- United States

- /

- Software

- /

- NasdaqGS:CFLT

Does Recent Price Drop Suggest Opportunity in Confluent Stock for 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Confluent stock is a bargain or overpriced, you are not alone. This analysis is for investors who care about real value and what drives it.

- Confluent’s share price has bounced around recently, dropping 4.7% in the last week and climbing 6.0% through the past month. However, it remains down 20.2% year-to-date and 16.9% over the past year.

- These swings are making waves amid a steady stream of industry news. There is growing demand for real-time data platforms, which is attracting both investors and competitors to the cloud data infrastructure space. High-profile partnerships and product launches from both Confluent and its rivals have fueled speculation about long-term growth as well as short-term volatility.

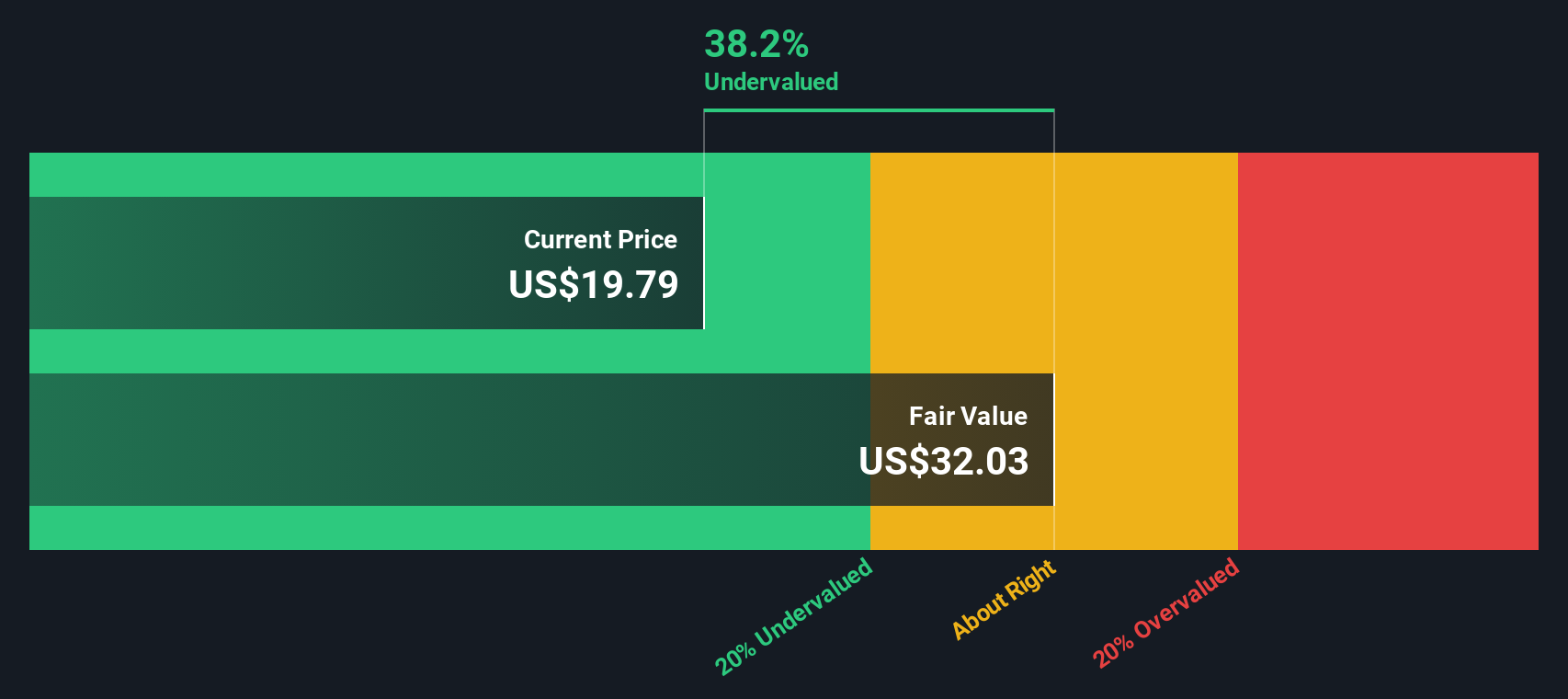

- Currently, Confluent scores a 5 out of 6 on our valuation checks, suggesting it is undervalued by most classic measures. Here is a breakdown of how that score is calculated and, more importantly, an exploration of an even better way to understand what Confluent could really be worth in the long run.

Find out why Confluent's -16.9% return over the last year is lagging behind its peers.

Approach 1: Confluent Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting them back to today's dollars. This approach calculates what Confluent is really worth based on the company’s expected cash generation power over time.

For Confluent, the latest reported Free Cash Flow (FCF) stands at $29.96 million. Analysts have provided forecasts out to 2029, projecting this figure will grow sharply, reaching $454.3 million by the end of that year. These forward-looking cash flows are extrapolated and then discounted to reflect their value in today’s terms.

Using these projections and the 2 Stage Free Cash Flow to Equity DCF model, Simply Wall St calculates an intrinsic value of $33.96 per share. Given this value and the current market price, the analysis suggests that Confluent stock is trading at a 33.6% discount to its intrinsic value according to DCF methods. In other words, the market may be significantly underestimating Confluent’s long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Confluent is undervalued by 33.6%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Confluent Price vs Sales

For technology companies like Confluent that are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. This is particularly relevant in fast-growing sectors where revenues are expanding rapidly, even as profits remain slim or negative.

Growth expectations and perceived risks play a crucial role in determining what is considered a "normal" or "fair" P/S ratio. Generally, companies with higher growth prospects and stronger competitive positions can command a higher multiple, while greater risks or slower growth will result in a lower fair value.

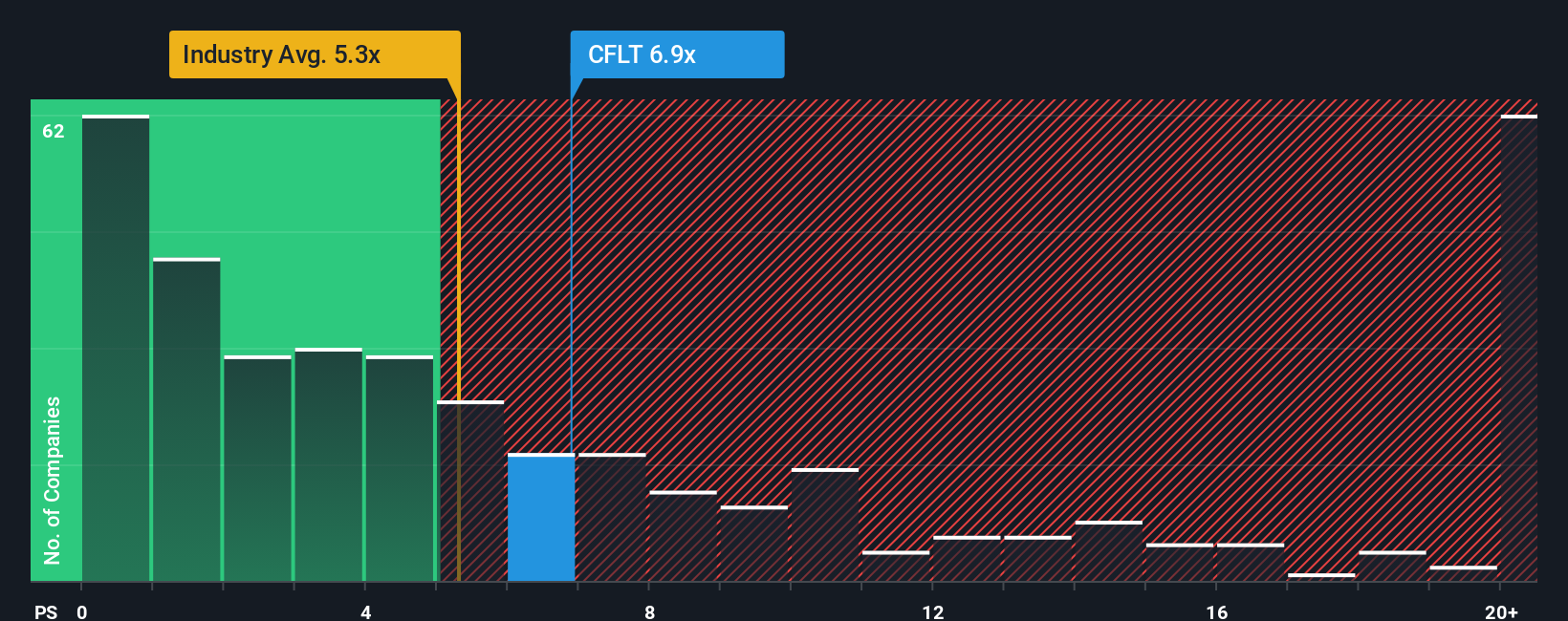

Currently, Confluent trades at a 7.08x P/S ratio. For comparison, the average P/S across the Software industry is 5.11x, while peers trade at an average of 9.48x. This places Confluent between the broader industry and its immediate competitors.

Simply Wall St's Fair Ratio for Confluent stands at 7.88x. Unlike a basic peer or industry comparison, the Fair Ratio incorporates factors such as the company’s growth outlook, profit margins, market cap, risk profile, and industry positioning. This makes it a more tailored and potentially reliable benchmark for investors seeking deeper assessment.

Since Confluent's current P/S is 7.08x and its Fair Ratio is 7.88x, the stock appears to be undervalued relative to what might be expected based on its fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Confluent Narrative

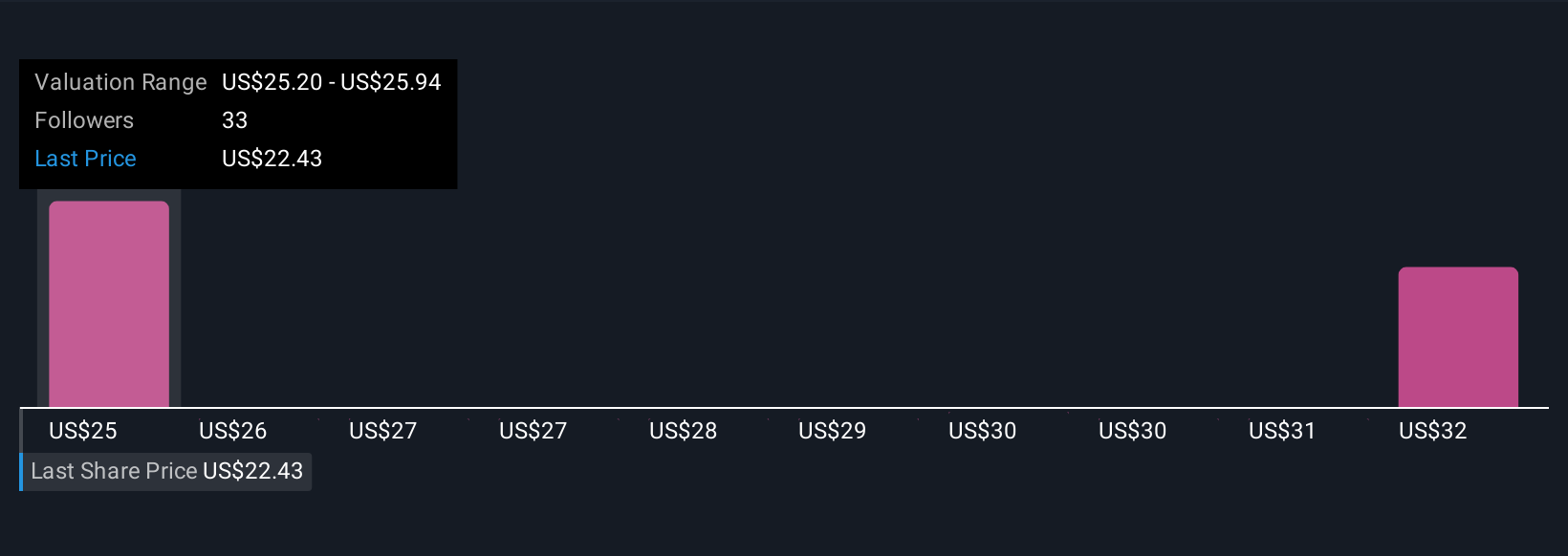

Earlier, we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you map out your own story about a company by combining your perspectives about its future with hard numbers, like expected revenue, margins, and eventual fair value.

Rather than just focusing on static ratios or analyst targets, Narratives connect the company’s business progress and industry changes directly to a financial forecast and your personal fair value estimate. This makes your investment thesis tangible and trackable.

On Simply Wall St’s Community page, millions of investors use Narratives to visualize their views, update assumptions, and compare their fair value to the latest market price to decide whether to buy or sell, all in just a few clicks.

The best part is, these Narratives automatically update as new information such as earnings, key announcements, or industry news becomes available, making them dynamic and always relevant.

For example, with Confluent, one investor might build a bullish Narrative around surging AI data demand and forecast a fair value of $36.00. Another may see risks from competition and customer churn and set their fair value at just $20.00, helping everyone clarify their own conviction before making a move.

Do you think there's more to the story for Confluent? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives