- United States

- /

- Software

- /

- NasdaqGS:CGNT

Cognyte Software Ltd.'s (NASDAQ:CGNT) one-year returns climbed after last week's 10% gain, institutional investors must be happy

Key Insights

- Significantly high institutional ownership implies Cognyte Software's stock price is sensitive to their trading actions

- 52% of the business is held by the top 8 shareholders

- Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

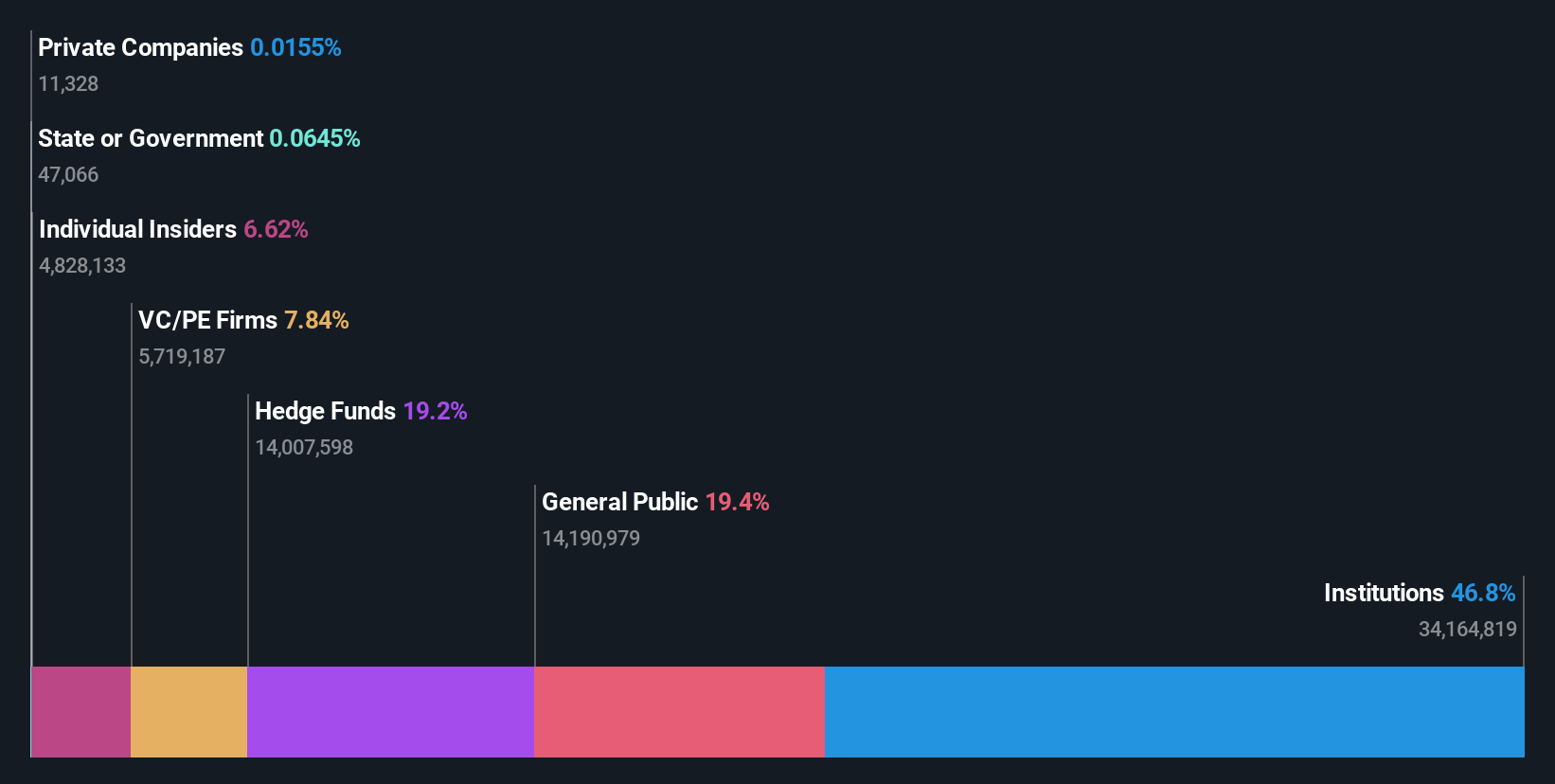

Every investor in Cognyte Software Ltd. (NASDAQ:CGNT) should be aware of the most powerful shareholder groups. With 47% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

And as as result, institutional investors reaped the most rewards after the company's stock price gained 10% last week. One-year return to shareholders is currently 2.3% and last week’s gain was the icing on the cake.

In the chart below, we zoom in on the different ownership groups of Cognyte Software.

See our latest analysis for Cognyte Software

What Does The Institutional Ownership Tell Us About Cognyte Software?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

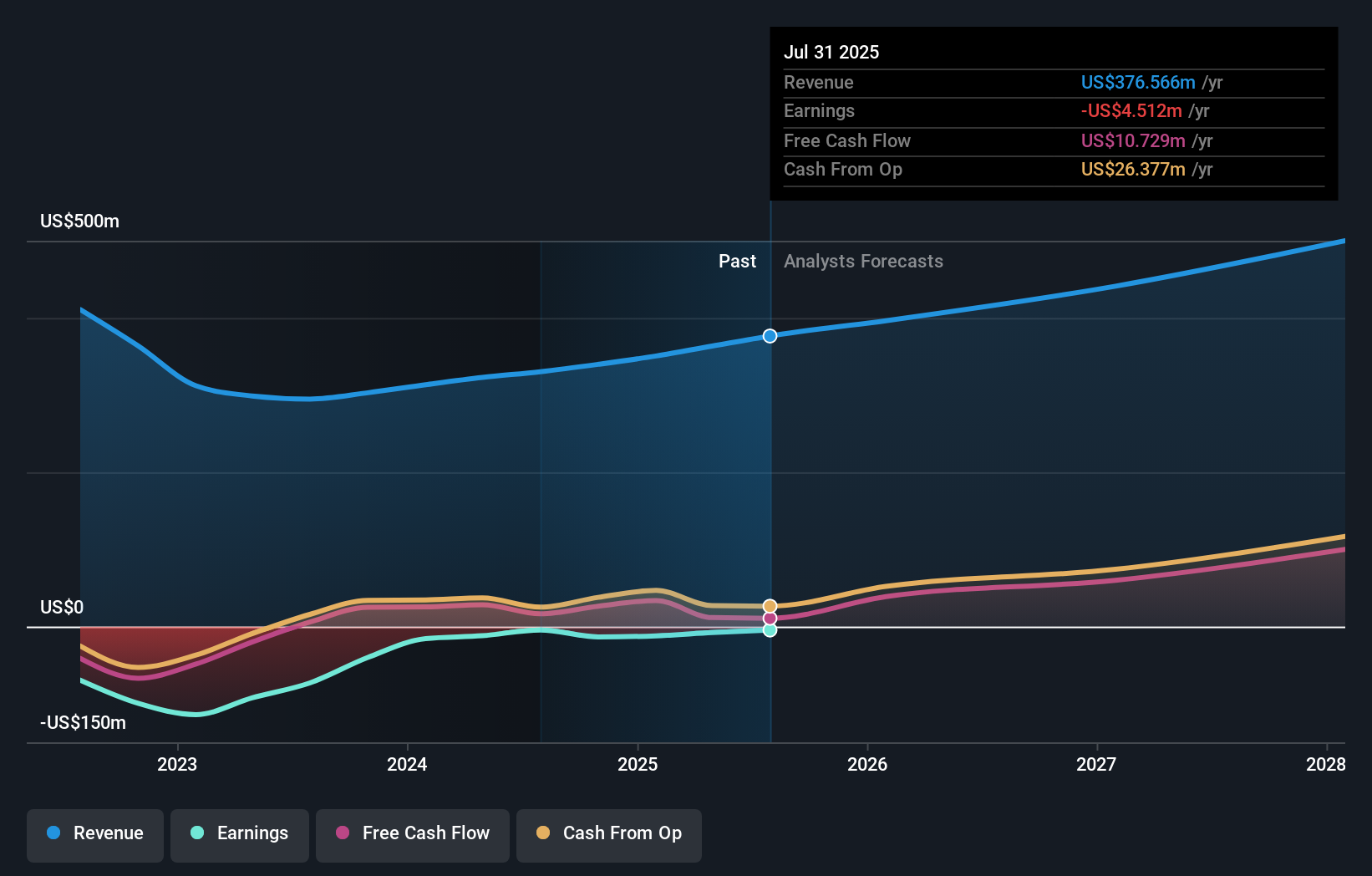

We can see that Cognyte Software does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Cognyte Software, (below). Of course, keep in mind that there are other factors to consider, too.

It looks like hedge funds own 19% of Cognyte Software shares. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. The company's largest shareholder is Topline Capital Management, LLC, with ownership of 9.9%. The second and third largest shareholders are Edenbrook Capital, Llc and American Capital Management, Inc., with an equal amount of shares to their name at 9.3%. In addition, we found that Elad Sharon, the CEO has 1.5% of the shares allocated to their name.

We did some more digging and found that 8 of the top shareholders account for roughly 52% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Cognyte Software

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Shareholders would probably be interested to learn that insiders own shares in Cognyte Software Ltd.. In their own names, insiders own US$42m worth of stock in the US$631m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 19% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With an ownership of 7.8%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Cognyte Software that you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CGNT

Cognyte Software

A software-led technology company, focuses on solutions for data processing and analytics worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.