- United States

- /

- Software

- /

- NasdaqGS:CHKP

A Look At Check Point Software Technologies (CHKP) Valuation After The New Hendrick Motorsports Partnership

Check Point Software Technologies (CHKP) has drawn fresh attention after agreeing to secure Hendrick Motorsports’ growing digital operations, while also taking associate sponsorship of the No. 17 Chevrolet in the 2026 NASCAR O’Reilly Series.

See our latest analysis for Check Point Software Technologies.

These Hendrick Motorsports and AI-era security launches have arrived during a softer patch for the stock, with a 90 day share price return of an 8.26% decline and a 1 year total shareholder return of a 17.66% decline, in contrast with stronger 3 and 5 year total shareholder returns of 39.74% and 51.79% respectively. This indicates that longer term holders have still seen gains despite recent weaker momentum.

If this NASCAR partnership has you thinking more broadly about cyber and AI exposure, it could be a good moment to scan other high growth tech and AI stocks that fit your view of where digital security is heading.

With CHKP shares down over the past year, recent annual revenue and net income growth, and a price target sitting above the current US$179.51, the key question is whether this is genuine mispricing or the market already baking in future gains.

Most Popular Narrative: 20.7% Undervalued

At $179.51, the most followed narrative puts Check Point Software Technologies' fair value closer to $226.51, using a consistent discount rate of 10.61%.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption, now accounting for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Curious what sits behind that fair value gap? The narrative leans on steady top line progress, firm margins, and a future earnings multiple that assumes continued platform traction. If you want to see how those pieces fit together numerically, the full narrative lays out the exact growth, profitability, and valuation bridge behind that $226.51 figure.

Result: Fair Value of $226.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on billings quality staying clean and on competitive spending in areas like SASE and AI not putting persistent pressure on those margin assumptions.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: Cash Flows Tell a Tighter Story

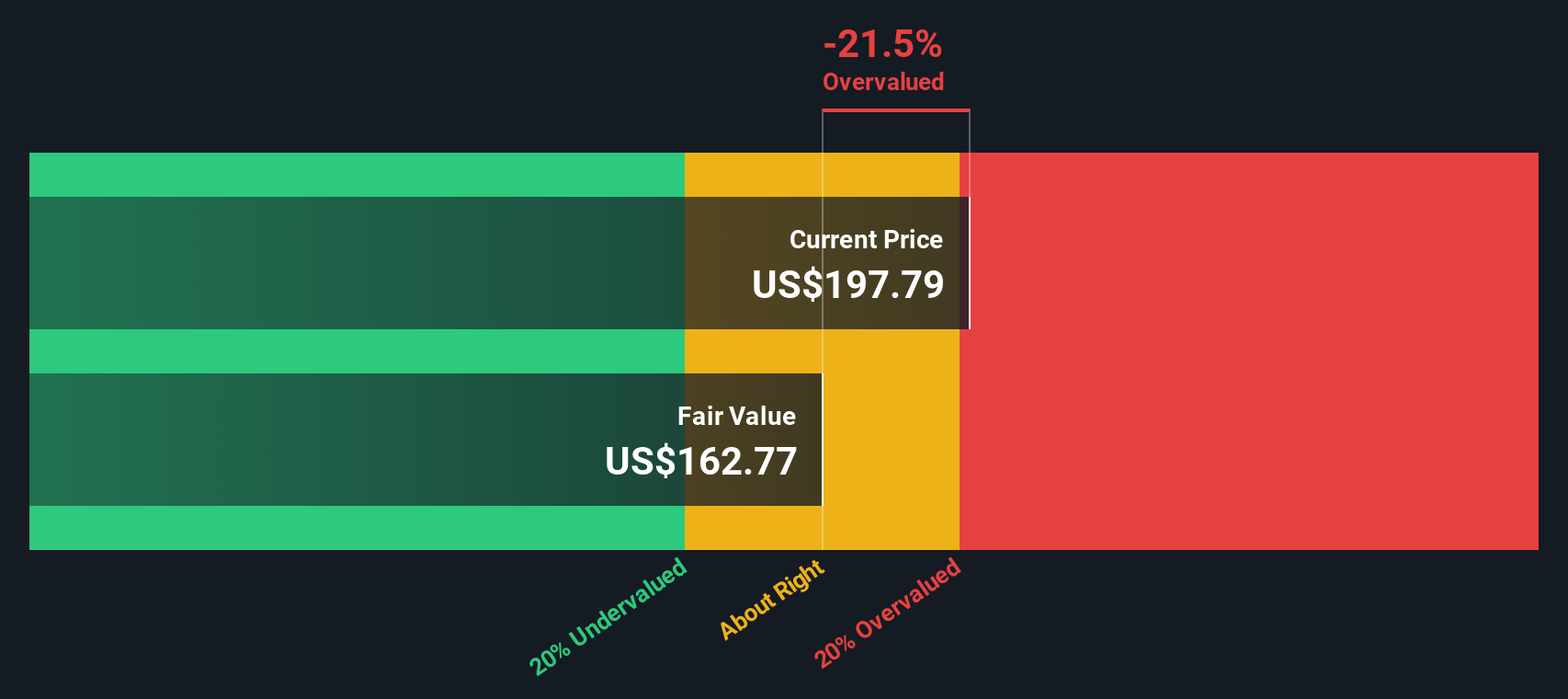

That 20.7% gap to the $226.51 fair value is built around earnings and multiples, but our DCF model paints a cooler picture, with a fair value of $166.71. On that view, CHKP at $179.51 screens as overvalued. This raises a simple question for you: are the cash flow assumptions too strict, or are the earnings expectations too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a full Check Point view yourself in a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for more investment ideas?

If you stop with just one stock, you could miss other opportunities that better fit your goals, risk comfort, and view on where markets are heading.

- Tap into potential growth stories by scanning these 3531 penny stocks with strong financials that already have financial strength behind them.

- Zero in on future facing themes with these 25 AI penny stocks that sit at the intersection of AI and market exposure.

- Target value driven setups using these 868 undervalued stocks based on cash flows where prices differ from cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.