- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT): Evaluating Valuation After Streaming Agents Launch Expands AI and Real-Time Data Capabilities

If you are watching Confluent (CFLT), there is something new to weigh this week. Confluent just unveiled Streaming Agents, a capability within its cloud platform built for Apache Flink. This announcement could be a meaningful step for the company’s push into enterprise AI, focusing on real-time data and automation. By directly connecting AI agents with streaming business data and enabling automation that can act, Confluent is signaling its ambition to become more than just a data backbone in the cloud. For anyone considering the stock, new technology like this might raise fresh questions about the future direction of the company’s growth story.

Looking at the bigger picture, Confluent’s share price has faced some pressure, down nearly 10% over the past year and about 33% since the start of the year. Momentum has pulled back even as the company reports double-digit annual revenue and net income growth. This new AI-focused product launch follows a period of cautious optimism after last quarter’s results. There is visible excitement about this move into agentic AI, yet the market response so far suggests investors are still assessing if or when this rollout could drive a turnaround.

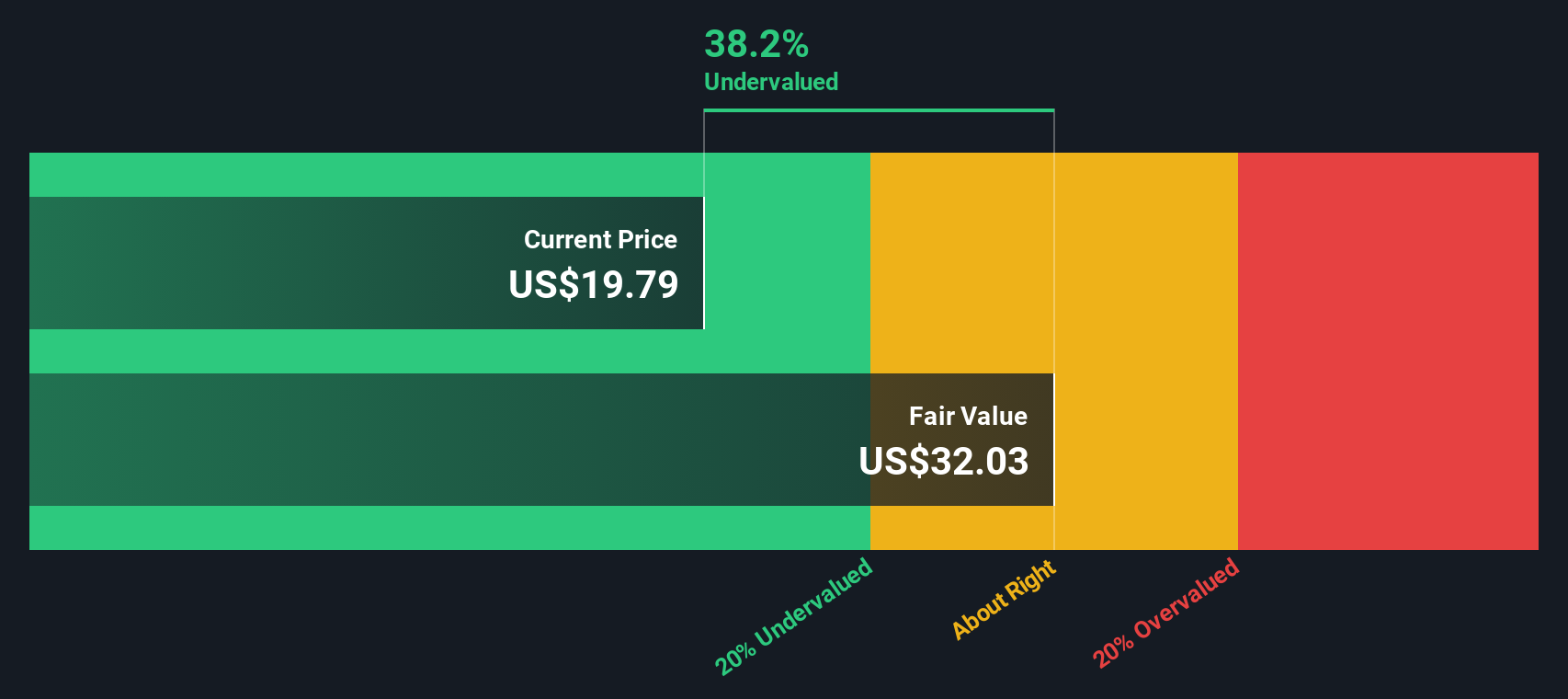

So is Confluent now undervalued with increased attention on its valuation, or is the market already factoring in higher expectations for future growth as a result of this AI initiative?

Most Popular Narrative: 23.6% Undervalued

According to community narrative, Confluent is seen as significantly undervalued, reflecting bullish analyst outlooks about its growth prospects and future margins.

Rapid growth in real-time AI and agentic workloads is driving increased demand for enterprise-grade streaming and processing solutions. Confluent is seeing a projected 10x expansion in production AI use cases across hundreds of customers. This trend is expected to accelerate subscription and platform revenue over the medium to long term as these use cases mature and proliferate.

Is Confluent on the verge of a breakout? The most popular narrative describes a future where recurring revenue, market expansion, and margin transformation fuel a revaluation that stands apart from today's price. Want to see the numbers and one key metric that could change everything? Find out what analysts are really betting on.

Result: Fair Value of $24.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent customer optimization and competition from cloud providers could slow Confluent’s cloud revenue and threaten margin expansion in the coming quarters.

Find out about the key risks to this Confluent narrative.Another View: What Does Our DCF Model Say?

For perspective, the SWS DCF model also points to Confluent being undervalued by the market. This valuation method reaches a similar conclusion but follows a very different line of reasoning. Could both approaches be correct, or will new tech trends alter the outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Confluent Narrative

If you think the current outlook misses something, or want to dig into the numbers yourself, you can craft your own perspective in just minutes. Do it your way

A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by when there are promising stocks beyond Confluent waiting to be found. If you want to get a step ahead of the crowd, use these smart shortcuts to highlight shares with serious potential for your portfolio:

- Uncover high-yield opportunities by scanning for dividend stocks with proven payouts using dividend stocks with yields > 3%.

- Pinpoint the innovators shaping tomorrow’s world with a focused look at emerging companies in artificial intelligence through AI penny stocks.

- Spot overlooked gems by filtering for stocks whose price may not yet reflect their underlying value. Check out undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.