- United States

- /

- Software

- /

- NasdaqGS:CHKP

Is Check Point Software Technologies (CHKP) Fairly Priced After Recent Share Price Weakness

- If you are wondering whether Check Point Software Technologies is fairly priced or offering value right now, it helps to start with how the market has been treating the stock over different timeframes.

- The share price last closed at US$180.91, with a 0.8% return over the past 7 days, a 4.6% decline over 30 days, and returns of 0.1% decline year to date, 14.8% decline over 1 year, 42.3% over 3 years, and 49.9% over 5 years.

- These mixed returns sit against a backdrop of ongoing investor focus on cybersecurity providers like Check Point Software Technologies. Recurring software revenue and security spending trends often shape sentiment, and recent coverage has continued to frame the company as a key name in network and cloud security, which can influence how investors react to shifts in the share price.

- Based on our framework, the company currently scores 4 out of 6 on our valuation checks, which suggests several measures point to undervaluation. Next, we will walk through traditional valuation approaches to see what they imply for Check Point Software Technologies, then finish with a more comprehensive way to think about value that brings these signals together.

Approach 1: Check Point Software Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth today by projecting its future cash flows and discounting them back to the present.

For Check Point Software Technologies, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $1.14b. Analyst and extrapolated projections supplied to the model show free cash flow reaching about $1.49b by 2030, with ten year forecasts combining analyst inputs for the earlier years and Simply Wall St extrapolations for the later period.

Bringing all those projected cash flows back to today, the DCF model arrives at an estimated intrinsic value of about $173.73 per share. Compared with the recent share price of US$180.91, this implies the stock is around 4.1% overvalued on this specific set of cash flow assumptions and discounting inputs.

This is a relatively small gap, so on this DCF view Check Point Software Technologies looks close to its modeled value.

Result: ABOUT RIGHT

Check Point Software Technologies is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Check Point Software Technologies Price vs Earnings

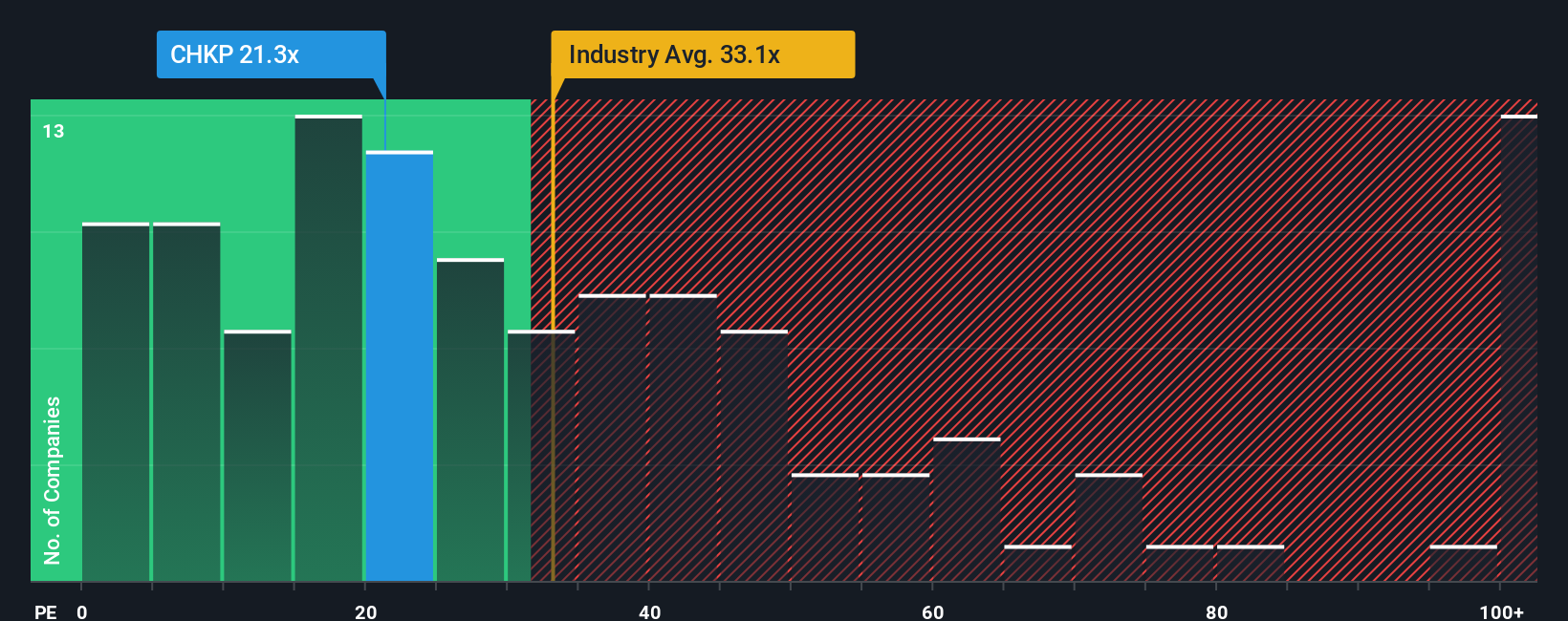

P/E is a useful yardstick for profitable companies because it links what you pay for the shares to the earnings the business is already generating. In general, higher expected growth and lower perceived risk can justify a higher P/E, while lower growth expectations or higher risk usually line up with a lower, more cautious P/E range.

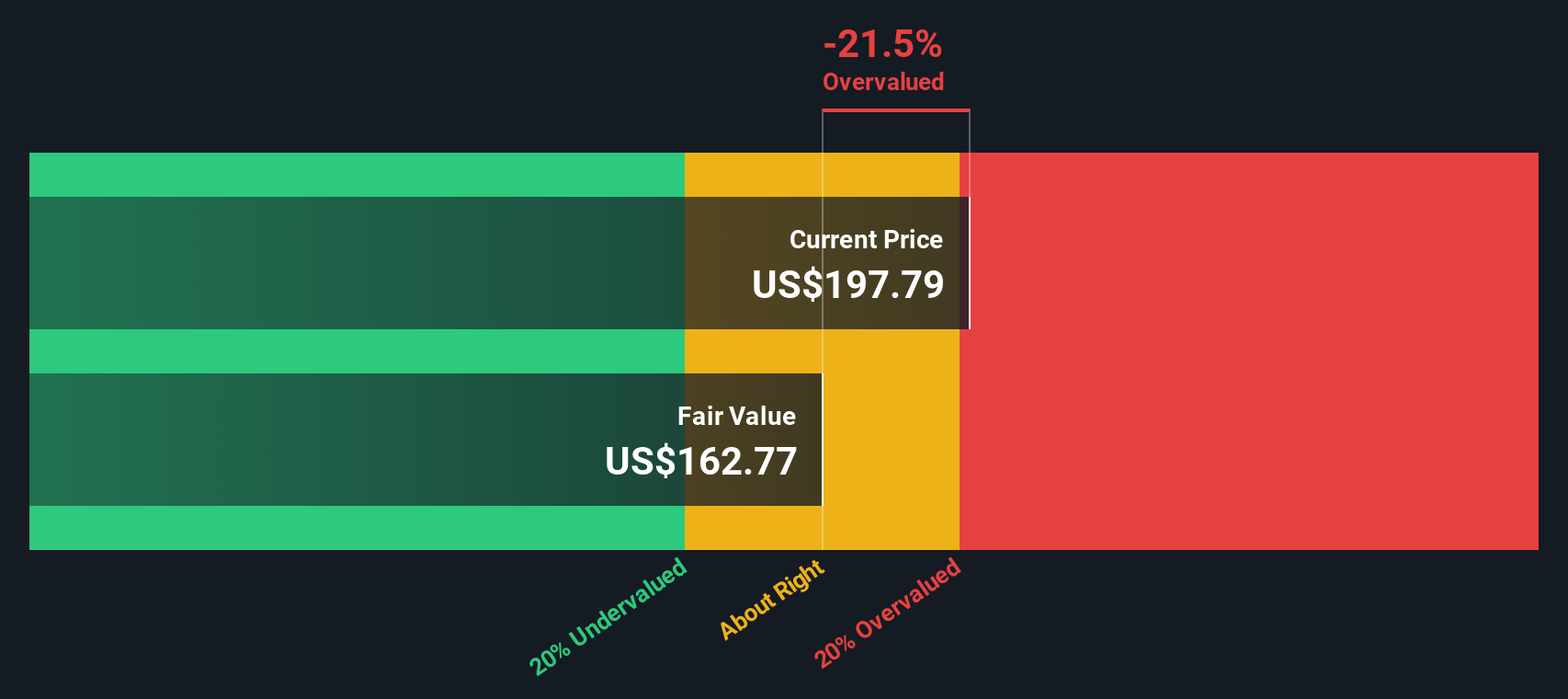

Check Point Software Technologies currently trades on a P/E of 19.23x. That sits below the Software industry average of 26.94x and also below the peer group average of 28.45x. On the surface, that suggests the market is paying a lower price for each dollar of Check Point Software Technologies earnings than for many software peers.

Simply Wall St’s Fair Ratio for the company is 23.40x. This is a proprietary estimate of what a more tailored P/E might look like after accounting for factors such as earnings growth, profit margins, industry, market cap and risk profile. Because it adjusts for these company specific drivers, the Fair Ratio can be more informative than a simple comparison with broad industry or peer averages. With the current P/E at 19.23x versus a Fair Ratio of 23.40x, Check Point Software Technologies screens as undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Check Point Software Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the story you believe about a company translated into numbers such as fair value, future revenue, earnings and margins.

A Narrative connects three pieces in one place: the business story you think makes sense, the financial forecast that flows from that story, and the fair value that drops out of those assumptions.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an accessible tool that lets you see and adjust these assumptions for Check Point Software Technologies. You can then compare the resulting Fair Value to the current share price to help you decide whether it might be a time to buy, hold, or sell based on your own view.

Because Narratives update when new information such as news or earnings is added to the platform, your fair value view can keep up with the latest data. You can see, for example, that some Check Point Software Technologies Narratives on the Community page assume a much higher fair value, while others apply more cautious forecasts and arrive at a materially lower figure.

Do you think there's more to the story for Check Point Software Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.