- United States

- /

- Software

- /

- NasdaqGS:CRNC

Revenues Working Against Cerence Inc.'s (NASDAQ:CRNC) Share Price Following 43% Dive

Unfortunately for some shareholders, the Cerence Inc. (NASDAQ:CRNC) share price has dived 43% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 91% share price decline.

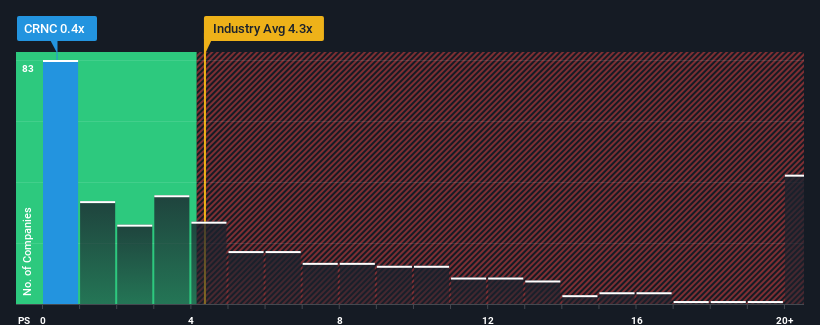

Following the heavy fall in price, Cerence may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 11x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Cerence

How Has Cerence Performed Recently?

Cerence's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Cerence's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Cerence would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 2.8% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 5.2% each year as estimated by the eight analysts watching the company. With the industry predicted to deliver 15% growth each year, that's a disappointing outcome.

With this information, we are not surprised that Cerence is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Cerence's P/S

Shares in Cerence have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Cerence's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Cerence is showing 3 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNC

Cerence

Provides AI-powered assistants for the mobility/transportation market in the United States, the rest of the Americas, Germany, the rest of Europe, the Middle East, Africa, Japan, and the rest of the Asia-Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives