- United States

- /

- Communications

- /

- NasdaqGS:LITE

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has experienced a positive trajectory, climbing 1.7% in the last 7 days and showing a 12% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation capabilities and have robust business models capable of capitalizing on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.64% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.64% | 66.60% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Legend Biotech | 26.68% | 57.96% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.57% | 60.58% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Cellebrite DI (CLBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cellebrite DI Ltd. provides solutions for legally sanctioned investigations across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of $3.89 billion.

Operations: Cellebrite DI Ltd. generates revenue primarily through its Internet Software & Services segment, amounting to $419.17 million. The company focuses on developing solutions for investigations that are legally sanctioned across multiple regions globally.

Cellebrite DI's recent advancements underscore its commitment to leveraging technology for societal benefits, particularly in law enforcement and public safety. The integration of NCMEC's CyberTipline hash value list into Cellebrite's Inseyets software marks a significant enhancement in combating child exploitation, enabling instant identification of harmful content and accelerating investigative processes. Financially, the company has shown robust growth with a 14.5% annual revenue increase and is on track for substantial profitability improvements, expecting earnings to surge by 76.3% annually. This financial trajectory coupled with strategic innovations like the Spring 2025 Release—introducing AI-driven enhancements across its digital investigation platforms—positions Cellebrite as a pivotal player in both tech innovation and critical societal issues resolution.

- Click here and access our complete health analysis report to understand the dynamics of Cellebrite DI.

Review our historical performance report to gain insights into Cellebrite DI's's past performance.

Lumentum Holdings (LITE)

Simply Wall St Growth Rating: ★★★★★★

Overview: Lumentum Holdings Inc. manufactures and sells optical and photonic products across various regions including the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market cap of $6.37 billion.

Operations: Lumentum Holdings generates revenue primarily from its Industrial Tech and Cloud & Networking segments, with the latter contributing $1.24 billion.

Lumentum Holdings Inc. recently showcased its innovative laser technologies at Laser World of Photonics 2025, emphasizing its role in advancing industrial photonics and precision manufacturing. The company's new PicoBlade Core ultrafast laser platform, capable of delivering up to 150 watts with sub-12 picosecond pulses, is set to enhance high-throughput micromachining across various applications including consumer electronics and energy storage. This technological advancement aligns with Lumentum's strategic focus on high-power diode-pumped lasers and specialty fibers, reinforcing its commitment to supporting high-growth sectors through scalable and reliable solutions. Moreover, the integration of advanced photonic systems in industrial and telecom applications showcases Lumentum’s dedication to driving future innovations while maintaining a competitive edge in the tech industry.

VNET Group (VNET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China, with a market capitalization of $1.57 billion.

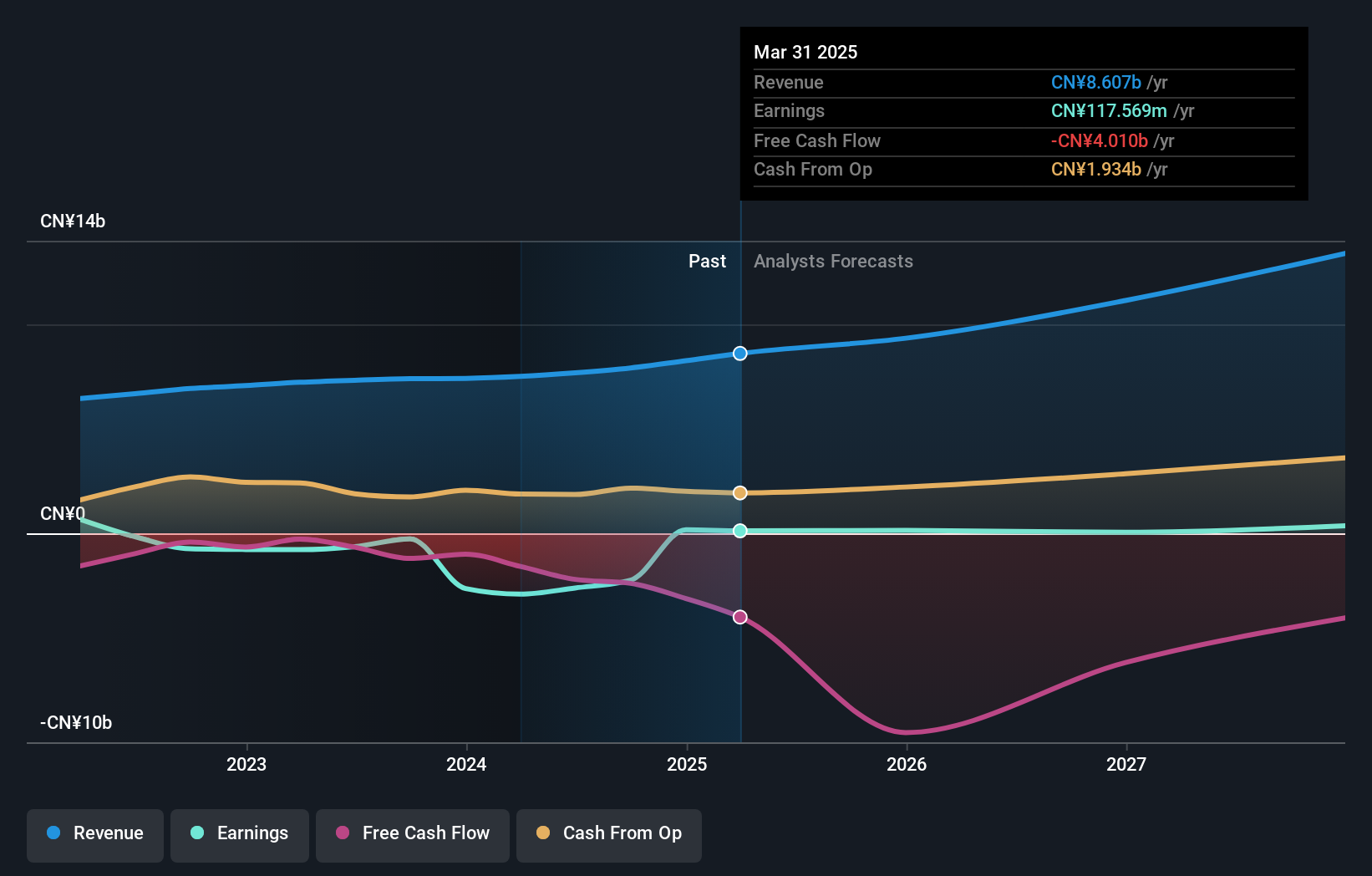

Operations: VNET Group generates revenue primarily through hosting and related services, amounting to CN¥8.61 billion.

VNET Group, despite recent losses, is navigating a promising trajectory with expected revenue growth of 13.8% annually, surpassing the US market average of 8.7%. This growth is underpinned by strategic R&D investments and an aggressive focus on expanding its tech infrastructure, aligning with broader industry trends towards enhanced digital services. The company's commitment to innovation is evident from its reiterated earnings guidance for 2025, projecting a revenue increase to between RMB 9.1 billion and RMB 9.3 billion—a clear indication of its resilience and adaptability in a competitive sector. With earnings forecasted to surge by nearly 32% annually, VNET is poised to cement its position within the high-growth tech landscape in the United States, leveraging robust technological advancements and market foresight.

- Click here to discover the nuances of VNET Group with our detailed analytical health report.

Understand VNET Group's track record by examining our Past report.

Next Steps

- Embark on your investment journey to our 229 US High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>