- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT) Revenue Growth Versus Persistent Losses Tests High Multiple Narratives

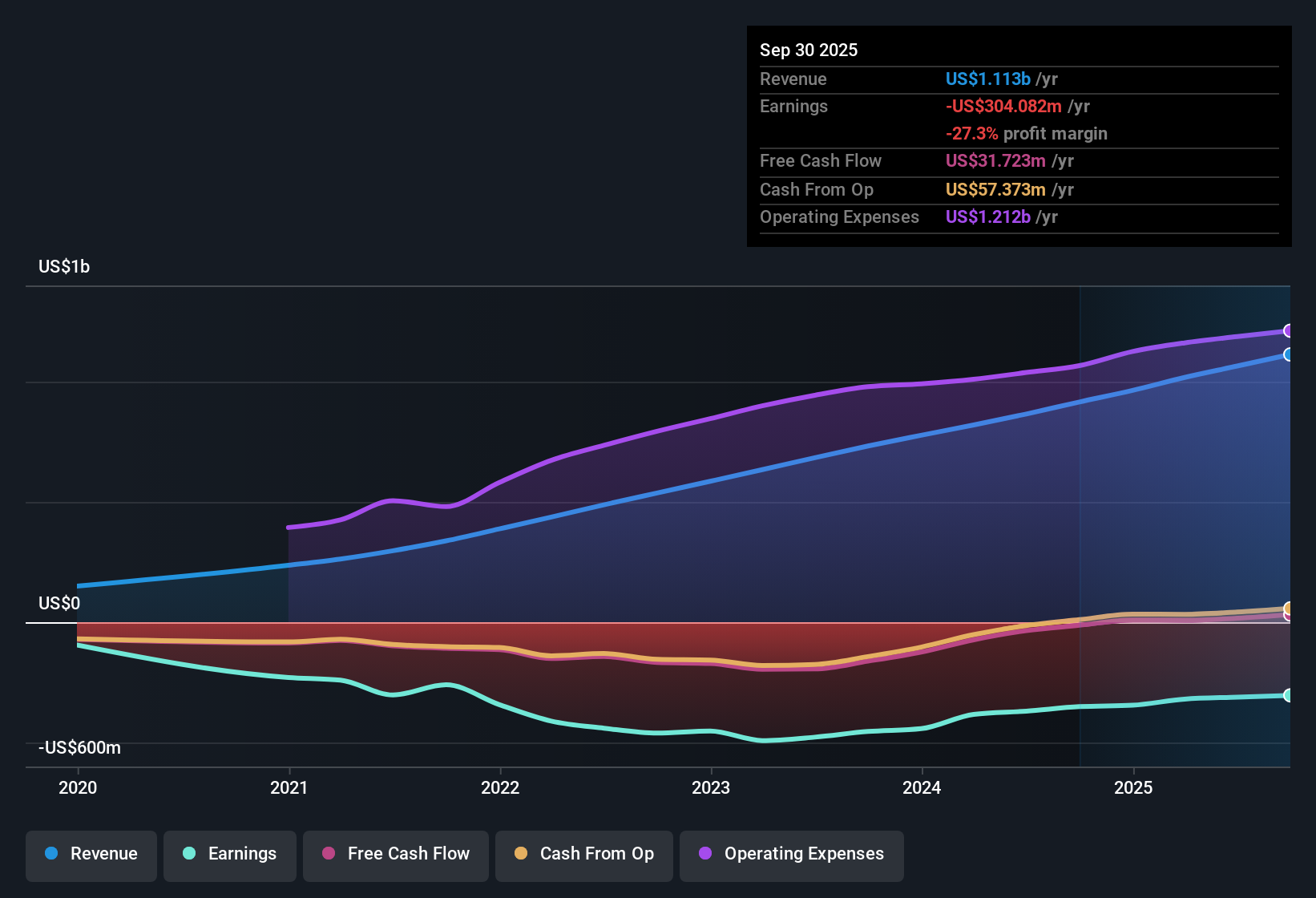

Confluent (CFLT) just wrapped up FY 2025 with Q4 revenue of US$314.8 million and a basic EPS loss of US$0.23, while trailing twelve month revenue sat at about US$1.17 billion against a full year basic EPS loss of US$0.86. Over recent quarters, the company has seen revenue move from US$261.2 million in Q4 2024 to US$314.8 million in Q4 2025, with quarterly basic EPS losses ranging between US$0.19 and US$0.27. The latest print keeps the spotlight firmly on how quickly revenue growth can offset ongoing losses and margin pressure.

See our full analysis for Confluent.With the headline numbers set, the next step is to see how this mix of strong top line scale and continued losses lines up with the widely followed narratives around Confluent's growth potential, risk profile and long term margin story.

See what the community is saying about Confluent

US$1.17b trailing revenue with losses still near US$295 million

- On a trailing twelve month basis, Confluent generated about US$1.17b of revenue against a net loss of roughly US$295 million and a basic EPS loss of US$0.86, so the business is clearly scaling but not yet covering its costs.

- Consensus narrative points to real time AI and data streaming demand as long run growth drivers, yet the trailing loss staying close to US$300 million shows that even with this revenue base, the company has not converted that demand into positive net income, which is what cautious investors will keep watching.

Quarterly losses range from about US$66 million to US$82 million

- Across FY 2025, quarterly net losses sat between US$66.5 million and US$82.0 million, with basic EPS losses between US$0.19 and US$0.24, so profitability has stayed consistently negative even as quarterly revenue moved from US$271.1 million to US$314.8 million.

- Bears argue that persistent customer cost cutting and slower new use case adoption could restrain growth, and the fact that losses remained in the US$60 million to US$80 million range across multiple quarters, despite higher revenue, supports their concern that cost pressure and discounts may be keeping operating leverage from showing through yet.

- Critics also highlight that forecasts still do not point to profitability over the next three years, which lines up with the current run rate of losses in FY 2025.

- The trailing pattern of growing losses over roughly five years at about 1.2% per year further fits the bearish view that net income may not quickly swing into positive territory.

Skeptics looking at these steady losses alongside customer cost cutting may want the full cautious case set out in one place. 🐻 Confluent Bear Case

P/S of 9.4x with price above DCF fair value

- Confluent traded on a P/S of 9.4x over the last 12 months, compared with about 3.7x for the broader US Software industry and 6.2x for its peer group, while the current share price of US$30.52 sits above the DCF fair value estimate of US$26.45.

- Bullish investors argue that strong demand for AI related streaming and partner driven growth can justify a premium, and the combination of roughly 12.9% forecast annual revenue growth with a high P/S multiple fits that story, although the current price sitting above DCF fair value and continued losses mean the share still needs that faster growth to keep the premium in place.

- Supporters point to expanding AI and data streaming use cases as justification for paying 9.4x sales, compared with 3.7x for the industry.

- At the same time, the DCF fair value of US$26.45 versus the US$30.52 price, along with ongoing net losses, is exactly what more cautious holders might use to question how far the bullish case can stretch.

If you are weighing that premium valuation against the AI driven growth story, it can help to see how bullish analysts connect the dots. 🐂 Confluent Bull Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Confluent on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data is sending you in a different direction, turn that into your own narrative in just a few minutes: Do it your way.

A great starting point for your Confluent research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Confluent is growing its revenue base but still reports sizeable net losses, a double digit P/S premium and a share price above its DCF fair value estimate.

If that mix of ongoing losses and premium pricing feels uncomfortable, take a closer look at 55 high quality undervalued stocks, where you can quickly compare companies priced more closely to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.