- United States

- /

- Software

- /

- NasdaqGS:CIFR

Should Cipher Mining’s (CIFR) Record July Hash Rate Prompt a Fresh Look at Its Bitcoin Strategy?

Reviewed by Simply Wall St

- Cipher Mining Inc. reported its unaudited July 2025 production and operations figures, revealing 214 Bitcoin mined, 52 Bitcoin sold, and a month-end operating hash rate of 20.4 exahashes per second with 111,500 deployed mining rigs.

- A unique point of interest is the company’s increased Bitcoin holdings, totaling 1,219 BTC at month-end, which may enhance operational flexibility moving forward.

- We'll now explore how Cipher Mining’s elevated operating hash rate and production levels could shape its broader investment outlook.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cipher Mining Investment Narrative Recap

To be a Cipher Mining shareholder, one typically needs conviction in the long-term adoption and value of Bitcoin, as well as belief in the company’s ability to scale operations efficiently. The July production update, highlighting increased hash rate and Bitcoin reserves, modestly supports near-term growth catalysts, while the biggest risk remains the impact of volatile Bitcoin prices on profitability. The recent operational results do not fundamentally alter the most important short-term drivers or risks facing the business today, but reinforce Cipher’s positioning amid ongoing market shifts.

Among recent announcements, the successful energization of the Black Pearl site in late June stands out, as it set the foundation for Cipher’s growth in hash rate now reflected in the July update. This expanded capacity helps support the company’s aim to reach ambitious self-mining targets, directly linking to the potential for higher Bitcoin production, a key catalyst cited by both management and analysts.

In contrast, one key issue investors should be aware of is how susceptible future earnings remain to significant swings in Bitcoin’s market price...

Read the full narrative on Cipher Mining (it's free!)

Cipher Mining's outlook projects $679.2 million in revenue and $90.2 million in earnings by 2028. This scenario is based on a 64.7% annual revenue growth rate and a $213.7 million improvement in earnings from the current level of -$123.5 million.

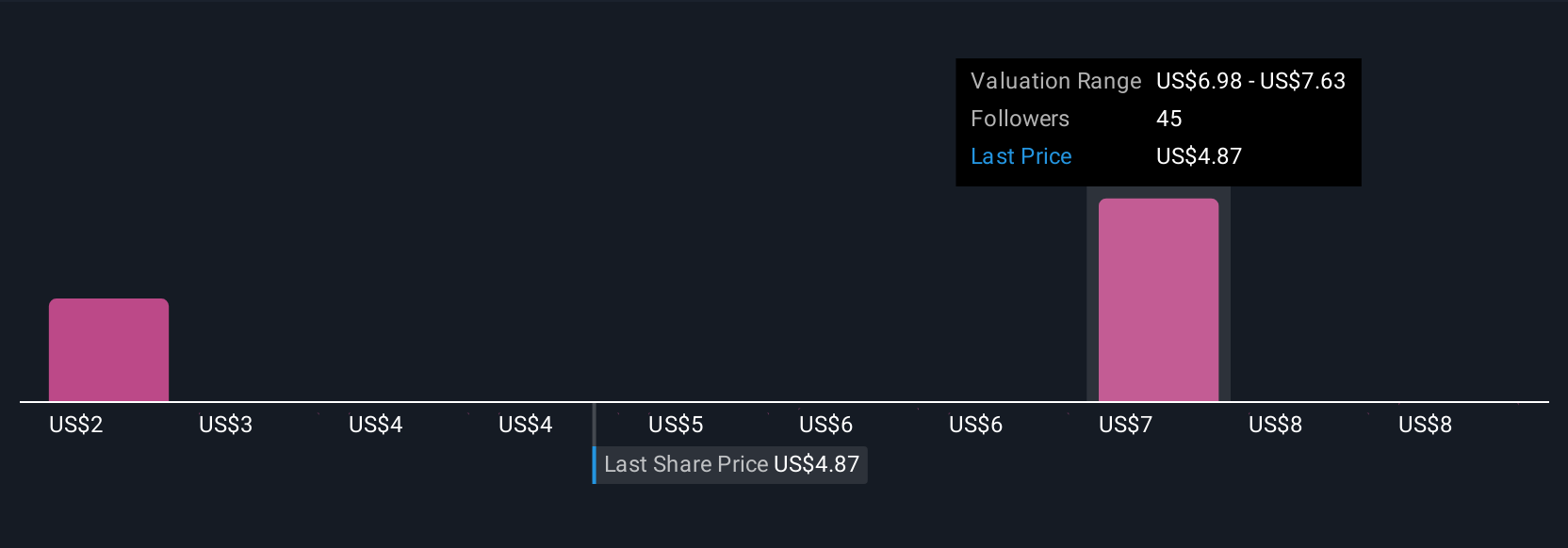

Uncover how Cipher Mining's forecasts yield a $7.36 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$2.44 to US$8.93 per share. While these assessments show wide variation, potential revenue growth driven by recent hash rate expansion may shape how the market ultimately prices Cipher Mining in the months ahead.

Explore 4 other fair value estimates on Cipher Mining - why the stock might be worth as much as 71% more than the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives