- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies' (NASDAQ:CHKP) Solid Earnings Have Been Accounted For Conservatively

Check Point Software Technologies Ltd.'s (NASDAQ:CHKP) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some analysis to find out why and believe that investors might be missing some encouraging factors contained in the earnings.

We check all companies for important risks. See what we found for Check Point Software Technologies in our free report.

Zooming In On Check Point Software Technologies' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

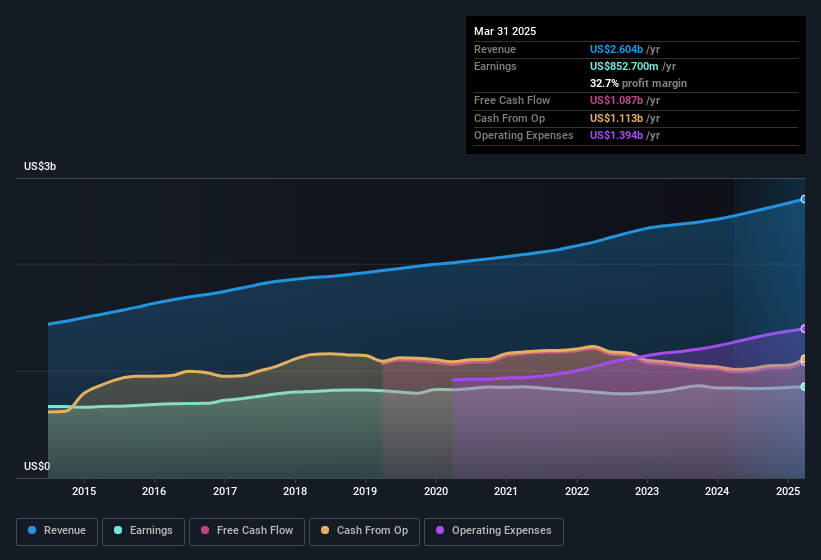

For the year to March 2025, Check Point Software Technologies had an accrual ratio of -0.19. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of US$1.1b during the period, dwarfing its reported profit of US$852.7m. Check Point Software Technologies' free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Check Point Software Technologies' Profit Performance

As we discussed above, Check Point Software Technologies' accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that Check Point Software Technologies' statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at 27% per year over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. At Simply Wall St, we have analyst estimates which you can view by clicking here.

This note has only looked at a single factor that sheds light on the nature of Check Point Software Technologies' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.