- United States

- /

- Software

- /

- NasdaqCM:BTDR

A Look At Bitdeer Technologies Group (BTDR) Valuation After Lawsuits And SEAL04 Project Setbacks

Reviewed by Simply Wall St

Multiple law firms have launched securities class action lawsuits against Bitdeer Technologies Group (BTDR), focusing on alleged misstatements around its SEALMINER A4 rigs and SEAL04 chip, following earnings misses and operational setbacks.

See our latest analysis for Bitdeer Technologies Group.

At a share price of $11.50, Bitdeer’s recent 7 day share price return of 2.59% contrasts with a 90 day share price return decline of 43.93%. Meanwhile, the 1 year total shareholder return decline of 38.11% and 3 year total shareholder return of 9.06% suggest mixed momentum as lawsuits, earnings misses and SEAL04 project delays continue to shape sentiment.

If this sort of legal and operational uncertainty has you looking wider, it could be a good time to scan high growth tech and AI stocks for other high performance computing and software names.

With Bitdeer trading at $11.50, sitting at a reported 96% intrinsic discount and a large gap to analyst targets, you have to ask: is this legal and operational overhang creating a bargain, or is the market already pricing in future growth?

Most Popular Narrative: 65.2% Undervalued

The most followed narrative sets Bitdeer’s fair value at US$33.00 per share, versus the last close at US$11.50, framing a steep valuation gap for investors to weigh.

The planned ramp-up to 40 exahash in self-mining capacity by Q4 2025, leveraging newly developed ASICs and expanded power capacity, is expected to significantly increase Bitcoin production, thereby driving revenue and potentially improving margins due to economies of scale.

Curious how a loss-making miner lands on a much higher fair value? The core is fast revenue expansion, fatter margins and a future earnings multiple that assumes meaningful profitability. Want to see how those moving parts fit together?

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh risks like Q4 2024 revenue dropping to US$69 million and the sizeable US$531.9 million IFRS net loss from derivative swings.

Find out about the key risks to this Bitdeer Technologies Group narrative.

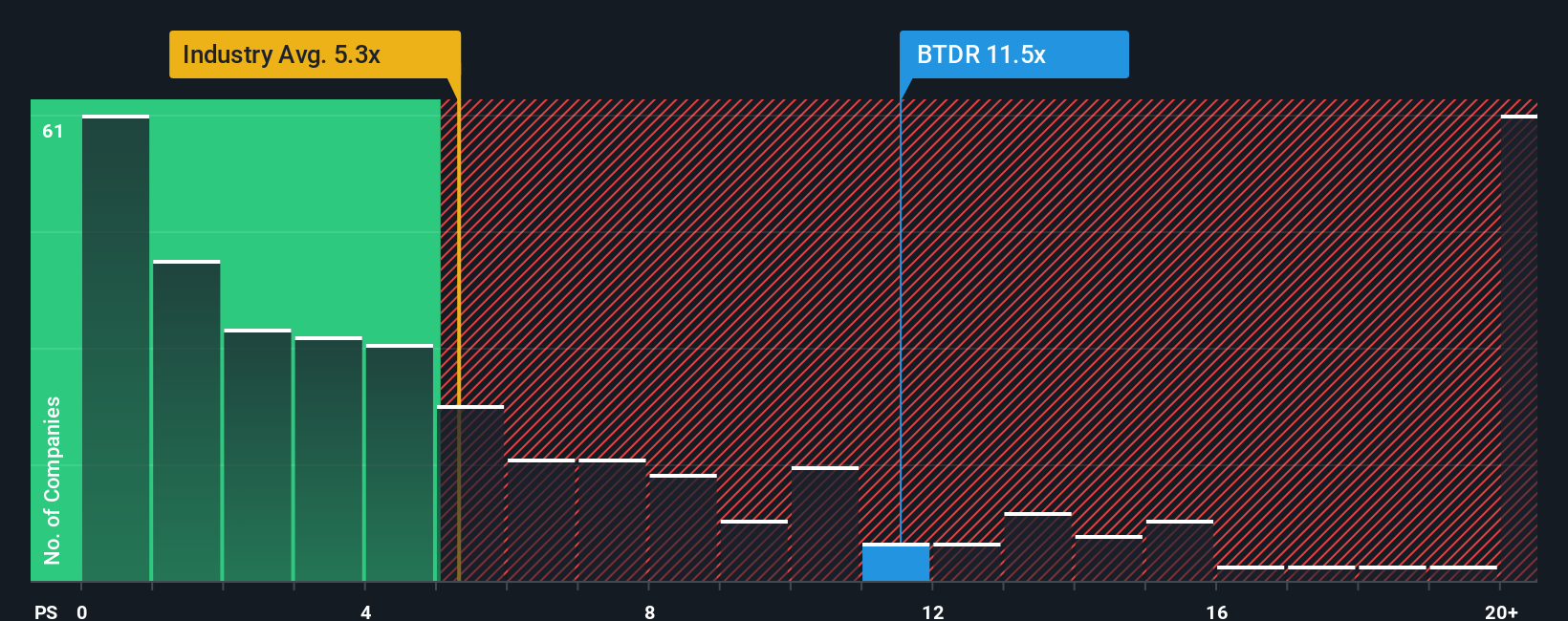

Another View: What The Market Multiple Is Saying

That big 96.3% gap to our SWS DCF fair value of US$312.63 paints Bitdeer as heavily undervalued. The market, however, is pricing the stock on a P/S of 5.9x, which is richer than both the US Software industry at 4.8x and peers at 2.3x, yet still below a fair ratio of 10.5x. So is this a setup for rerating potential, or a sign that expectations already sit high for a business that is still loss making and volatile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If you look at the numbers and reach a different conclusion, or just like testing your own thesis, you can build a fresh view on Bitdeer in a few minutes by starting with Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bitdeer is only one piece of your watchlist, do not stop here. Broaden your opportunity set with focused stock ideas filtered for you.

- Target potential value upside by zeroing in on these 885 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Explore developments in computing by scanning these 29 quantum computing stocks that are working on real use cases in this specialist field.

- Build a cash flow focused watchlist by checking out these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026