- United States

- /

- Software

- /

- NasdaqGS:CRWD

How Might CrowdStrike (CRWD) Elevate Platform Reliability With Its New Chief Resilience Officer?

Reviewed by Sasha Jovanovic

- CrowdStrike recently announced the appointment of Amjad Hussain as chief resilience officer, reporting directly to CEO George Kurtz, to drive operational excellence and reliability across the company's platform and broader cybersecurity ecosystem.

- Hussain brings over 25 years of relevant experience from leading technology companies, strengthening CrowdStrike’s focus on resilience as it expands its AI-powered security offerings and industry best practices.

- We'll now explore how the addition of a chief resilience officer could impact CrowdStrike's investment narrative and outlook for reliability.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

CrowdStrike Holdings Investment Narrative Recap

To be a CrowdStrike shareholder, you need conviction in the company’s ability to maintain technical leadership and drive recurring revenue growth as the cybersecurity market rapidly evolves. The appointment of Amjad Hussain as chief resilience officer supports CrowdStrike’s operational excellence story, but has limited direct impact on the main near-term catalyst, continued momentum around module adoption, cloud expansion, and the execution of Falcon Flex. The biggest risk remains operational costs tied to innovation and growth initiatives, which could impact margins if not managed prudently.

Of the company’s recent announcements, the rollout of Falcon Next-Gen Identity Security stands out as highly relevant, given Hussain’s experience with cloud operational excellence and security at AWS and Microsoft. These new identity protection features, aimed at strengthening privileged access management and introducing phishing-resistant MFA, are key to maintaining customer trust and supporting CrowdStrike’s drive toward higher platform adoption, one of the most important short-term catalysts right now. However, while these developments reinforce operational reliability, investors should track how expanding product lines affect overall cost structure and execution risks.

Yet, for all the promise of platform leadership and innovation, investors should be aware of the heightened execution risk from new products and acquisition bets...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' outlook projects $7.9 billion revenue and $691.1 million earnings by 2028. This is based on a 22.1% annual revenue growth rate and a $988.1 million increase in earnings from the current level of -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $495.45 fair value, a 3% downside to its current price.

Exploring Other Perspectives

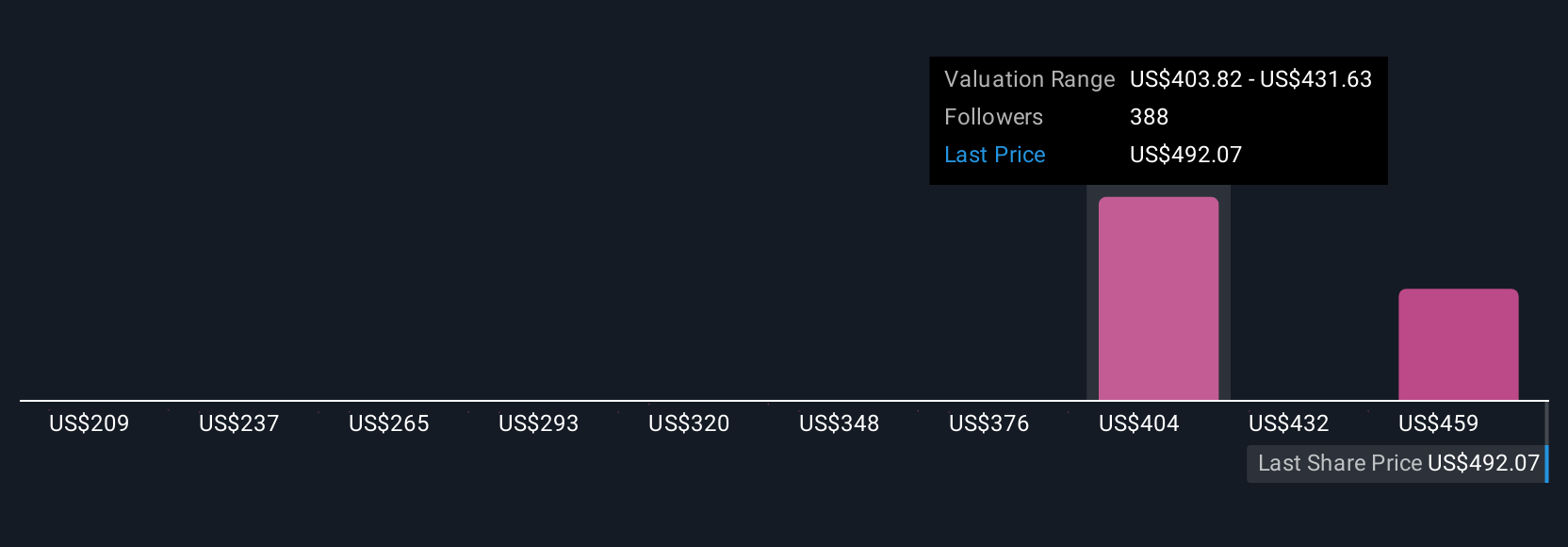

The Simply Wall St Community’s 37 fair value estimates for CrowdStrike range widely from US$200 to over US$600 per share. Alongside this diversity, competitive pressures and untested new products could have broader implications for future growth and margin stability. Explore different viewpoints to see what other investors are forecasting.

Explore 37 other fair value estimates on CrowdStrike Holdings - why the stock might be worth as much as 18% more than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion