- United States

- /

- Diversified Financial

- /

- NasdaqGS:CASS

Increases to CEO Compensation Might Be Put On Hold For Now at Cass Information Systems, Inc. (NASDAQ:CASS)

In the past three years, the share price of Cass Information Systems, Inc. (NASDAQ:CASS) has struggled to generate growth for its shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 20 April 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Cass Information Systems

Comparing Cass Information Systems, Inc.'s CEO Compensation With the industry

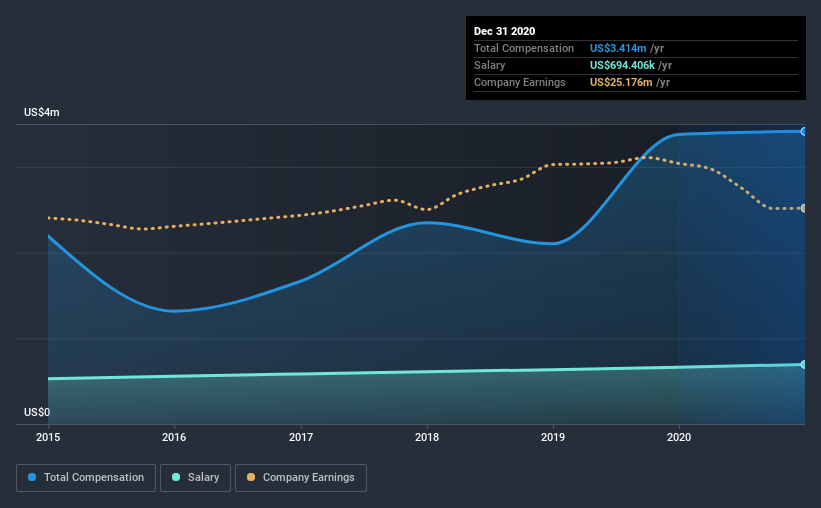

Our data indicates that Cass Information Systems, Inc. has a market capitalization of US$657m, and total annual CEO compensation was reported as US$3.4m for the year to December 2020. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at US$694k.

In comparison with other companies in the industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$1.9m. This suggests that Eric Brunngraber is paid more than the median for the industry. Moreover, Eric Brunngraber also holds US$4.9m worth of Cass Information Systems stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$694k | US$663k | 20% |

| Other | US$2.7m | US$2.7m | 80% |

| Total Compensation | US$3.4m | US$3.4m | 100% |

On an industry level, around 14% of total compensation represents salary and 86% is other remuneration. Cass Information Systems pays out 20% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Cass Information Systems, Inc.'s Growth Numbers

Cass Information Systems, Inc. saw earnings per share stay pretty flat over the last three years. Its revenue is down 8.9% over the previous year.

We generally like to see a little revenue growth, but it is good to see a modest EPS growth at least. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cass Information Systems, Inc. Been A Good Investment?

With a three year total loss of 3.5% for the shareholders, Cass Information Systems, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

So you may want to check if insiders are buying Cass Information Systems shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Cass Information Systems, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CASS

Cass Information Systems

Provides payment and information processing services to manufacturing, distribution, and retail enterprises in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives