- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR): Losses Worsen, Challenging Bullish Growth Narratives Despite Strong Profitability Forecasts

Reviewed by Simply Wall St

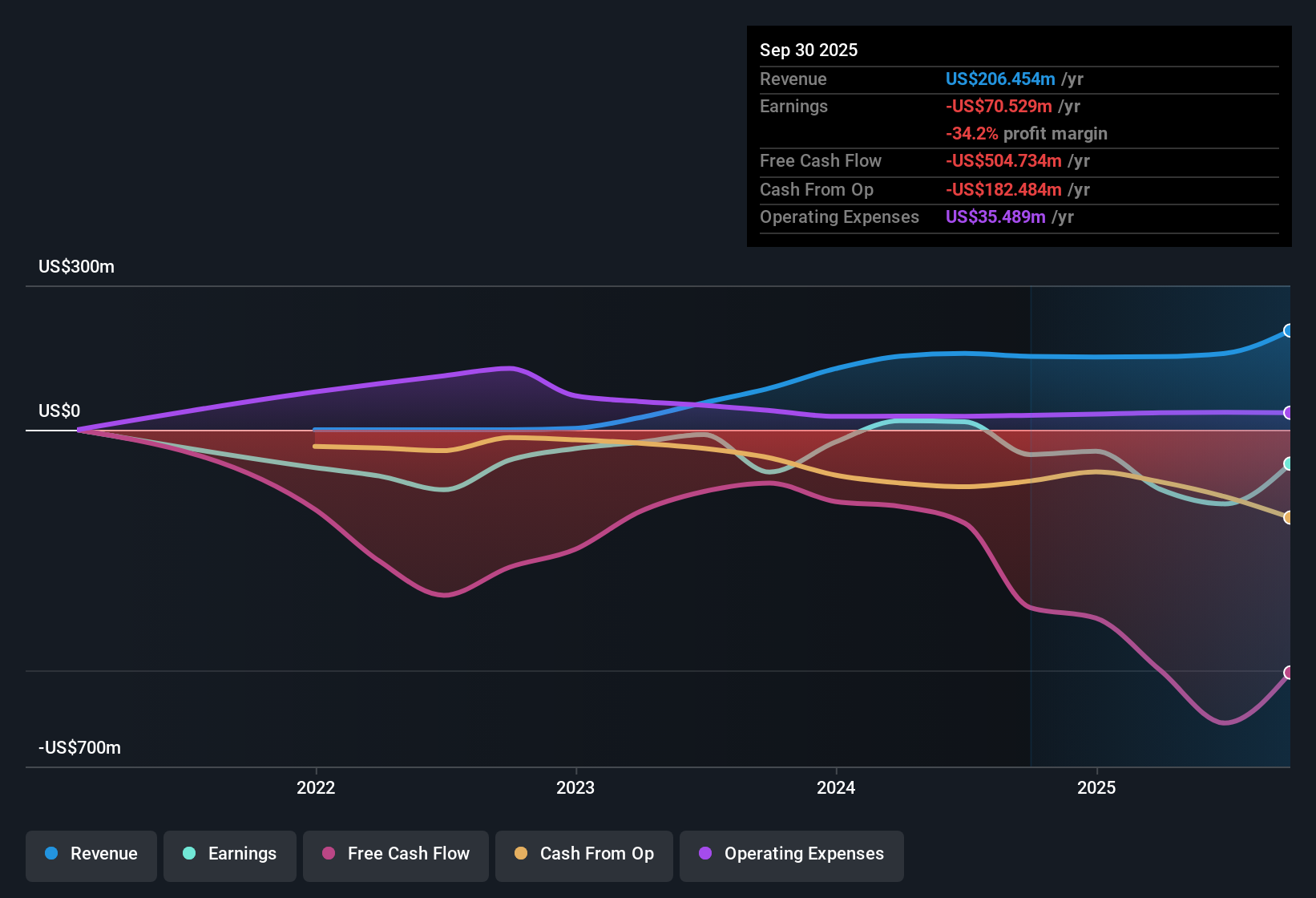

Cipher Mining (CIFR) remains unprofitable, with losses having accelerated at an average rate of 10.3% per year over the past five years. Despite the current challenges, including a Price-to-Sales Ratio of 43.4x, which sits well above both its peer group’s 28.7x average and the broader US software industry’s 5.3x benchmark, investors are closely watching the company’s forecast for 34.8% annual revenue growth and a robust 67.96% earnings growth per year. This positions Cipher on a pathway to profitability within the next three years. The market is weighing these strong growth projections against recent share price volatility and a premium valuation as the company attempts to transition into the black.

See our full analysis for Cipher Mining.Next up, we’ll put these fresh results against the market’s most widely held narratives for Cipher Mining to reveal whether the company’s story is evolving as expected or taking a new turn.

See what the community is saying about Cipher Mining

Margin Pressures Despite Industry-Leading Growth Targets

- Analysts estimate Cipher Mining’s revenue will rise by 63.6% per year over the next 3 years, with profit margins forecast to improve from -96.9% today to 13.1%, the US software industry average, by around September 2028.

- Analysts' consensus view emphasizes that Cipher’s expansion into new mining and data center capacity is strategically critical for supporting these growth targets.

- However, analysts highlight ongoing heavy dependence on volatile Bitcoin mining for top-line performance, leaving the company exposed to swings in Bitcoin prices and sector trends.

- Consensus also notes that although infrastructure upgrades and low power contract rates could eventually lift margins, persistent cash burn and large capital outlays create real uncertainty about how soon profitability will arrive.

- Strong revenue growth forecasts have not yet translated to stable or positive profit margins, highlighting execution risk around both operating leverage and market demand.

Peer-Beating Valuation Keeps Expectations High

- Cipher Mining’s Price-to-Sales Ratio sits at 43.4x, which is much higher than its peer group average of 28.7x and the broader US software industry benchmark of 5.3x.

- Analysts' consensus view sees this premium pricing as both a reward for above-market revenue forecasts and a source of pressure.

- Analysts note that investors are banking on rapid improvement in future profitability to justify paying so far above sector and peer averages for each dollar of revenue.

- However, consensus also cautions that any stumbles in scaling or cost management, given such expensive entry, could trigger swift revaluations if the company fails to execute.

Share Price Volatility and Analyst Targets Narrowly Aligned

- The current share price of $22.76 is just above the latest analyst price target of $21.88, representing a -3.9% difference, which suggests the market currently sees Cipher as close to fairly valued despite the journey toward profitability not being complete.

- Analysts' consensus view points out this tight margin between price and target could indicate investors are fully pricing in Cipher’s ambitious forecasts.

- Consensus analysis adds that instability in share price over the past three months underscores the risk of sentiment turning quickly should financial results diverge from projections.

- Consensus stresses the need for investors to regularly revisit both the speed of margin recovery and capital intensity as catalysts for future rerating.

- If you want the complete play-by-play on how market narratives for Cipher connect with the latest numbers, check out the consensus view in depth: 📊 Read the full Cipher Mining Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cipher Mining on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something unexpected in the numbers? Take a few minutes to dive in and share your interpretation of Cipher’s story. Do it your way

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Cipher Mining faces persistent margin pressure, ongoing dependence on volatile Bitcoin prices, and a premium valuation, even as its progress toward profitability remains uncertain.

If you want investments with more reliable valuations and upside, consider using these 839 undervalued stocks based on cash flows to spot companies trading at attractive prices with real growth potential today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion