- United States

- /

- Software

- /

- NasdaqCM:CLSK

CleanSpark (NasdaqCM:CLSK) Produces 694 Bitcoin In May Sells At US$102,254 Each

Reviewed by Simply Wall St

In June 2025, CleanSpark (NasdaqCM:CLSK) released its production and sales performance for May, highlighting the production of 694 Bitcoin and sales of 294 Bitcoin at strong market prices. These operational updates align with a 10.95% share price increase in the last quarter. Despite reporting a net loss for the second quarter, the company's solid Bitcoin production and sales figures reflect positive operational capacity. Additionally, CleanSpark's inclusion in key S&P indices earlier this year may have added weight to its broader market movement, as the overall market grew by 12% over the past 12 months.

We've discovered 4 warning signs for CleanSpark that you should be aware of before investing here.

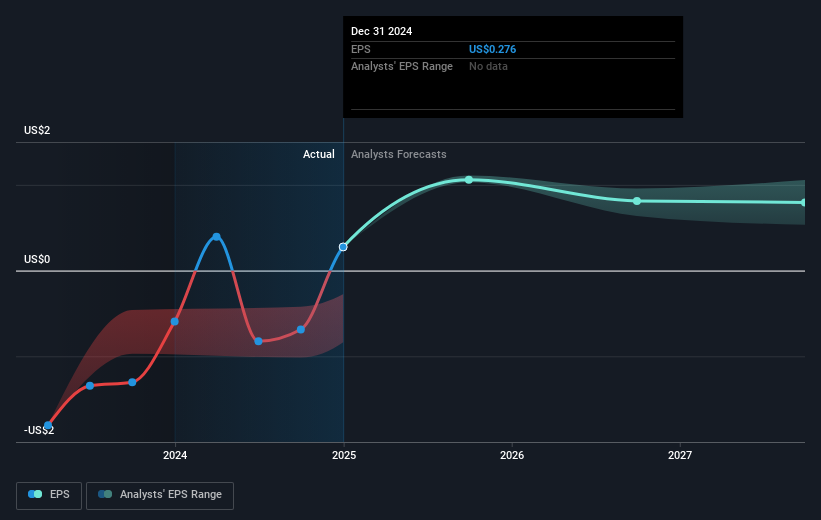

The recent operational updates from CleanSpark, showcasing robust Bitcoin production and sales in May, align with the company's previous strategic efforts to boost capacity and scale. These developments not only reinforce CleanSpark's focus on leveraging energy-rich expansions, but may also bolster revenue and earnings forecasts by substantiating the company's operational potential. Analysts' predictions of a 48.1% annual revenue growth and improved profit margins over three years could gain credibility with such consistent production achievements, while the 10.95% quarterly share price increase reaffirms investor confidence.

Over the longer term, CleanSpark shares have surged with a total return of 296.77% in the past five years. However, when compared to the broader US market, the company underperformed with an 11.9% market return over the past year. Within the context of CleanSpark’s price target, today's share price of US$8.44 presents a substantial upside to the consensus target of US$19.12, which projects a potential increase of 55.9% based on current forecasts. This underscores ongoing investor optimism and potential for further growth, suggesting that the company's continued focus on expanding its Bitcoin mining operations and holding strategies could resonate well with the market.

Review our historical performance report to gain insights into CleanSpark's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion