- United States

- /

- Software

- /

- NasdaqGS:CCSI

Consensus Cloud Solutions, Inc. (NASDAQ:CCSI) Not Doing Enough For Some Investors As Its Shares Slump 27%

To the annoyance of some shareholders, Consensus Cloud Solutions, Inc. (NASDAQ:CCSI) shares are down a considerable 27% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

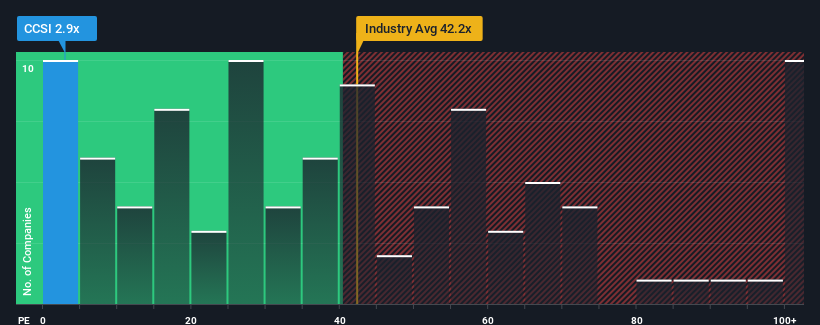

Following the heavy fall in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Consensus Cloud Solutions as a highly attractive investment with its 2.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Consensus Cloud Solutions as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Consensus Cloud Solutions

Is There Any Growth For Consensus Cloud Solutions?

The only time you'd be truly comfortable seeing a P/E as depressed as Consensus Cloud Solutions' is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.0% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 35% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 3.0% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 12% growth forecast for the broader market.

With this information, we can see why Consensus Cloud Solutions is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Consensus Cloud Solutions' P/E looks about as weak as its stock price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Consensus Cloud Solutions' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Consensus Cloud Solutions you should be aware of, and 2 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCSI

Consensus Cloud Solutions

Provides information delivery services with a software-as-a-service platform in the United States, Canada, Ireland, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks