- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

US High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

The United States market has shown a positive trend, with a 2.8% increase over the last week and a 9.3% rise over the past year, while earnings are projected to grow by 14% annually in the coming years. In this environment, identifying high growth tech stocks requires focusing on companies that demonstrate strong innovation potential and robust financial health to capitalize on these favorable market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.35% | 34.10% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.69% | ★★★★★★ |

| Ardelyx | 20.63% | 59.87% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.96% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Ascendis Pharma | 35.05% | 60.24% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 230 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Core Scientific (NasdaqGS:CORZ)

Simply Wall St Growth Rating: ★★★★★★

Overview: Core Scientific, Inc. is a U.S.-based company specializing in digital asset mining services with a market capitalization of approximately $2.58 billion.

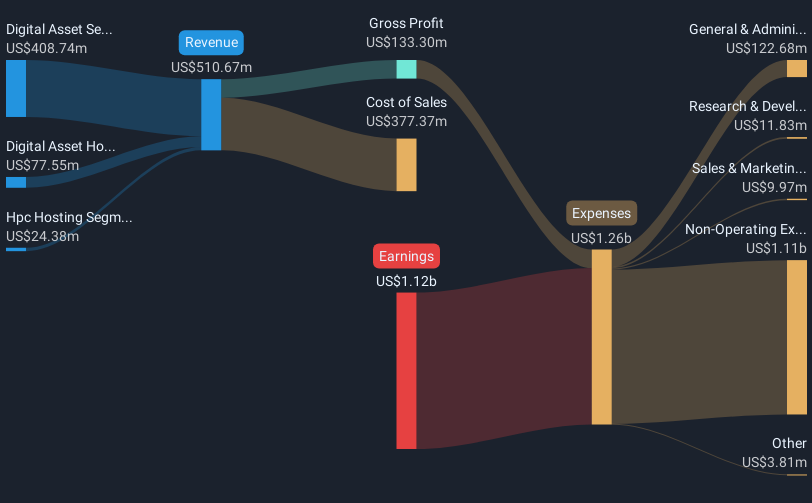

Operations: Core Scientific generates revenue primarily from its Digital Asset Self-Mining Segment, contributing $408.74 million, and its Digital Asset Hosted Mining Segment, adding $77.55 million. The company also earns from the HPC Hosting Segment with a revenue of $24.38 million.

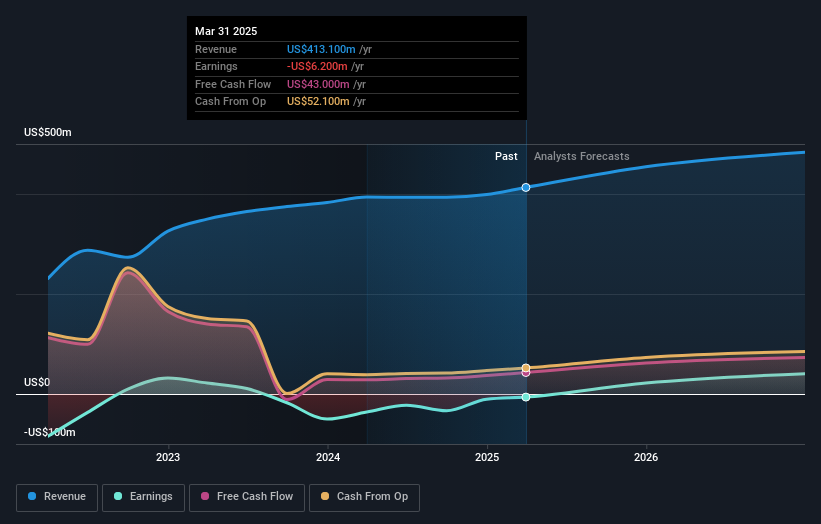

Core Scientific is navigating a transformative phase, marked by significant operational and executive shifts set to enhance its strategic positioning. With an expected revenue growth of 24% annually, the company outpaces the US market average of 8.4%. Despite current unprofitability, forecasts suggest a robust earnings growth of 110% per year, signaling potential future profitability. Core Scientific's focus on high-performance computing data centers is further evidenced by its recent $1.2 billion contract expansion with CoreWeave, boosting its total contracted power to 1.3 gigawatts and emphasizing its commitment to energy-dense sectors like AI and blockchain technologies. This strategic direction, coupled with management enhancements such as appointing Jim Nygaard as CFO—a veteran with extensive financial acumen—positions Core Scientific favorably for navigating the volatile tech landscape while aiming for sustained growth and operational stability.

- Click here to discover the nuances of Core Scientific with our detailed analytical health report.

Review our historical performance report to gain insights into Core Scientific's's past performance.

Scholar Rock Holding (NasdaqGS:SRRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Scholar Rock Holding Corporation is a biopharmaceutical company dedicated to discovering, developing, and delivering medicines targeting serious diseases influenced by protein growth factor signaling, with a market cap of $3.12 billion.

Operations: Scholar Rock Holding Corporation focuses on creating innovative treatments for serious diseases influenced by protein growth factor signaling. The company operates in the biopharmaceutical sector with a market capitalization of approximately $3.12 billion.

Scholar Rock Holding is poised for significant growth, with a projected annual revenue increase of 50.9%, substantially outpacing the U.S. market average of 8.5%. This biotech firm has recently bolstered its leadership team, appointing seasoned executives from renowned companies, which could enhance its strategic execution capabilities. Particularly noteworthy is their investigational drug apitegromab, targeting spinal muscular atrophy (SMA), which has received priority review from the FDA—a testament to its potential impact on a serious condition. With R&D efforts backed by promising clinical trial results and robust executive guidance, Scholar Rock seems well-positioned to navigate the complex biotech landscape effectively.

Emerald Holding (NYSE:EEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Holding, Inc. is a business-to-business event organizer in the United States with a market capitalization of $914.16 million.

Operations: Emerald Holding generates revenue primarily from its Connections segment, which accounts for $370 million.

Emerald Holding is actively pursuing growth through strategic mergers and acquisitions, recently integrating InsurTech Insights and This is Beyond into its portfolio. These additions underscore its commitment to expanding into resilient sectors, aiming to diversify offerings and enhance shareholder value. With a solid M&A strategy aligned with its three pillars—value creation, customer centricity, and portfolio optimization—Emerald anticipates building on its diverse portfolio. Financially, the company has shown progress with a first-quarter sales increase to $147.7 million from $133.4 million year-over-year and net income rising to $15.3 million from $11 million in the same period. Moreover, Emerald's board has declared a consistent dividend payout amidst these expansions, reinforcing confidence in their financial health and future prospects.

- Take a closer look at Emerald Holding's potential here in our health report.

Explore historical data to track Emerald Holding's performance over time in our Past section.

Summing It All Up

- Gain an insight into the universe of 230 US High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion