- United States

- /

- Software

- /

- NasdaqGS:CCC

CCC Intelligent Solutions (CCC): Assessing Valuation After New $500 Million Share Buyback Authorization

Reviewed by Simply Wall St

CCC Intelligent Solutions Holdings (CCC) just wrapped up a $300 million buyback and immediately rolled out authorization for another $500 million, which signals that management is comfortable with the risk reward at current levels.

See our latest analysis for CCC Intelligent Solutions Holdings.

The new buyback comes after a choppy run for CCC, with the share price at around $7.90 and a 30 day share price return of 9.42 percent, yet a much weaker year to date share price return of negative 31.90 percent and a 1 year total shareholder return of negative 34.44 percent. This suggests near term momentum is improving while the longer term picture is still in repair mode.

If this kind of capital return story has your attention, it could be a good moment to compare CCC with other software names and explore high growth tech and AI stocks.

With the stock down sharply this year but trading at a sizable discount to analyst targets, the fresh buyback raises a key question: Is CCC now an underappreciated SaaS compounding story, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 32.8% Undervalued

With the narrative fair value sitting well above CCC Intelligent Solutions Holdings' last close of $7.90, the story leans firmly toward upside potential.

The company's strong subscription based recurring revenue model (80% of total), consistent gross dollar/net dollar retention above 99%/107%, and further penetration into OEMs and parts suppliers provide a cushion against industry cyclicality and claims volume fluctuations, driving resilient revenue and profitability.

Want to see why this valuation still bakes in punchy revenue growth, rising margins, and a rich future earnings multiple, yet calls the stock undervalued? The full narrative unpacks the exact growth runway, margin shift, and terminal multiple assumptions powering that fair value guess. Curious which moving piece does the heavy lifting in this upside case? Dive in and decide whether the numbers behind the optimism really stack up.

Result: Fair Value of $11.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if claim volumes remain structurally weak or if major insurers slow the adoption and integration of CCC’s newer AI driven modules.

Find out about the key risks to this CCC Intelligent Solutions Holdings narrative.

Another View: Multiples Paint a Richer Picture

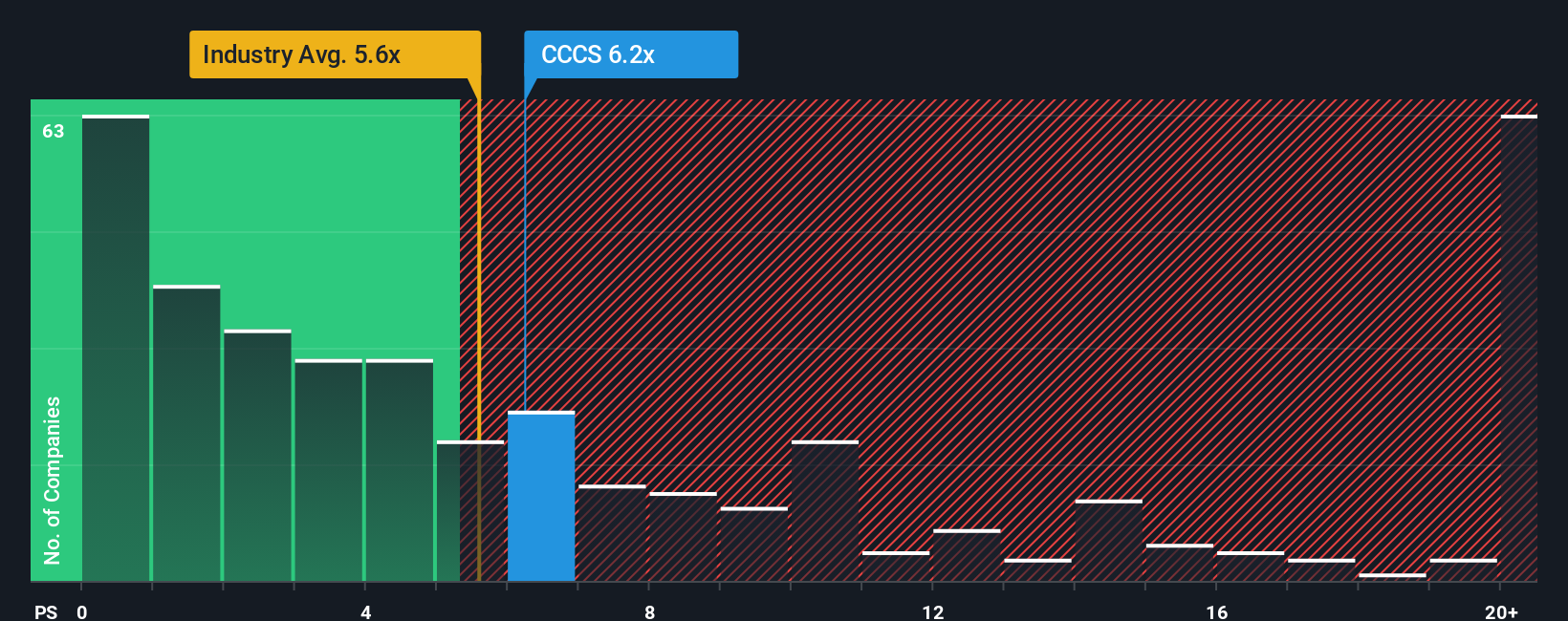

Step back from the narrative fair value and CCC looks less of a bargain. Its price to sales ratio sits at 4.9 times, roughly in line with the US software sector and peers, and slightly above a 4.8 times fair ratio, hinting at limited multiple upside if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CCC Intelligent Solutions Holdings Narrative

If you are not fully convinced or simply prefer to dive into the numbers yourself, you can craft a tailored view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CCC Intelligent Solutions Holdings.

Looking for more investment ideas?

Do not stop at a single opportunity, use the Simply Wall Street Screener to quickly surface fresh ideas that match your strategy and keep your edge sharp.

- Capture potential mispricings by scanning these 913 undervalued stocks based on cash flows that strong cash flow models suggest the market is overlooking.

- Tap into the next wave of innovation by targeting these 24 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that can add reliable yield to a long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCC

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion