- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike Holdings (NasdaqGS:CRWD) Expands API Security While Share Price Dips 10%

Reviewed by Simply Wall St

CrowdStrike Holdings (NasdaqGS:CRWD) recently experienced a 3.56% decline in its share price over the last month, a period marked by significant corporate developments and broader market volatility. The company announced API integrations with Salt Security, enhancing its cybersecurity capabilities which might not have provided immediate investor reassurance amidst the unstable market conditions. A key event was the appointment of Alex Ionescu as Chief Technology Innovation Officer, aimed at spearheading tech advancements, yet this positive internal shift coincided with a period of significant market declines driven by tariff uncertainties and recession fears weighing heavily on investor sentiment.

CrowdStrike Holdings has 1 weakness we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

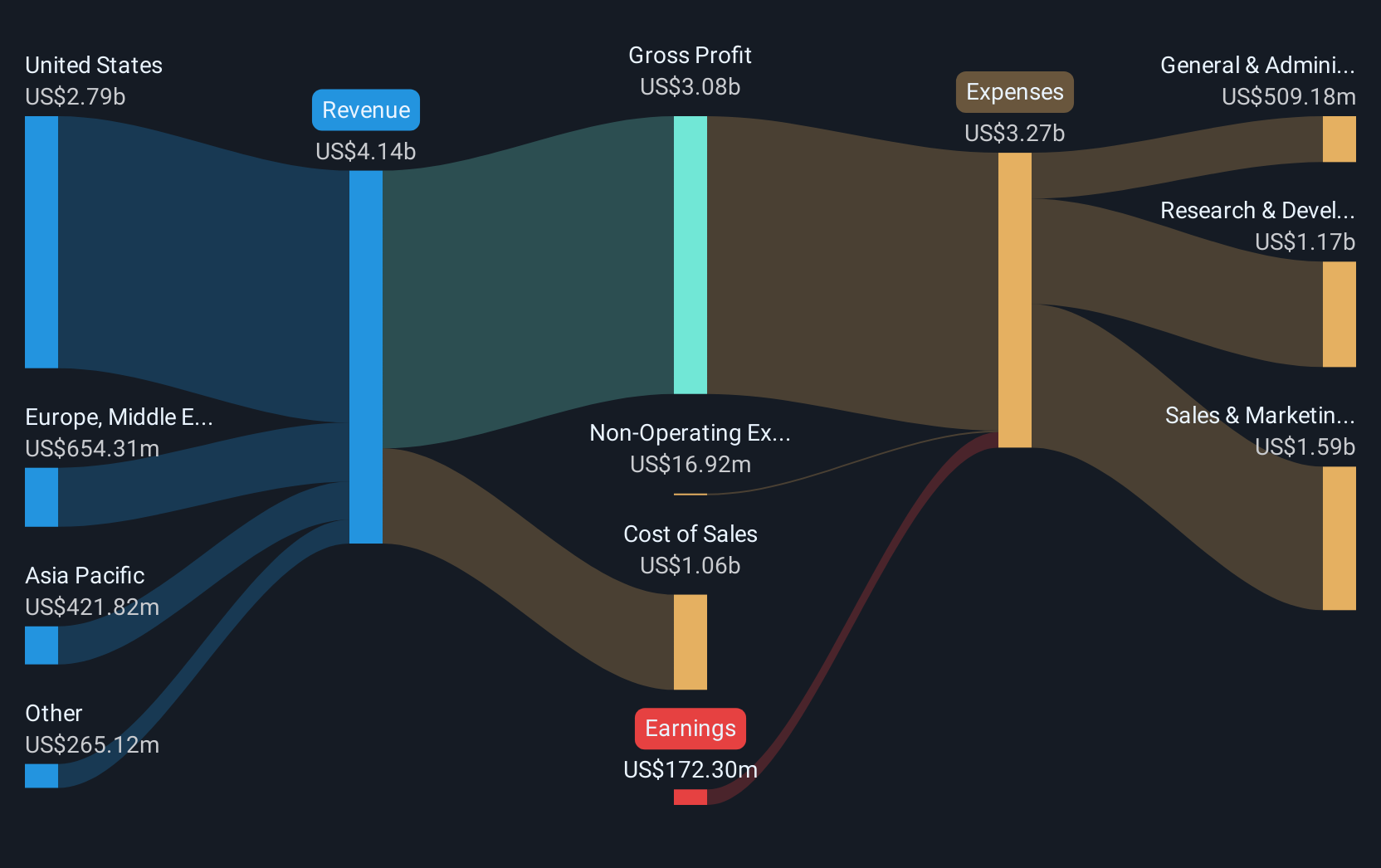

CrowdStrike Holdings' recent corporate developments, such as the API integrations with Salt Security and the appointment of Alex Ionescu, may provide a stronger foundation for future innovations despite the short-term 3.56% share price decline. These efforts aim to bolster their competitive edge in cloud security, which could drive future revenue and earnings. Importantly, CrowdStrike's introduction of Falcon Flex, a subscription model, and advancements in AI capabilities like Charlotte, are positioned to enhance customer relationships and operational efficiency, potentially leading to positive financial results over time.

Over the past five years, CrowdStrike has achieved a very large total return of 453.10%, reflecting its potential to rebound from short-term losses. Despite a challenging year across the US Software industry, where it outpaced the industry's -9.3% return, the company's strong five-year performance stands out. In terms of analyst expectations, CrowdStrike’s shares currently trade at a discount of approximately 11.7% to their consensus price target of US$410.19, indicating potential for upward movement.

However, the execution risks associated with their new initiatives and acquisitions could present challenges. The market's high expectations are underlined by projected revenue growth of 23.4% annually and an expected earnings turnaround by 2028. Investors may want to consider whether these prospects justify the current price in relation to the forecasted improvements in earnings, profit margins, and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion