- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike (CRWD) Valuation Check After Falcon AIDR Launch and New Amazon, SailPoint Partnerships

Reviewed by Simply Wall St

CrowdStrike Holdings (CRWD) has been in focus after rolling out its Falcon AI Detection and Response product, while also landing deeper ties with Amazon Business Prime and SailPoint, moves that quietly expand its AI era security footprint.

See our latest analysis for CrowdStrike Holdings.

All of this comes after a strong run, with CrowdStrike’s latest share price at $481.28 and a robust year to date share price return of 38.56 percent. Its three year total shareholder return of 371.89 percent shows momentum has been building for some time, even as recent options activity hints at more mixed short term sentiment.

If Falcon AIDR and the Amazon and SailPoint tie ups have put AI security on your radar, it could be worth seeing what else is shaping the space through high growth tech and AI stocks.

With analysts still targeting upside from here but valuation already reflecting a premium growth story, the real question is whether this latest AI momentum leaves room for new buyers, or if markets are already pricing in tomorrow’s gains.

Most Popular Narrative Narrative: 9.7% Undervalued

With CrowdStrike trading at $481.28 against a narrative fair value of $533.26, the spread reflects confidence in durable, AI led growth.

The strategic focus on Next-Gen SIEM, cloud-native security, and large-scale partnerships, along with CrowdStrike's expansive data capabilities for AI development, positions the company for robust demand growth, which can drive revenue and contract value higher in future periods.

Curious how much growth it takes to back that kind of optimism? The narrative leans on rising margins, accelerating earnings, and a punchy future profit multiple.

Result: Fair Value of $533.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in newer products or intensifying cloud security competition could challenge those upbeat assumptions and pressure both growth and valuation expectations.

Find out about the key risks to this CrowdStrike Holdings narrative.

Another Angle on Valuation

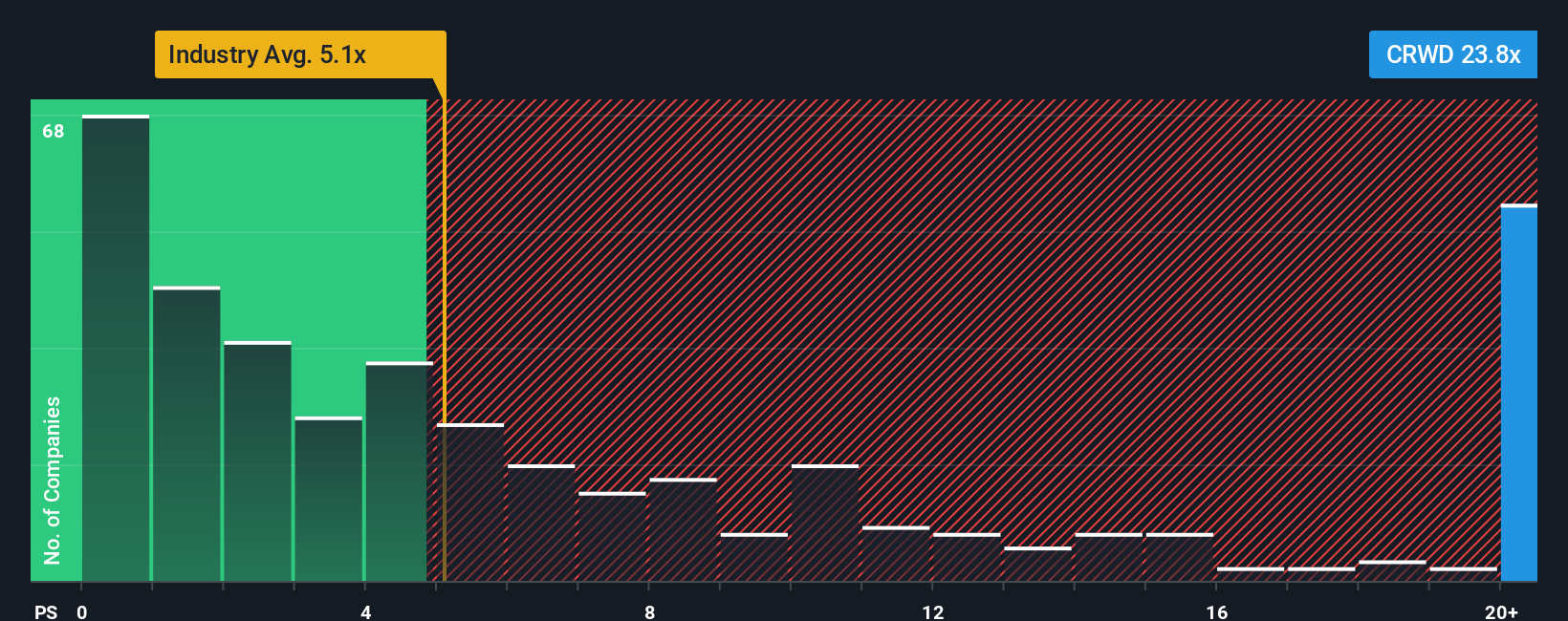

Our fair ratio work paints a more cautious picture, with CrowdStrike's price to sales at 26.6 times versus 12.1 times for peers and a fair ratio of 15.4 times. That gap suggests real valuation risk if growth cools and leaves investors to ask how long this premium can hold.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CrowdStrike Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build a custom view in just a few minutes: Do it your way.

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street's Screener to work and line up your next opportunities with data backed confidence and clarity.

- Consider potential asymmetric returns by targeting these 3634 penny stocks with strong financials that already show improving fundamentals instead of waiting for the crowd to notice.

- Explore structural growth trends by focusing on these 29 healthcare AI stocks bringing machine learning into real world patient outcomes and clinical decision making.

- Seek out reliable income streams with these 12 dividend stocks with yields > 3% that may help strengthen your portfolio when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion