- United States

- /

- Software

- /

- NasdaqGS:CRNC

The Market Doesn't Like What It Sees From Cerence Inc.'s (NASDAQ:CRNC) Revenues Yet As Shares Tumble 26%

Cerence Inc. (NASDAQ:CRNC) shares have had a horrible month, losing 26% after a relatively good period beforehand. The good news is that in the last year, the stock has shone bright like a diamond, gaining 234%.

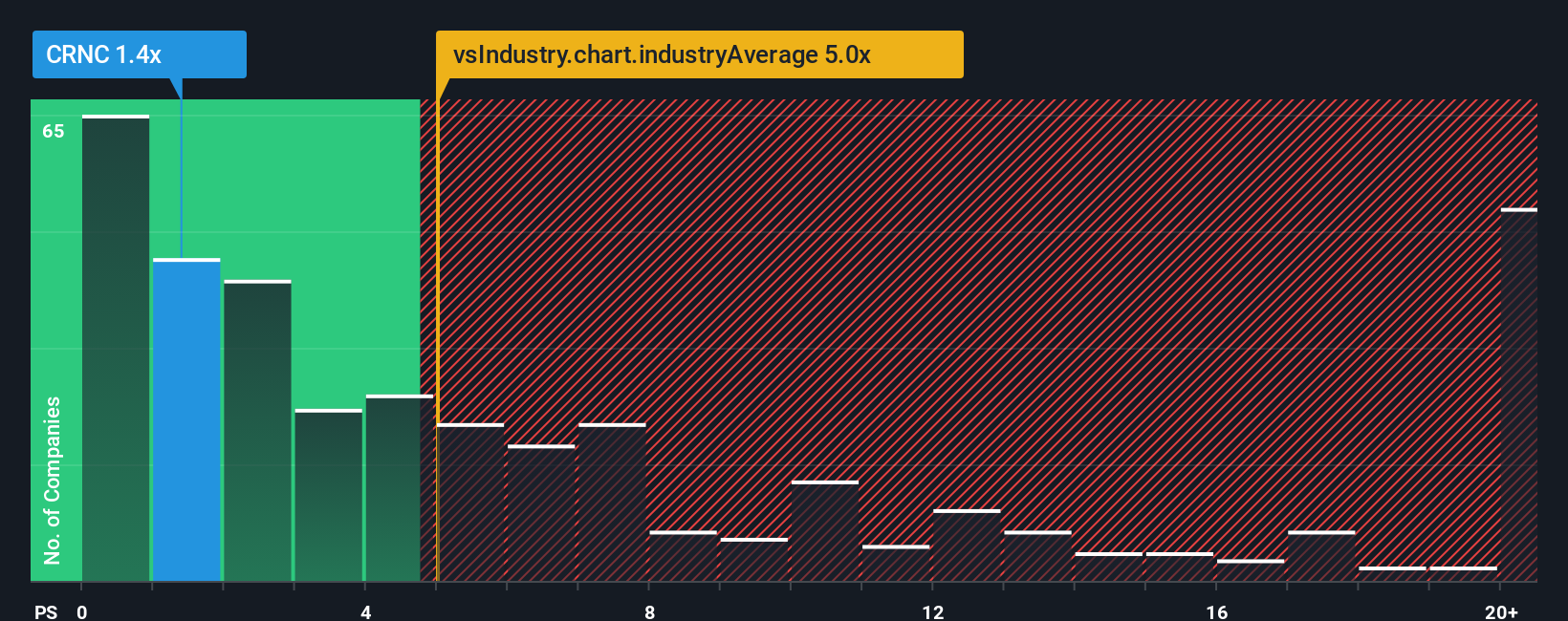

Since its price has dipped substantially, Cerence may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Cerence

What Does Cerence's Recent Performance Look Like?

Cerence hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Cerence will help you uncover what's on the horizon.How Is Cerence's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Cerence's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 1.6% over the next year. With the industry predicted to deliver 20% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Cerence's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Cerence's P/S?

Cerence's P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Cerence's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Cerence that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNC

Cerence

Provides AI-powered assistants for the mobility/transportation market in the United States, the rest of the Americas, Germany, the rest of Europe, the Middle East, Africa, Japan, and the rest of the Asia-Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives