- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR): Reassessing Valuation After Major AI Data Center Deals and Analyst Upgrade

Cipher Mining (CIFR) just flipped the script on its business model, locking in multi billion dollar AI and high performance computing data center deals with AWS and Fluidstack that reshape its long term revenue picture.

See our latest analysis for Cipher Mining.

The market has already been repositioning Cipher around this pivot, with a 1 year to date share price return above 300 percent and a 3 year total shareholder return above 2,300 percent, signaling powerful but volatile momentum.

If Cipher’s AI pivot has caught your attention and you want to see what else is shaping the digital infrastructure story, explore other high growth tech and AI names via high growth tech and AI stocks.

With the stock already up more than 2,300 percent in three years and analysts still seeing upside to their price targets, is Cipher Mining an underappreciated AI infrastructure play, or are markets already pricing in years of future growth?

Most Popular Narrative Narrative: 27.2% Undervalued

Compared with Cipher Mining’s most popular fair value estimate of $27.25, the last close at $19.83 implies a sizable valuation gap that hangs on ambitious growth and margin assumptions.

The rapid expansion and optimization of production capacity, notably through adding Black Pearl Phase 1 and the upcoming Phase 2, along with fully funded next-generation miner deployments, positions Cipher to significantly increase its hash rate and Bitcoin output, directly supporting future top-line revenue growth.

Want to see what justifies such a rich future earnings multiple? The narrative leans on aggressive revenue compounding, a sharp margin reset, and a premium valuation usually reserved for elite software names.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup still depends on robust Bitcoin pricing and flawless execution on AI leases, where delays or underutilised capacity could quickly pressure valuations.

Find out about the key risks to this Cipher Mining narrative.

Another View: Price Versus Fundamentals

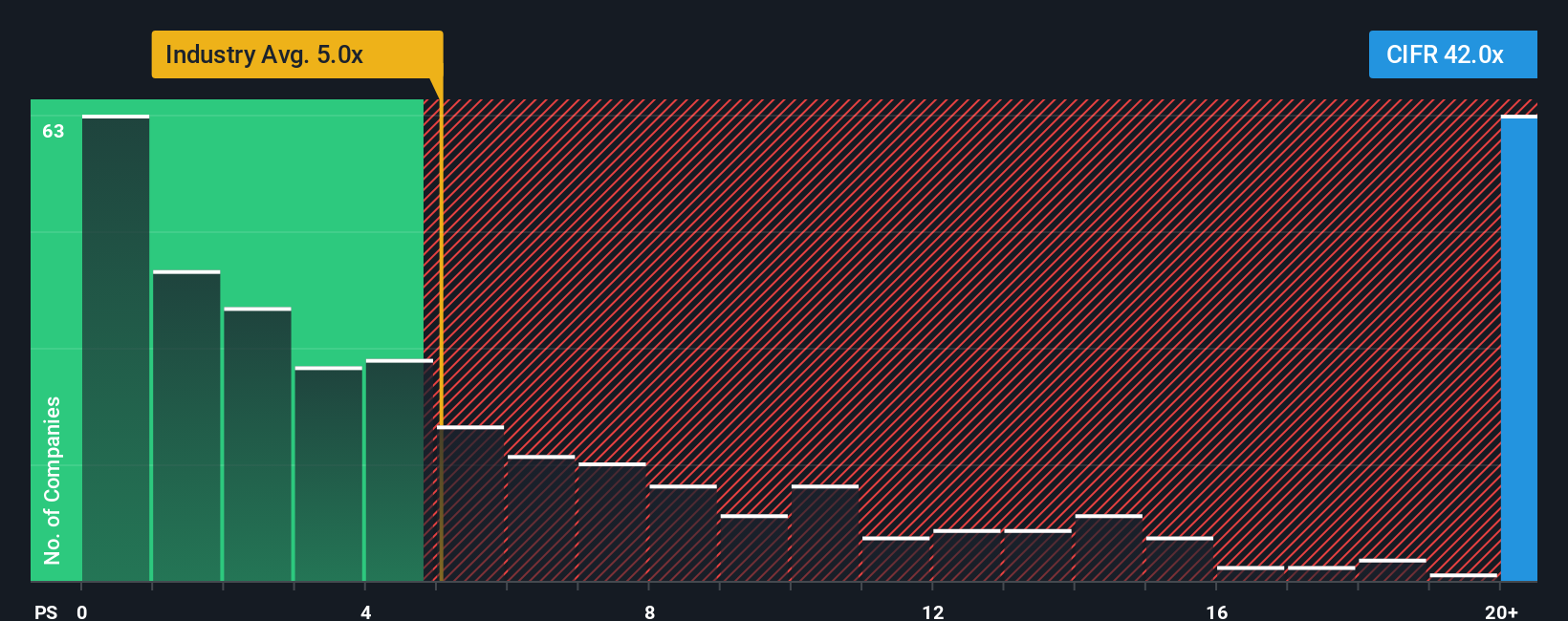

On a revenue multiple basis, Cipher looks stretched, trading at a 37.9x price to sales ratio versus 5x for the US software industry, 21x for peers, and a fair ratio of 8.4x that the market could drift toward. This raises the risk of a sharp de rating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If this view does not fully line up with your own or you want to dig into the numbers yourself, you can build a personalized thesis in just a few minutes, Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before you move on, lock in more potential opportunities with targeted ideas from Simply Wall Street’s powerful screener tools that surface stocks many investors overlook.

- Boost your hunt for quality by targeting dependable income streams with these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Jump ahead of the curve by focusing on innovation leaders through these 26 AI penny stocks positioned to benefit from accelerating AI adoption.

- Sharpen your value strategy with these 913 undervalued stocks based on cash flows that may be trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

European Defense Strategic Authonomy

Grangex is set to achieve a 191.89% revenue growth in five years

Verve Group: A Tale of Three Futures

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.