- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific (CORZ) Persistent Losses Challenge Bullish Growth Outlook Ahead of Earnings

Reviewed by Simply Wall St

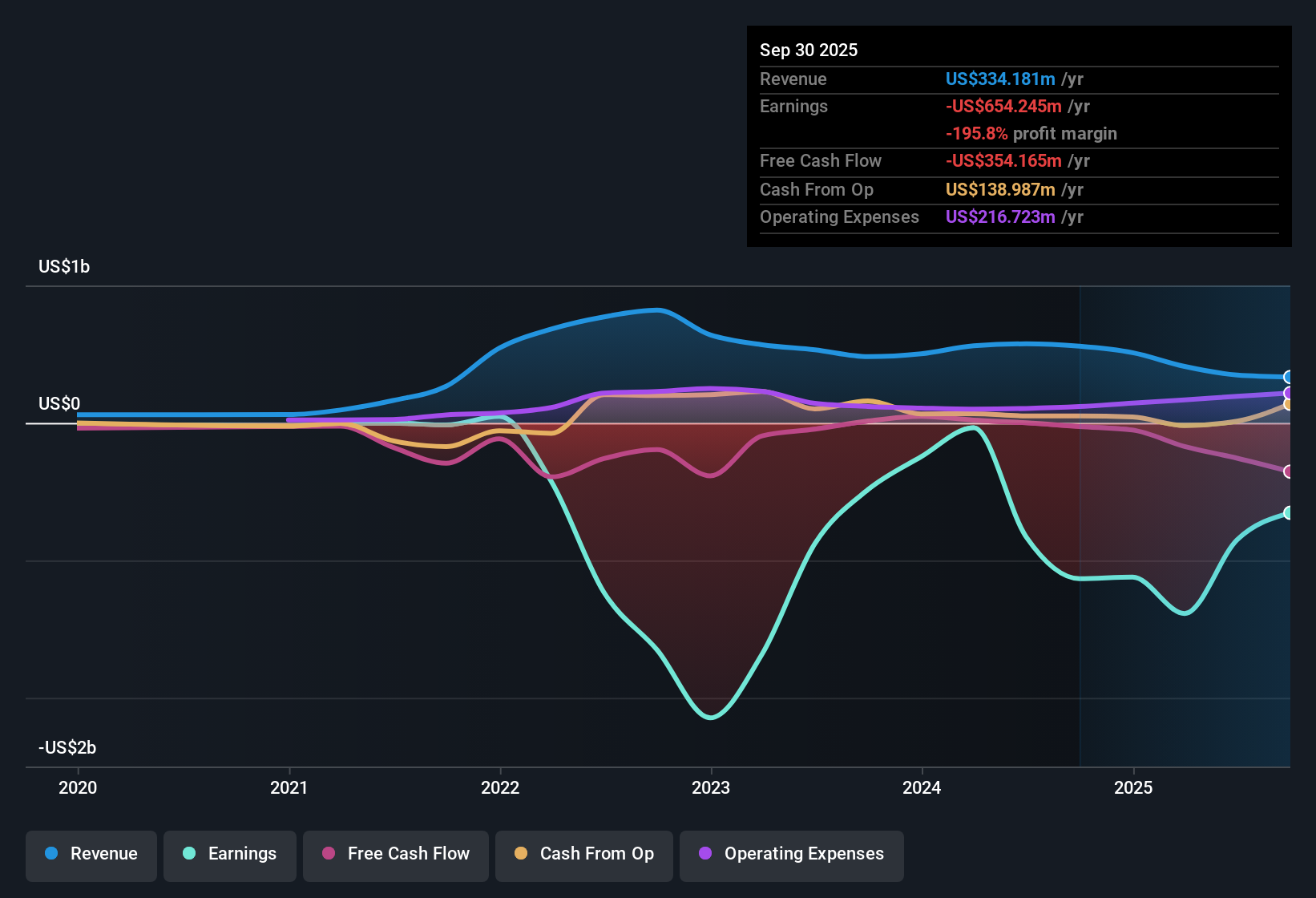

Core Scientific (CORZ) extended its streak of unprofitability this quarter, with net losses having grown at an average rate of 23.1% per year over the past five years. Looking ahead, analysts forecast an 83.98% annual growth in earnings and expect the company to achieve profitability within three years, while revenue is projected to expand at 36.3% per year, well above the US market average. Despite these optimistic growth projections, Core Scientific’s net profit margin has yet to show improvement, and its persistent losses remain a concern for investors.

See our full analysis for Core Scientific.The real test is how these numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged.

See what the community is saying about Core Scientific

Customer Concentration Heightens Revenue Risk

- Core Scientific’s recent $8.7 billion, 12-year contract with CoreWeave highlights a massive revenue opportunity, but also increases concentration risk since so much future revenue depends on a single client.

- According to analysts' consensus view, this expansion could drive rapid growth. However, the dependency on CoreWeave means any change in that customer’s business health or commitment could materially affect both top-line and profit margins.

- The consensus narrative notes that while diversifying the customer base would stabilize earnings, over-reliance on CoreWeave may lead to lumpy or volatile revenue streams if there are delays or contract changes.

- It is notable that despite efforts to branch out, current projections still tie a significant portion of potential upside to this relationship, adding risk to the optimistic long-term outlook.

- Analysts support their view with expectations that Core Scientific’s profit margin could move from -170.8% to 23.0% within three years if the HPC business scales as planned, a scenario closely linked to CoreWeave’s sustained demand.

- If these expectations are met, consensus projects the company could shift from a $595.2 million loss today to $334.4 million in earnings by 2028, assuming no major setbacks with its main client or strategic execution.

- See if a wider investor community agrees with this key risk and opportunity in the consensus narrative.📊 Read the full Core Scientific Consensus Narrative.

Balance Sheet Transformation Improves Funding Flexibility

- Debt restructuring led to $625 million in new funds raised via a convertible note at 0% interest, providing Core Scientific with greater flexibility to pursue data center expansion without the burden of interest payments.

- The consensus narrative indicates that this improved balance sheet not only strengthens the company's operational position but could also boost margins if strategic hires in data center management yield anticipated efficiencies.

- The consensus also observes that management’s move away from crypto mining toward high-performance computing could lead to steadier cash flows, assuming the investment in infrastructure is successful.

- However, risks remain regarding cost overruns and execution, as delays in site build-outs could offset the advantages of cheap capital and balance sheet improvements.

Valuation Far Above Industry Averages

- Core Scientific trades at a Price-to-Sales Ratio of 17.9x, significantly higher than both the US software industry average of 5.3x and its peer group’s 7.5x, indicating the market is pricing in aggressive future growth.

- The consensus narrative highlights that for the current share price of $19.34 to be justified, investors would need to expect the company to achieve high targets and move to a 27.8x PE ratio by 2028, a significant turnaround from today's -7.0x.

- The consensus notes that the valuation gap puts pressure on the company to achieve rapid profitability improvements, or risk a sharp correction if execution falls short or key customers change plans.

- In this context, the $23.17 analyst target requires not only revenue growth but also materially higher and sustainable net margins to support the premium valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Core Scientific on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticing a different angle in the numbers? Bring your viewpoint to life and shape your own story. Get started in under three minutes. Do it your way

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Core Scientific faces pressure from an aggressive valuation, persistent losses, and heavy reliance on a single customer. This combination makes its future growth less predictable.

If you want more predictable growth paths, jump into stable growth stocks screener (2102 results) and discover companies with steadier earnings and more consistent performance through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)