- United States

- /

- Software

- /

- NasdaqCM:BTDR

Can Bitdeer's (BTDR) AI Hosting Pivot Strengthen Its Competitive Edge Amid Mining Market Shifts?

Reviewed by Sasha Jovanovic

- Recently, Bitdeer Technologies Group accelerated its Bitcoin self-mining operations and announced new initiatives in AI hosting and data center infrastructure to address declining demand for mining rigs.

- This move underscores Bitdeer's effort to diversify revenue streams and develop more resilient operations as it adapts to changing sector dynamics.

- We'll examine how Bitdeer's expansion into AI hosting could influence its investment narrative and the outlook for more stable growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bitdeer Technologies Group Investment Narrative Recap

To be a shareholder in Bitdeer Technologies Group, you need to believe in the potential for the company’s proprietary technology and vertical integration to drive revenue growth and operational efficiency as the cryptocurrency sector evolves. The recent expansion into AI hosting and data center infrastructure signals a focus on diversifying revenue and reducing earnings volatility, but this shift does not materially change Bitdeer’s immediate catalysts or address its biggest near-term risk: ongoing cost pressures and earnings variability from rising operational and R&D expenses.

One highly relevant announcement is the recent launch of the SEALMINER A3 series, which advances Bitdeer's push into energy-efficient mining hardware. This product release directly ties to the company’s underlying catalyst of ASIC commercialization and holds significance for future revenue streams, but it does not immediately resolve the financial performance challenges posed by the volatile Bitcoin mining environment. However, investors also need to consider the contrasting risk that high R&D and capital costs may...

Read the full narrative on Bitdeer Technologies Group (it's free!)

Bitdeer Technologies Group's narrative projects $1.8 billion in revenue and $343.9 million in earnings by 2028. This requires 71.6% yearly revenue growth and a $664.2 million increase in earnings from the current level of -$320.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $24.33 fair value, a 37% upside to its current price.

Exploring Other Perspectives

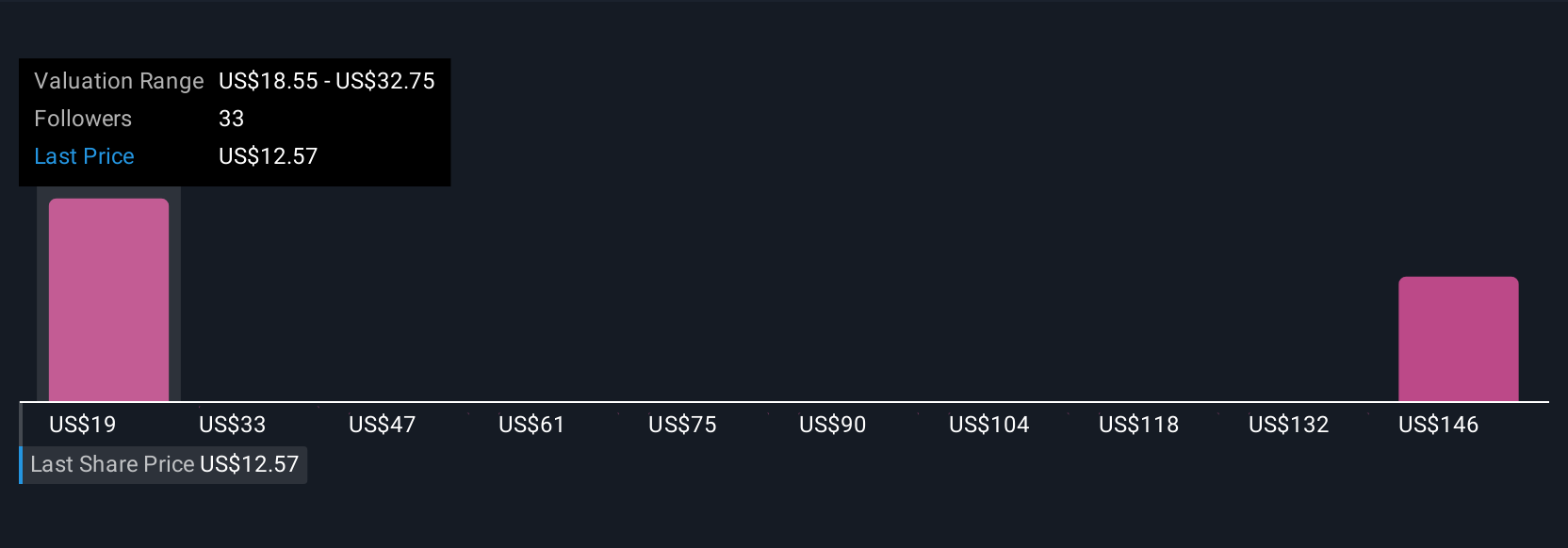

Private views from the Simply Wall St Community on Bitdeer’s fair value range from US$18.55 to US$175.43 across 7 individual estimates. Even with this broad spread, the company’s elevated costs and ongoing net losses remain central to the discussion about its future performance, inviting you to compare different outlooks and analysis methods.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be worth over 9x more than the current price!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion