- United States

- /

- Software

- /

- NasdaqCM:BTDR

Little Excitement Around Bitdeer Technologies Group's (NASDAQ:BTDR) Revenues

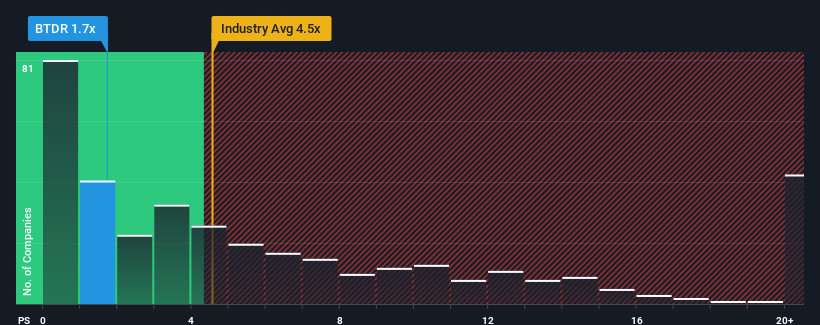

With a price-to-sales (or "P/S") ratio of 1.7x Bitdeer Technologies Group (NASDAQ:BTDR) may be sending very bullish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios greater than 4.5x and even P/S higher than 12x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Bitdeer Technologies Group

What Does Bitdeer Technologies Group's Recent Performance Look Like?

Bitdeer Technologies Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bitdeer Technologies Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Bitdeer Technologies Group?

In order to justify its P/S ratio, Bitdeer Technologies Group would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's understandable that Bitdeer Technologies Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Bitdeer Technologies Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Bitdeer Technologies Group you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion