- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Technologies Group (NasdaqCM:BTDR): Evaluating Valuation Following SEALMINER A3 Launch and Enhanced Mining Efficiency

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 27% Undervalued

The prevailing narrative sees Bitdeer Technologies Group as substantially undervalued, based on significant upside potential in future earnings and revenues.

The planned commercialization of SEALMINER ASICs, coupled with a high demand for energy-efficient mining machines, represents a diversification of revenue streams and is likely to enhance revenue growth as Bitdeer becomes a key player in the ASIC market.

Want to see what is fueling this bullish math? There is one bold forecast deep in the narrative, hinging on blockbuster gains from both top line and margins. What ambitious target and key financial leap set this price apart from the crowd? The real surprise lies in the projected profits lurking just a few years away.

Result: Fair Value of $22.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including recent revenue declines and ongoing high R&D costs. Either of these factors could dampen Bitdeer’s profitability outlook.

Find out about the key risks to this Bitdeer Technologies Group narrative.Another View: What the Market Multiple Says

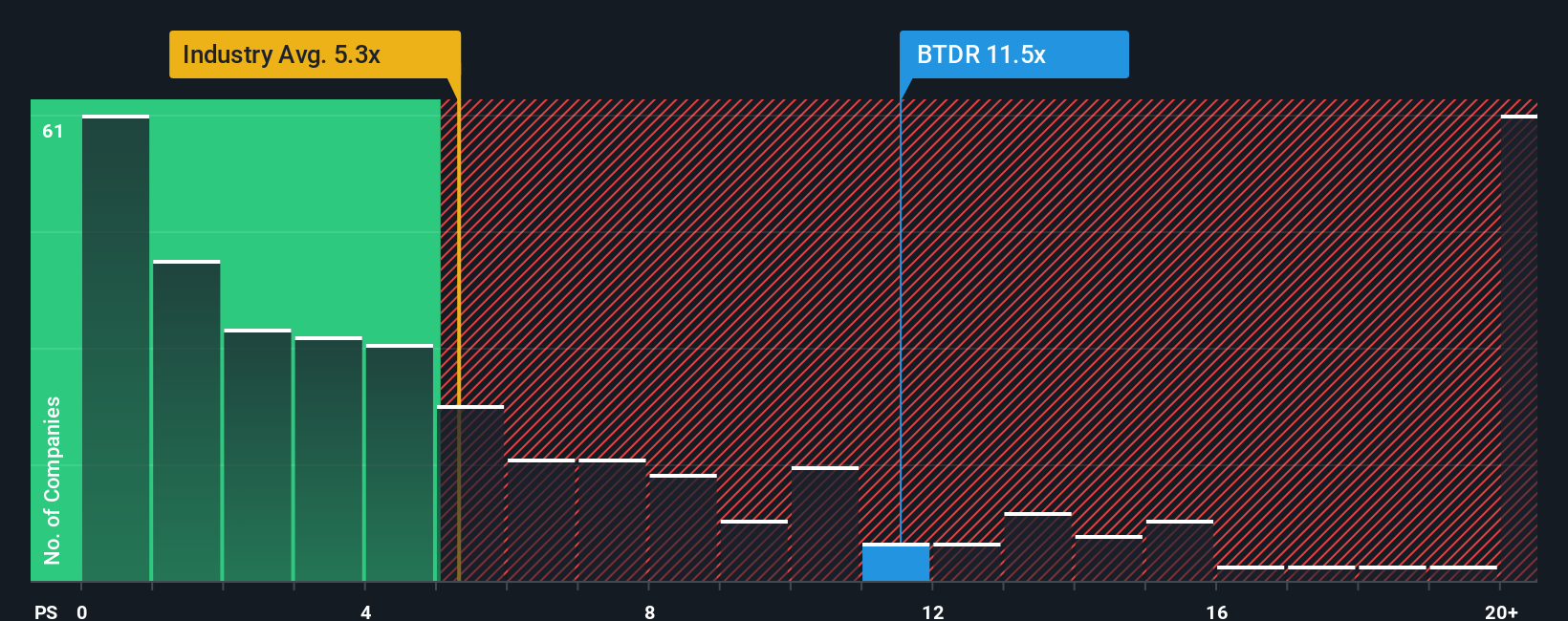

Looking at Bitdeer from a market perspective, its current valuation based on sales lags behind the broader industry. This suggests the stock is more expensive by this measure. Does this challenge the bullish outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If you are curious to explore the numbers for yourself or want to shape a different perspective, crafting your own take only takes a few minutes. Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Seize your chance to uncover high-potential stocks before the crowd catches on. The right idea now could be tomorrow’s winning trade, so do not miss your edge.

- Tap into breakout potential by checking out penny stocks with strong financials. Discover up-and-comers that are already impressing market-watchers with their momentum. penny stocks with strong financials

- Position yourself at the forefront of tech by tracking AI-focused innovators. These companies are redefining everything from automation to predictive analytics. AI penny stocks

- Secure steady income streams by finding dividend stocks with yields above 3 percent. This approach can give your portfolio some defensive power and attractive cash flow. dividend stocks with yields > 3%

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives