- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (CHKP) Completes Massive Buyback as Earnings Show Steady Growth

Reviewed by Simply Wall St

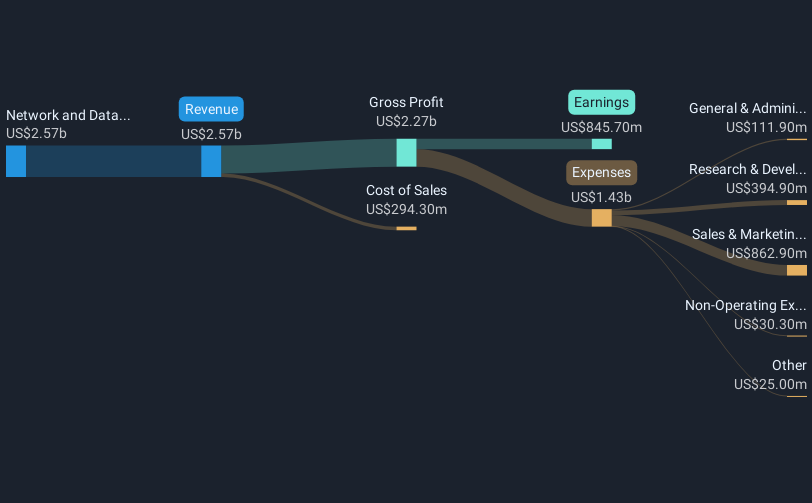

Check Point Software Technologies (CHKP) recently released its second-quarter earnings with positive year-over-year growth, highlighting increased revenues and net income. The market, mainly focused on earnings, remained relatively flat, with CHKP's share price movements echoing this broader market trend. The company's ongoing share buyback program likely added weight to investor sentiment during this period. Moreover, the strategic partnership announcement with MetTel and the executive appointment of a new CTO, Jonathan Zanger, focused on cybersecurity and AI, may have contributed additional interest, aligning with broader tech sector trends. Overall, CHKP's recent updates mirrored the stable performance of the general market.

The recent partnership with MetTel and the leadership change at Check Point Software Technologies could enhance its revenue and earnings forecasts by solidifying its position in cybersecurity and AI-focused solutions. The continuity in the company's strategy, highlighted by the ongoing share buyback program and leadership focused on innovation, could support future revenue growth and potentially boost investor confidence.

Over a three-year period leading up to today's date, Check Point’s total return, including share price and dividends, was 84.42%. This performance highlights significant investor return, indicating strong historical share appreciation amidst a competitive industry. Over the past year, though Check Point underperformed the US Software industry which saw a 31% return, it exceeded the broader US market return of 17.5%.

The current share price of US$218.33 reflects a marginal discount to the consensus price target of US$236.10, suggesting a perceived fair valuation range by analysts. The price movement exhibits moderate optimism about the company's growth tactics and market developments, balancing immediate market demands with longer-term growth strategies. These align with the projected enhancements in Check Point's capabilities and competitive positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives