- United States

- /

- Software

- /

- NasdaqGS:CRNC

Cerence (CRNC) Is Up 20.8% After Samsung Settlement and Upbeat 2026 Revenue Guidance - What's Changed

Reviewed by Sasha Jovanovic

- Cerence Inc. recently reported fourth-quarter and full-year 2025 results, exceeding expectations with quarterly revenue of US$60.64 million, a narrowed net loss, and a significant patent license payment resulting from the resolution of a legal dispute with Samsung.

- An important development was the company’s upward revenue guidance for fiscal 2026 and initial adoption of its xUI AI platform, highlighting growing customer interest and a focus on intellectual property monetization.

- We will explore how the Samsung settlement and stronger forward guidance shape Cerence's investment narrative and future growth drivers.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cerence Investment Narrative Recap

To be a Cerence shareholder, you need to believe in the company's ability to convert growing adoption of its xUI AI platform and successful intellectual property monetization into more predictable revenue, despite the headwinds faced by global vehicle production and competitive pressure from larger tech firms. The recent resolution of the Samsung dispute and higher revenue guidance address near-term financial uncertainty, but heavier reliance on variable licensing still poses the most important short-term risk around earnings stability and cash flow visibility. Stronger guidance and a large one-time patent payment may help with the transition yet do not fully mitigate the ongoing volatility of non-recurring revenue streams.

One of the most relevant recent announcements is Cerence being selected by Mahindra to deploy Audio AI solutions in next-generation electric vehicles. This client win reinforces the company’s push to embed its conversational AI across wider automotive market segments, supporting the thesis that expanding the installed base can offset some volatility from legacy contract transitions and help drive adoption of its next-gen platforms.

In contrast, the unpredictability of variable license revenue can impact quarterly earnings and is something investors should be aware of, especially if ...

Read the full narrative on Cerence (it's free!)

Cerence's outlook projects $282.6 million in revenue and $10.2 million in earnings by 2028. This is based on a 4.7% annual revenue growth rate and a $36 million increase in earnings from the current -$25.8 million.

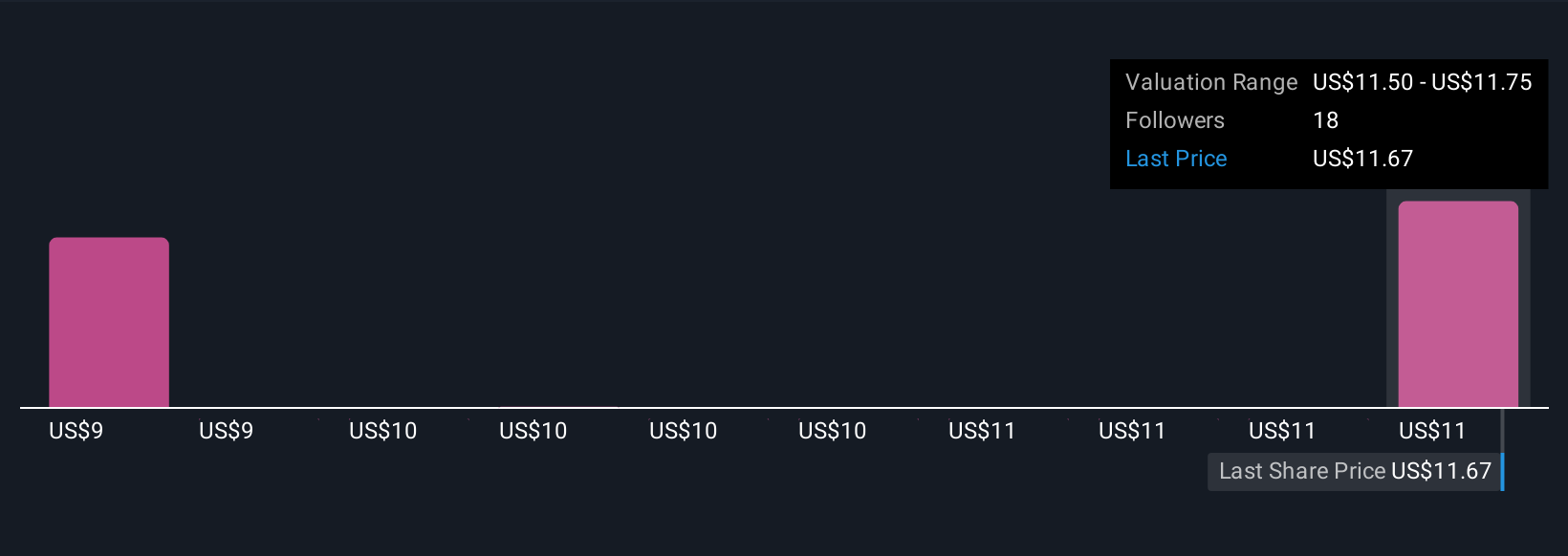

Uncover how Cerence's forecasts yield a $11.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Four different fair value estimates from the Simply Wall St Community range from US$6.83 to US$16, showing wide divergence in opinions. Amid this variety, ongoing shifts toward variable revenue models underscore the risk that cash flow swings could influence future performance and sentiment.

Explore 4 other fair value estimates on Cerence - why the stock might be worth as much as 58% more than the current price!

Build Your Own Cerence Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cerence research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cerence research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cerence's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNC

Cerence

Provides AI powered virtual assistants for the mobility/transportation market in the United States, rest of the Americas, Germany, rest of Europe, the Middle East, Africa, Japan, and rest of the Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives