- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 1.3% increase over the last week and a significant 24% rise over the past year, while earnings are anticipated to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for revenue expansion and innovation in line with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ADMA Biologics (NasdaqGM:ADMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company focused on developing, manufacturing, and marketing specialty plasma-derived biologics for treating immune deficiencies and infectious diseases globally, with a market cap of $4.36 billion.

Operations: ADMA Biologics generates revenue primarily through its ADMA Biomanufacturing segment, which accounts for $373.22 million, and its Plasma Collection Centers contributing $9.45 million.

ADMA Biologics showcases a robust trajectory in the high-tech biotech sector, with its recent strategic board appointments enhancing governance and potentially steering future growth. The company's aggressive debt management, evidenced by a significant $30 million loan repayment, underscores a prudent financial strategy. Impressively, ADMA reported a surge in quarterly sales to $119.84 million from $67.28 million year-over-year and revised its annual revenue forecast upwards to between $415 million and $465 million. This financial uplift is mirrored in their net income leap to $35.91 million for Q3 2024 from just $2.57 million in the previous year, reflecting not only enhanced operational efficiency but also an effective alignment with market demands and innovation imperatives.

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc., along with its subsidiaries, focuses on developing and operating large-scale bitcoin mining data centers in the United States, with a market capitalization of $1.94 billion.

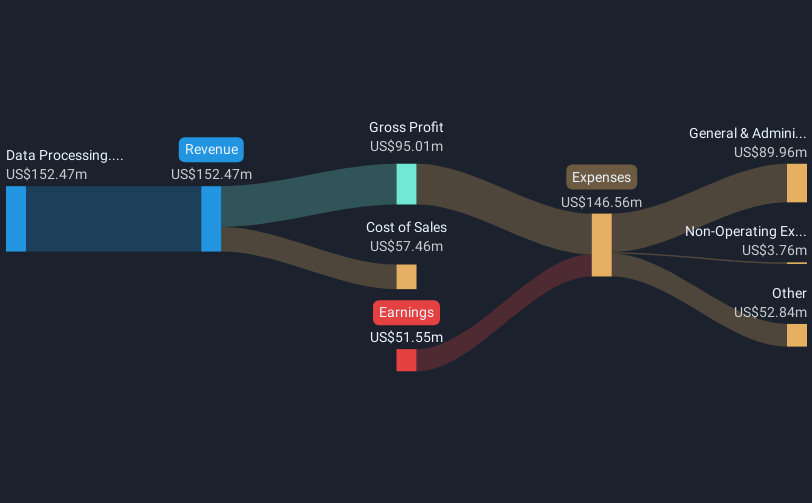

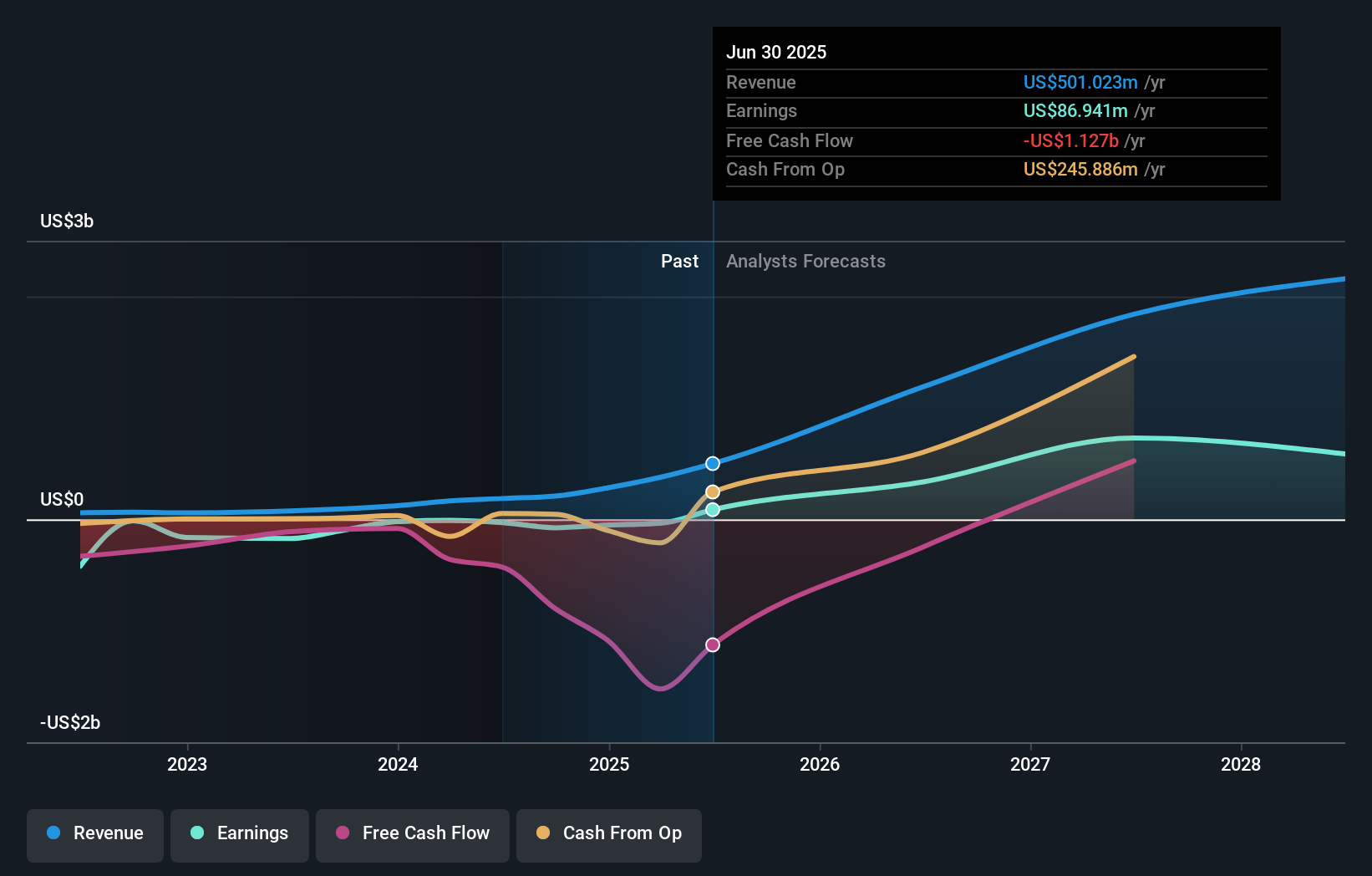

Operations: Cipher Mining Inc. generates revenue primarily through data processing, amounting to $152.47 million. The company is involved in the industrial-scale bitcoin mining sector within the U.S., leveraging large-scale data centers for its operations.

Cipher Mining, navigating through the volatile tech sector, has shown notable activity with its recent expansion into a new site in West Texas and strategic acquisitions aimed at scaling operations. Despite reporting a significant net loss of $86.75 million in Q3 2024, the company's aggressive growth tactics—such as securing up to 2.6 GW across multiple sites—highlight its commitment to enlarging its footprint in high-performance computing and bitcoin mining sectors. These moves could position Cipher for recovery as it aims to capitalize on the burgeoning demand for digital currency infrastructure, underscored by an expected revenue surge of 56.9% annually and projected earnings growth of 81.15% per year.

- Click here and access our complete health analysis report to understand the dynamics of Cipher Mining.

Understand Cipher Mining's track record by examining our Past report.

IREN (NasdaqGS:IREN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IREN Limited is engaged in owning and operating bitcoin mining data centers with a market capitalization of $2.43 billion.

Operations: The company generates revenue primarily from building and operating data center sites for bitcoin mining, amounting to $208.75 million.

Despite recent setbacks, IREN Limited demonstrates potential with a forecasted annual revenue growth of 42.3% and earnings expected to surge by 96.64% annually. This growth is supported by strategic shifts like the recent name change and expansion into Bitcoin mining, evidenced by the mining of 529 Bitcoins in December alone. However, challenges such as a substantial net loss reported in Q3 and ongoing legal issues underline the volatile nature of its journey towards profitability within the tech sector. These factors combined suggest a company at an inflection point, aiming to leverage high-growth opportunities while navigating significant hurdles.

- Delve into the full analysis health report here for a deeper understanding of IREN.

Explore historical data to track IREN's performance over time in our Past section.

Where To Now?

- Reveal the 236 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives