- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific (CORZ): Assessing Valuation as Shares Rally on Strong Revenue Growth and New HPC Contract

Reviewed by Simply Wall St

Core Scientific (CORZ) has seen steadily rising returns this past month, catching the attention of investors seeking growth in the digital infrastructure sector. Shares have gained 19% over the past month and this adds to its strong year-to-date momentum.

See our latest analysis for Core Scientific.

Core Scientific’s momentum is hard to ignore, with a 19.2% one-month share price return adding to a robust 38.7% gain year-to-date. Combined with a 40.5% total return over the past year, it is clear investor optimism is building as the company’s initiatives begin to gain traction.

If you’re curious about other fast-moving opportunities in tech and digital infrastructure, there is a free list of promising companies to explore: See the full list for free.

With such impressive returns and positive revenue growth, the key question now is whether Core Scientific’s rapid gains still leave room for fresh upside, or if the market has fully priced in its future growth potential.

Most Popular Narrative: 3.8% Undervalued

The latest narrative places Core Scientific’s fair value at $20.88, just above the last close at $20.09, suggesting limited near-term upside according to analyst consensus. This sets a high bar for the company’s future growth to justify the current market enthusiasm.

Core Scientific secured a major HPC contract with CoreWeave, with a total revenue potential of $8.7 billion over a 12-year term, significantly boosting future revenue compared to their current levels. The company is expanding HPC infrastructure capacity by reallocating resources from Bitcoin mining, adding new sites, and extending existing ones, expecting to drive future revenue growth as data center needs rise.

Want to know the bold financial bets fueling this valuation? There's an aggressive ramp in revenue growth, margin transformation, and profit projections that could redefine expectations. Intrigued by the underlying numbers driving this price target? Unpack the hidden catalysts powering this bullish outlook. Details are a click away.

Result: Fair Value of $20.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in HPC expansion or increased reliance on CoreWeave as a client could challenge the expected upside and impact Core Scientific’s path to profitability.

Find out about the key risks to this Core Scientific narrative.

Another View: Market Comparisons Raise Valuation Risks

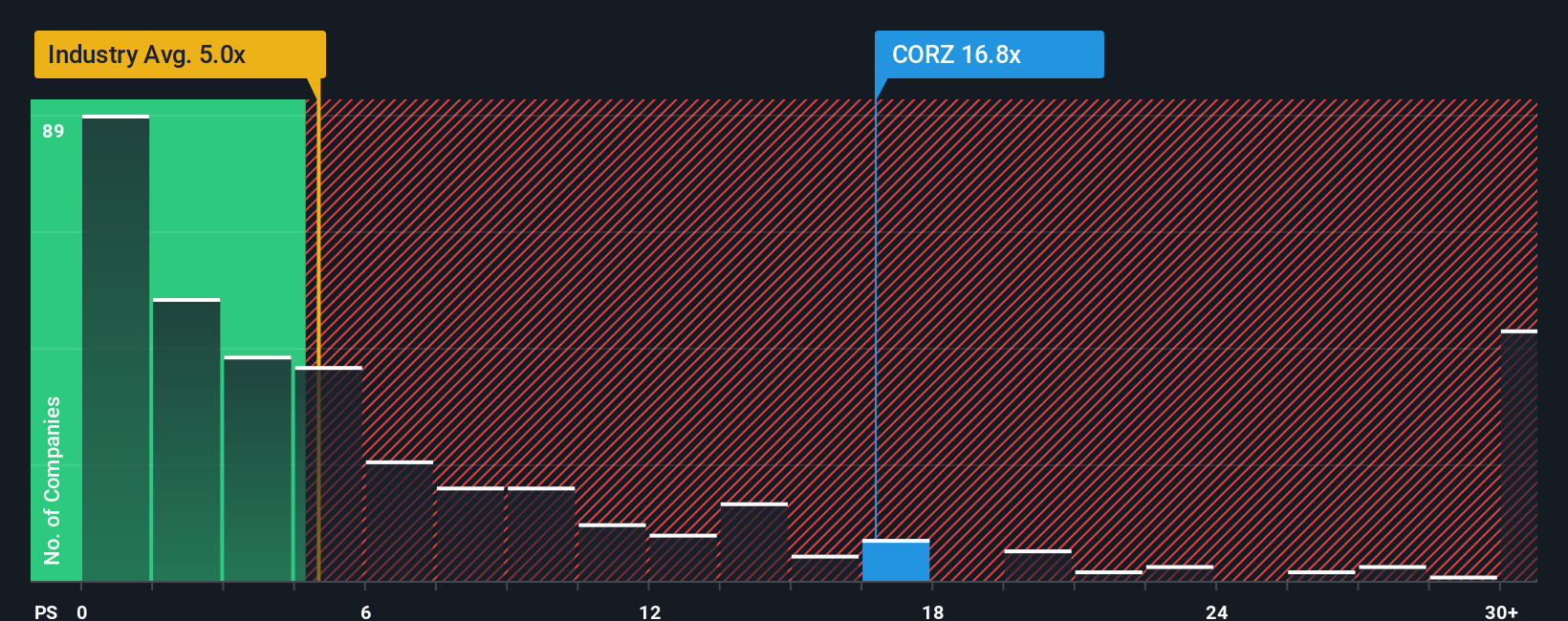

Looking through another lens, Core Scientific’s price-to-sales ratio is an eye-catching 18.6x. This is far above both its peer average of 7.7x and the US Software industry average of 5.5x. Even the fair ratio is just 6.4x. Such a gap points to real valuation risk if the market questions future growth. Could this premium be justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If you want to dig deeper or have a different perspective, take a few minutes to explore the underlying data and build your own take on Core Scientific. Do it your way

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart moves come from staying ahead. Step up your investing game and seize tomorrow’s biggest winners before the crowd catches on. Why let these opportunities pass you by?

- Capitalize on the explosive rise of artificial intelligence by checking out these 26 AI penny stocks, which are transforming entire industries and unlocking fresh growth.

- Tap into steady income potential with these 21 dividend stocks with yields > 3% to access attractive yields and a solid foundation for your strategy.

- Ride the wave of digital currencies and blockchain advancements with these 81 cryptocurrency and blockchain stocks, where innovation meets real-world disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives