- United States

- /

- Software

- /

- NasdaqGS:CLBT

Is Cellebrite DI’s Latest Law Enforcement Partnerships Enough to Support Its Current Stock Valuation?

Reviewed by Bailey Pemberton

- Curious if Cellebrite DI is a hidden bargain or just riding the current tech wave? Let’s unravel what really matters when it comes to the stock’s value.

- Cellebrite DI has seen a 19.8% surge over the past week, with its 1-year return sitting at 4.2% and a strong 299.4% climb over three years. However, it is down -14.8% year-to-date.

- In the past month, Cellebrite DI stock’s movement grabbed headlines after the company announced new partnerships with law enforcement agencies and rolled out advanced features to its digital intelligence platform. Industry analysts have taken notice and suggest these developments may be driving renewed interest and speculation about its future growth potential.

- On our valuation checks, Cellebrite DI scores just 1 out of 6 for being undervalued, meaning it only passes one critical test so far. We will look at how traditional valuation approaches hold up for this stock, but stick around for a smarter way to think about value at the end of this article.

Cellebrite DI scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cellebrite DI Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For Cellebrite DI, this involves taking analysts’ reasonable forecasts for free cash flow and extrapolating them, then assessing what all those future dollars are worth right now.

Currently, Cellebrite DI generates $140.4 Million in Free Cash Flow (FCF), with analysts projecting steady growth over the coming years. By 2027, FCF is expected to reach $205 Million, and projections extend further out to 2035, though estimates past 2027 are extrapolations rather than direct analyst forecasts. The assumed growth slows over time, with discounted future FCF in 2035 estimated at $127.7 Million. All values are considered in US Dollars.

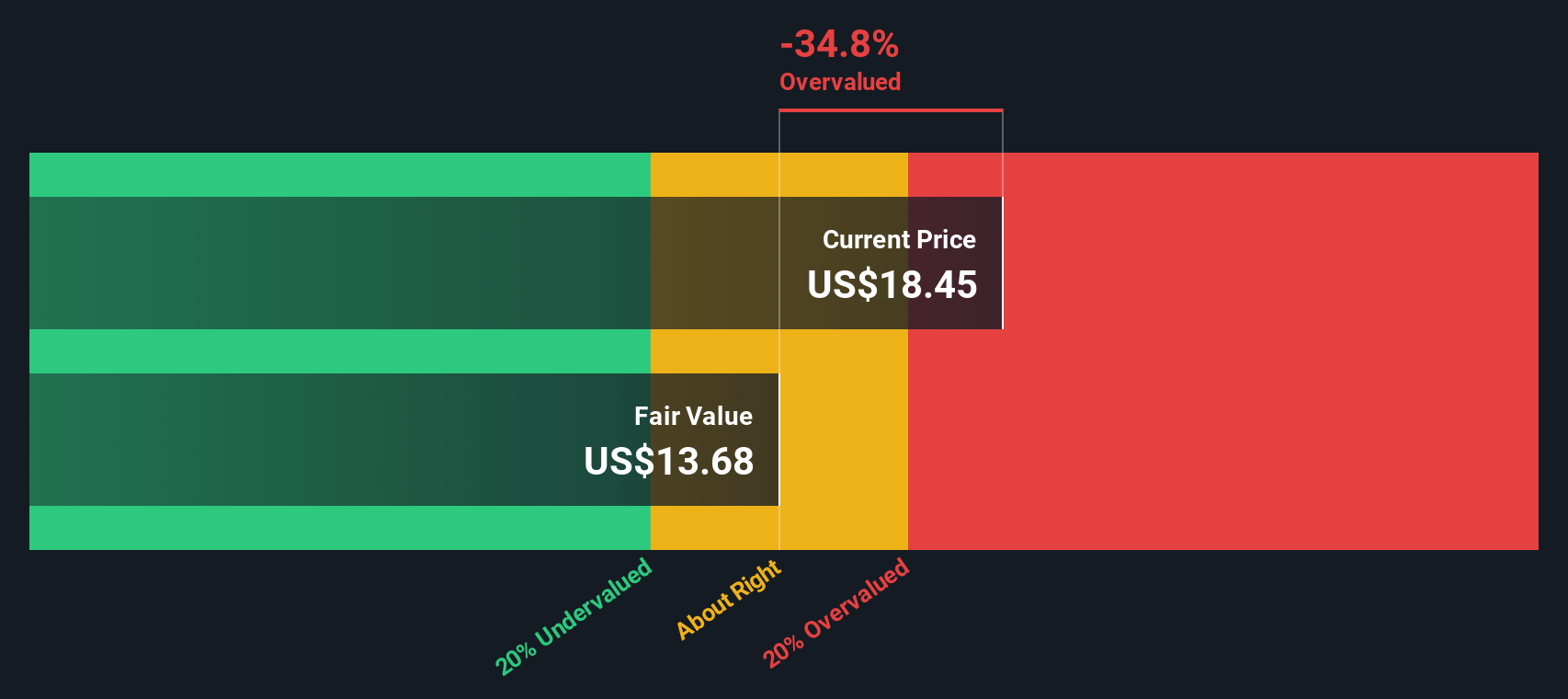

Using the 2 Stage Free Cash Flow to Equity model, the resulting estimated intrinsic value per share is $13.68. This model suggests the stock is currently trading at a 34.8% premium to its intrinsic value, indicating it is overvalued based on this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cellebrite DI may be overvalued by 34.8%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cellebrite DI Price vs Earnings (PE)

For profitable companies like Cellebrite DI, the Price-to-Earnings (PE) ratio is one of the most widely used and informative valuation metrics. The PE ratio tells us how much investors are willing to pay for each dollar of a company’s earnings, making it especially useful when a business generates consistent profits.

It is important to keep in mind that growth expectations and company-specific risks play a significant role in what constitutes a “fair” PE ratio. Companies expected to deliver higher earnings growth in the future typically command higher PE multiples, while businesses with more risks or weaker prospects tend to have lower ones.

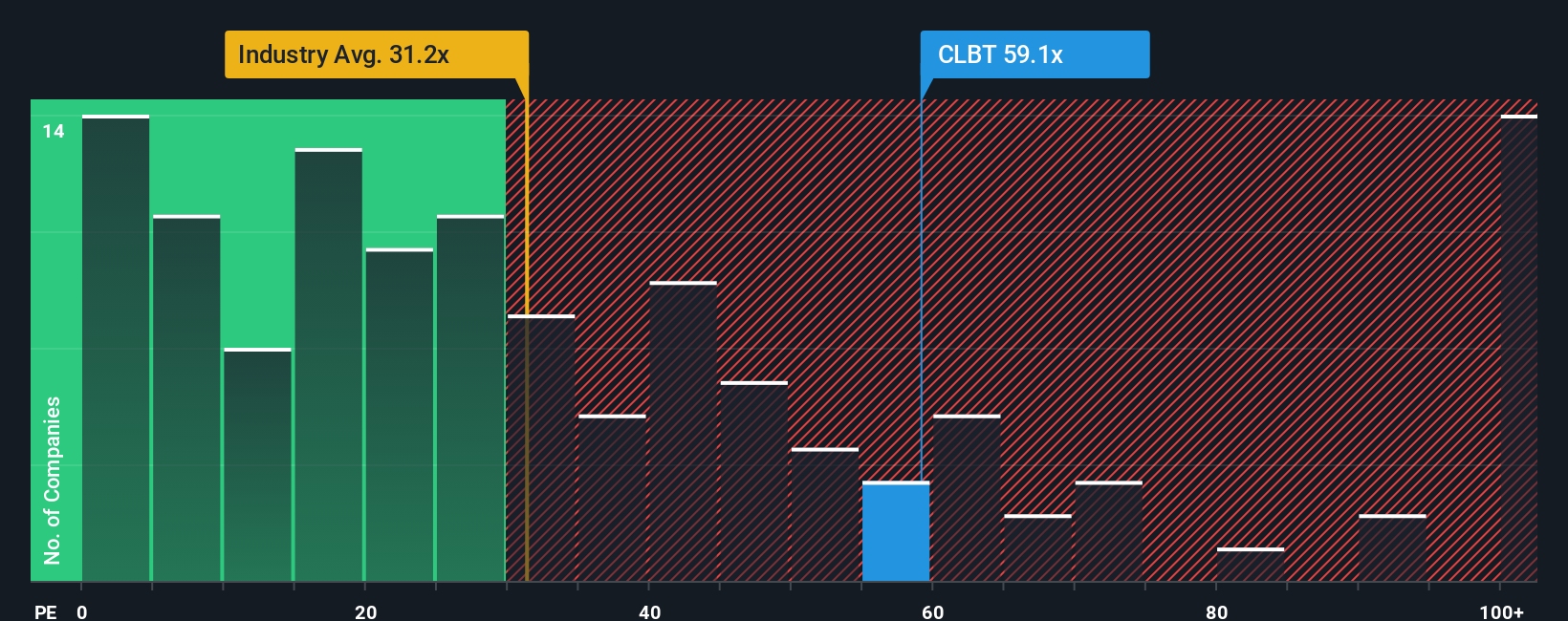

Cellebrite DI currently trades at a PE ratio of 59.1x. That is substantially higher than the Software industry’s average PE of 31.2x and also above its peer average of 48.8x. At first glance, this suggests the stock is priced at a premium relative to industry benchmarks.

However, Simply Wall St’s proprietary “Fair Ratio” metric offers a more nuanced perspective. The Fair Ratio for Cellebrite DI stands at 33.9x, calculated by weighing factors such as the company’s unique earnings growth outlook, risks, profit margins, and its relative size and industry characteristics. This approach is often more reliable than simply comparing against peers or broad industry multiples, as it accounts for company-specific strengths and vulnerabilities that standard benchmarks might miss.

Comparing the current PE of 59.1x with its Fair Ratio of 33.9x, Cellebrite DI appears meaningfully overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cellebrite DI Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about Cellebrite DI’s future; it connects your view of what may drive growth, margins, and risks with your assumptions for revenue, future earnings, and ultimately what you see as a fair price for the stock. Narratives make your investment thinking clear and actionable by linking your story directly to financial forecasts and fair value. They allow you (and others) to see exactly how different perspectives drive different valuations.

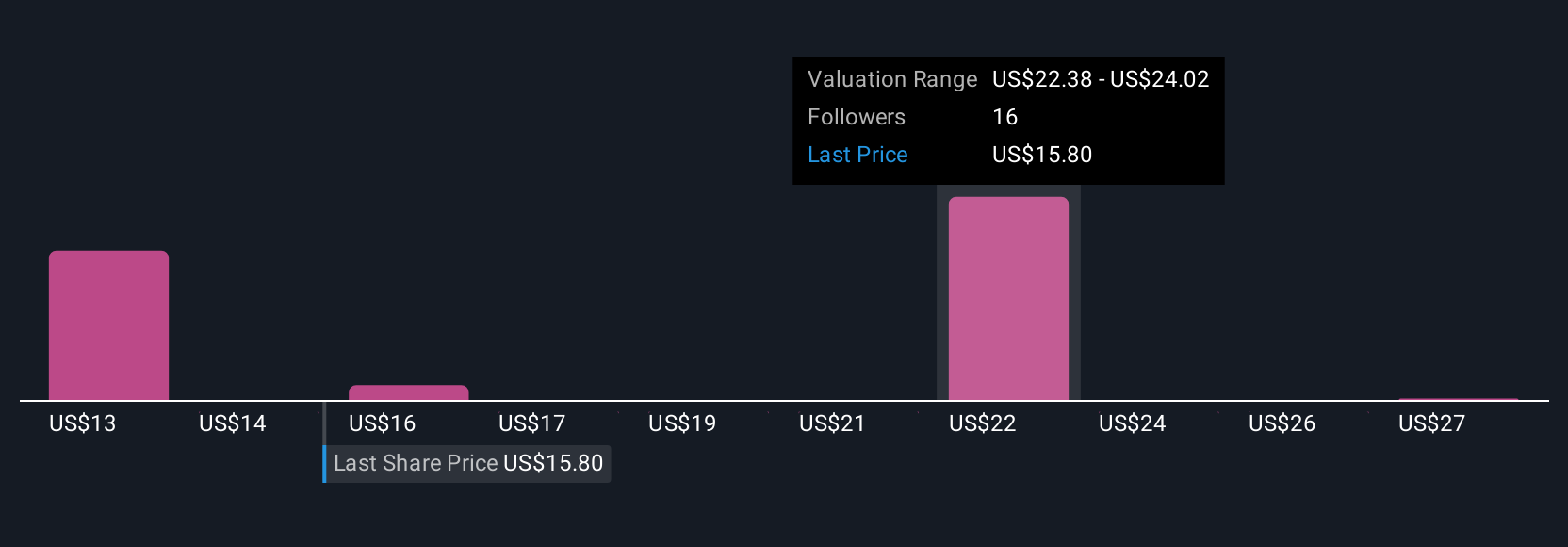

The best part is that Narratives are easy to create and explore on Simply Wall St’s Community page, used by millions of investors worldwide. Narratives help you decide when to buy or sell by comparing your calculated Fair Value with Cellebrite DI’s actual share price. They update dynamically as news or earnings are released so you always stay informed. For example, one investor may build a bullish Narrative expecting rapid SaaS adoption and sustainable double-digit revenue growth, justifying a fair value as high as $28.00. Another may focus on federal contract delays and increased competition, assigning a more cautious fair value of $18.00. With Narratives, you bring your own view and can quickly sense-check it against the latest market consensus, all in one place.

Do you think there's more to the story for Cellebrite DI? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives