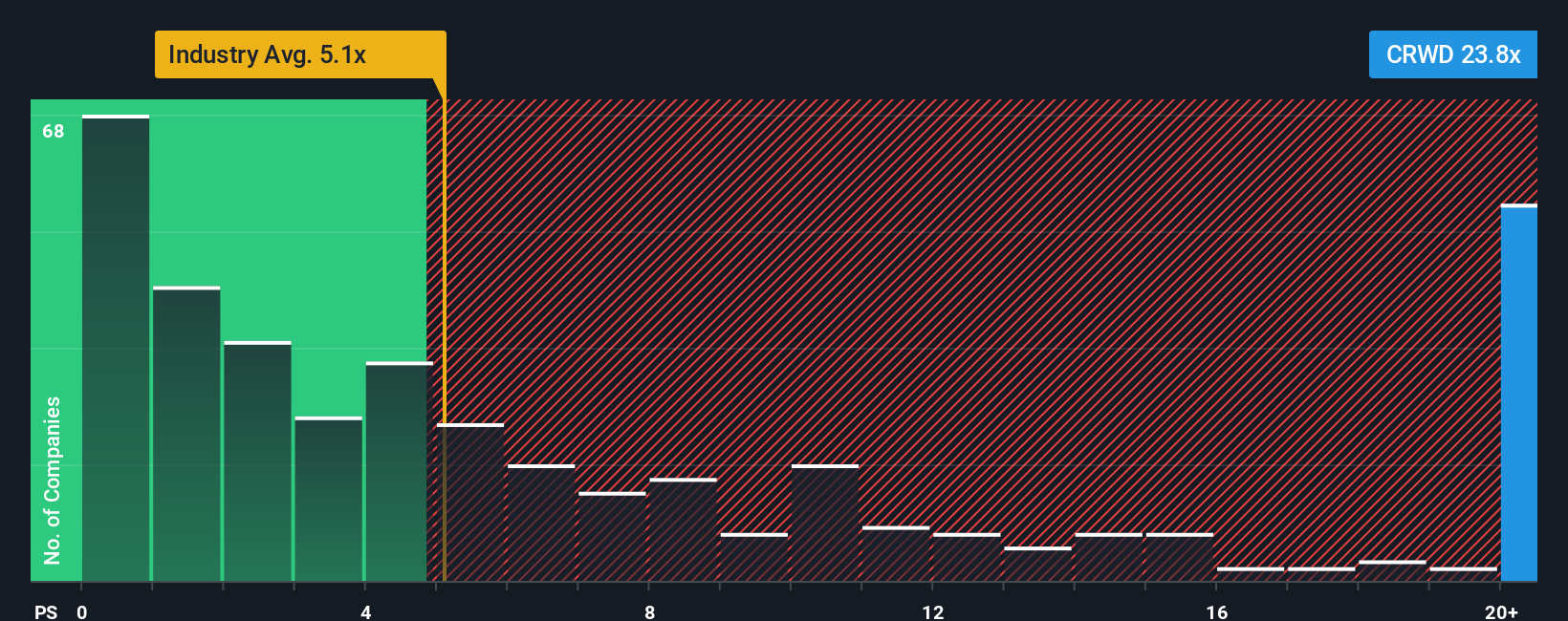

CrowdStrike currently trades at a P/S ratio of 32.18x. This is substantially higher than the industry average of 4.84x and the peer average of 14.81x, reflecting the market's enthusiasm for its growth prospects and competitive strengths. However, raw comparisons to peers or the broader industry do not always provide the full context.

That is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio, in this case 18.43x, is shaped by multiple factors unique to CrowdStrike, including its exceptional revenue growth, profit margins, business risks, and its overall market cap. Unlike off-the-shelf multiples, the Fair Ratio aims to measure what an investor should rationally pay for CrowdStrike given those specifics.

When comparing CrowdStrike's actual P/S ratio of 32.18x to its Fair Ratio of 18.43x, the stock looks overvalued based on this metric. The premium price suggests very high expectations for future performance that may already be priced in.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. At its core, a Narrative is your own investment story. It is a way to connect your view of a company’s future with the numbers, so you are not just crunching figures, but shaping the fair value with your perspective on CrowdStrike Holdings’ growth, profitability, and the factors that matter most to you.

Rather than relying only on analyst models or rigid formulas, Narratives allow you to blend what you know about CrowdStrike, such as its business model, product innovations, risks, and market position, into an actual financial forecast. This process is made easy and accessible right inside the Simply Wall St platform, on the Community page, where millions of investors create and update their Narratives every day.

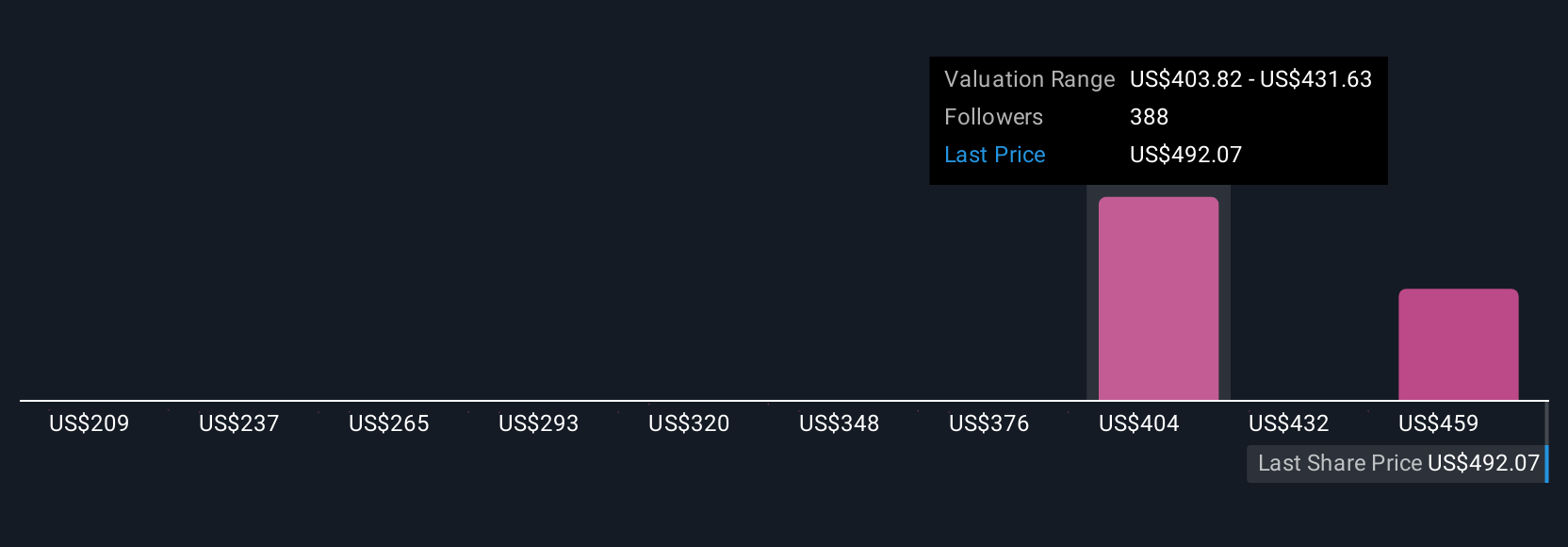

With Narratives, you can instantly compare your calculated Fair Value with the market Price to decide whether to buy, hold, or sell. Your Narrative updates dynamically as soon as fresh news or earnings are announced. For example, some investors see fair value for CrowdStrike as low as $431 per share based on a cautious view of future growth, while others forecast values above $505, reflecting more bullish expectations. Narratives put you in control, letting your investment story drive your decisions with transparency and confidence.

Do you think there's more to the story for CrowdStrike Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives