- United States

- /

- Software

- /

- NasdaqGS:CLBT

Could Cellebrite (CLBT) Strengthen Its Regulatory Edge With New Legal Leadership Amid AI Transitions?

Reviewed by Sasha Jovanovic

- Cellebrite DI Ltd. recently appointed Holly Windham as General Counsel and Chief Compliance Officer, highlighting her background in legal leadership, compliance, and technology sector expertise, and succeeding Ayala Berler Shapira in this role.

- This leadership change comes as Greenhaven Road Capital spotlighted Cellebrite as a top holding, pointing to subscription revenue growth and ongoing sector challenges related to AI adoption in software.

- We’ll explore how Ms. Windham’s compliance and privacy experience could impact Cellebrite’s investment outlook amid evolving regulatory pressures.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cellebrite DI Investment Narrative Recap

To be a shareholder in Cellebrite DI, one must believe in the growing global need for advanced digital forensics and the ability of the company to maintain its technological edge while executing on a shift to high-margin recurring revenues. The recent appointment of Holly Windham as General Counsel and Chief Compliance Officer strengthens Cellebrite’s positioning around regulatory compliance and privacy, but this move alone does not substantially shift the near-term catalyst of US federal spending cycle recovery, or the acute risk associated with delays and bottlenecks in federal contract procurement.

Among recent company developments, Cellebrite’s 2025 product launches, specifically the rollout of Cellebrite Cloud and AI-powered product enhancements, are most relevant, as they directly support the company’s drive for sustained subscription revenue growth. While these innovations are key to long-term differentiation, the pace of government contract recovery remains the most critical short-term factor to watch.

However, investors should also be aware that escalating competition and rapid advances in device security represent a risk that could...

Read the full narrative on Cellebrite DI (it's free!)

Cellebrite DI's narrative projects $671.4 million in revenue and $128.8 million in earnings by 2028. This requires 15.4% yearly revenue growth and a $279.7 million increase in earnings from the current -$150.9 million.

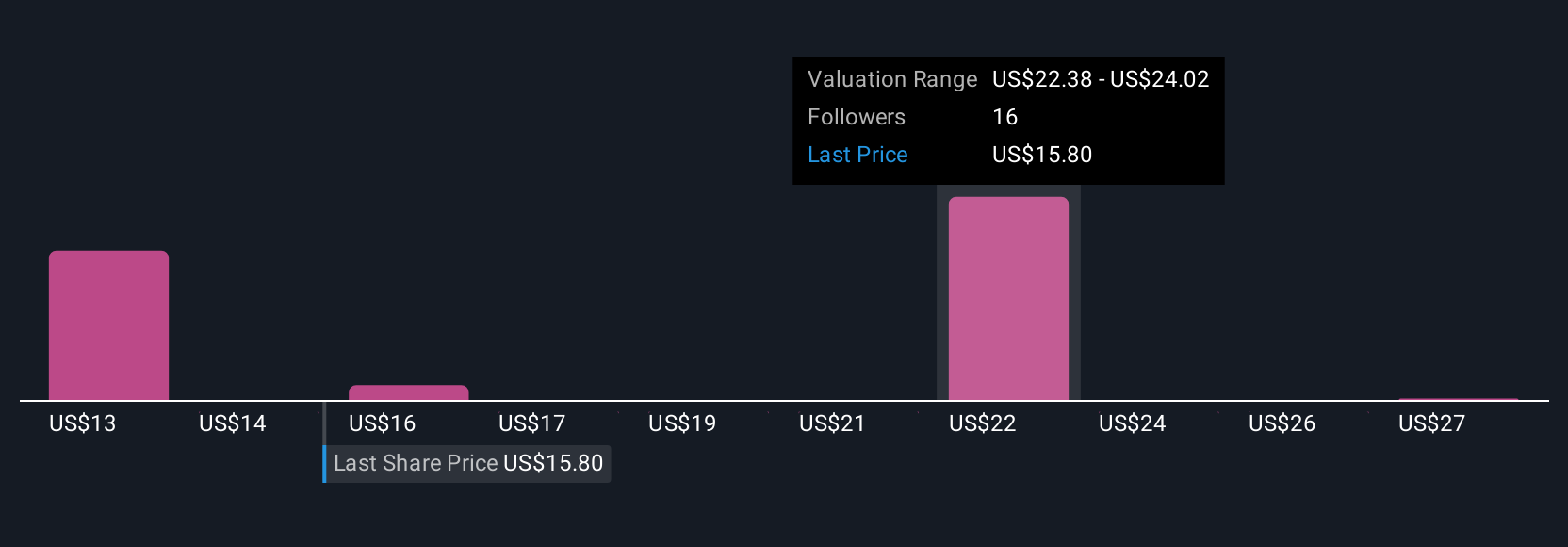

Uncover how Cellebrite DI's forecasts yield a $23.14 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assigned fair values ranging from US$12.42 to US$32 across 6 recent perspectives. With the company's future performance sensitive to public sector contract timing, many investors may find it valuable to compare these varied views before making conclusions.

Explore 6 other fair value estimates on Cellebrite DI - why the stock might be worth 21% less than the current price!

Build Your Own Cellebrite DI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cellebrite DI research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cellebrite DI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cellebrite DI's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives