- United States

- /

- Software

- /

- NasdaqGS:CHKP

A Fresh Look at Check Point Software Technologies (CHKP) Valuation as Recent Performance Moderates

Reviewed by Kshitija Bhandaru

See our latest analysis for Check Point Software Technologies.

Check Point’s share price is hovering near the $195 mark after a recent dip. This comes after a solid run so far in 2024, but the stock’s momentum has cooled lately. Its 1-year total shareholder return is still behind at -6.2 percent. Looking at a longer time frame, its 3- and 5-year total shareholder returns of 74.8 percent and 54.4 percent show how much long-term investors have benefited from holding through ups and downs.

If cybersecurity’s big moves have you curious about what else is out there, it might be a good time to discover the high growth tech and AI names on our radar. See the full list for free.

So with recent performance moderating and the share price still shy of analyst targets, the key question is whether Check Point is now trading at a discount or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 12% Undervalued

With the consensus narrative assigning a fair value of $223 for Check Point, compared to a recent close at $196, the valuation gap is notable and centers on optimistic future assumptions. Let's take a look at one of the biggest anticipated catalysts shaping this outlook.

Check Point's Quantum Force appliances have driven strong demand, resulting in significant product and license revenue growth. This trend, expected to continue with a robust pipeline, indicates potential for sustained revenue and earnings growth.

Want to know what drives this bullish target? The narrative’s fair value relies on future growth rates and profitability levels that could shift the game for investors. Which business segments and bold financial assumptions are behind this eye-catching number? Explore the full story to uncover the surprising drivers in the valuation math.

Result: Fair Value of $223 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks, including ongoing macroeconomic uncertainty and fierce competition in AI-driven cybersecurity, which could derail these optimistic projections.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: Discounted Cash Flow Model

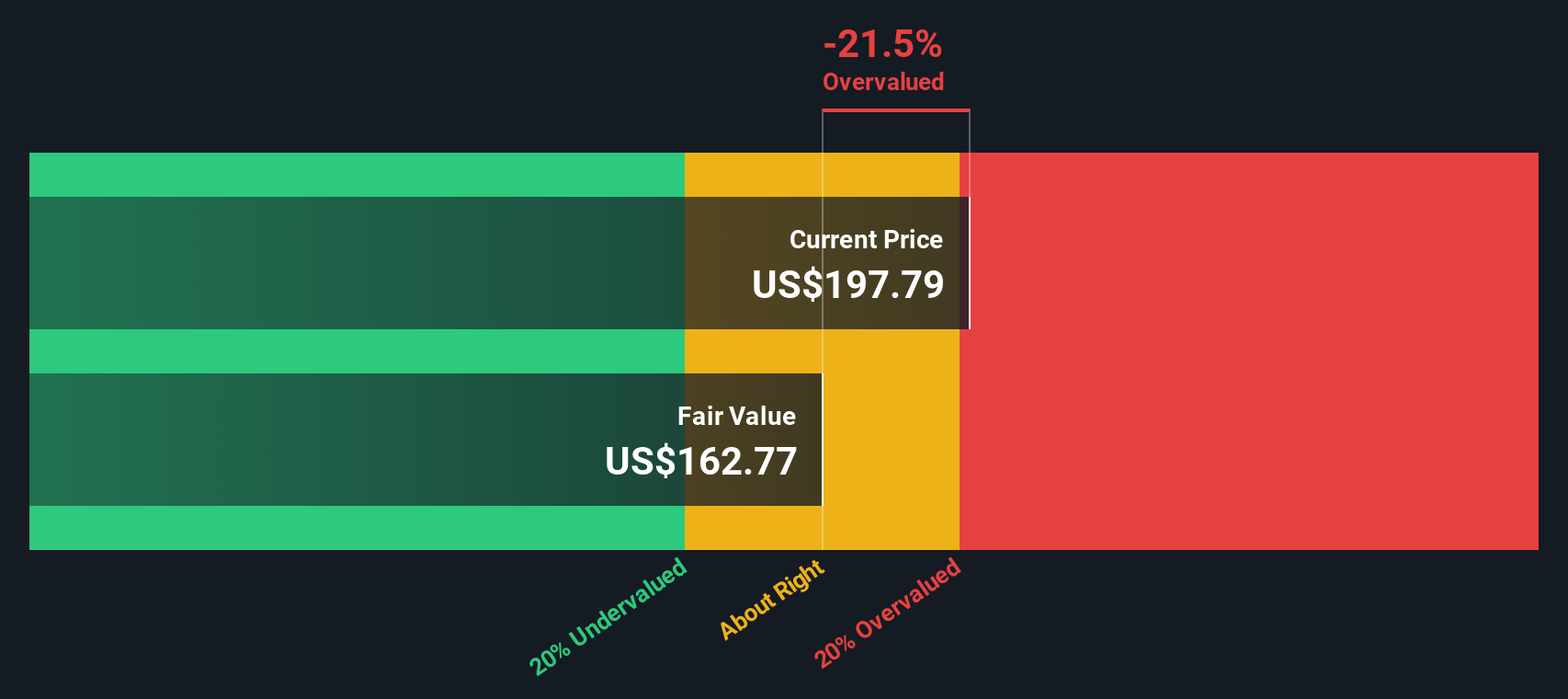

While analyst consensus points to upside, our DCF model comes to a more conservative conclusion. It estimates Check Point's fair value at $163.16 per share, which is actually below the current price. This raises a key question: what factors explain the gap between future optimism and cash flow reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own Check Point narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for more investment ideas?

Unlock even more stock opportunities before the crowd catches on by using the Simply Wall Street Screener. Here are three smart ways to zero in on what matters for your portfolio:

- Uncover high-yield potential by checking out these 19 dividend stocks with yields > 3% offering attractive dividend payouts and steady returns. This is a useful approach for income-focused investors.

- Spot companies changing healthcare forever with these 32 healthcare AI stocks targeting AI breakthroughs and smarter medical solutions in this dynamic sector.

- Find tomorrow’s breakout performers with these 24 AI penny stocks and position yourself ahead of the next surge in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion