- United States

- /

- Software

- /

- NasdaqCM:BTDR

A Look At Bitdeer Technologies Group (BTDR) Valuation After Analyst Rating Shift On AI And Expansion Uncertainty

Analyst rating shift puts Bitdeer Technologies Group (BTDR) under closer scrutiny

A recent rating change on Bitdeer Technologies Group (NasdaqCM:BTDR) highlighted concerns around its AI cloud services and limited visibility on expansion plans, even as some analysts still see potential in its bitcoin mining ambitions.

See our latest analysis for Bitdeer Technologies Group.

The rating change comes after a mixed year for Bitdeer Technologies Group, with a 14.20% year to date share price return and a 30 day share price return of 14.20% contrasting with a 90 day share price return decline of 38.19% and a 1 year total shareholder return loss of 25.77%. This leaves momentum looking fragile despite a 3 year total shareholder return of 25.02%.

If you are weighing Bitdeer’s AI and bitcoin mining story against other opportunities in similar areas, this could be a useful moment to size up high growth tech and AI stocks.

With a recent rating cut, mixed share price performance, an intrinsic value suggesting a discount, and a price target more than double the last close, you have to ask: is Bitdeer undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 58.7% Undervalued

Bitdeer Technologies Group's most followed narrative points to a fair value of about $31.92 per share, well above the last close at $13.19, which puts a lot of focus on the assumptions behind that gap.

The planned ramp-up to 40 exahash in self-mining capacity by Q4 2025, leveraging newly developed ASICs and expanded power capacity, is expected to significantly increase Bitcoin production, thereby driving revenue and potentially improving margins due to economies of scale.

Curious how this narrative connects aggressive capacity build out, margin expansion, and future earnings power into a single fair value number? The model leans heavily on faster revenue growth, a sharp swing in profitability, and a future earnings multiple that sits below many software names. Want to see exactly how those ingredients combine into that $31.92 figure? Read the full narrative to unpack the assumptions behind it.

Result: Fair Value of $31.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case runs into some real friction if revenue softness in cloud and hosting persists, or if high R&D and capex keep margins under pressure.

Find out about the key risks to this Bitdeer Technologies Group narrative.

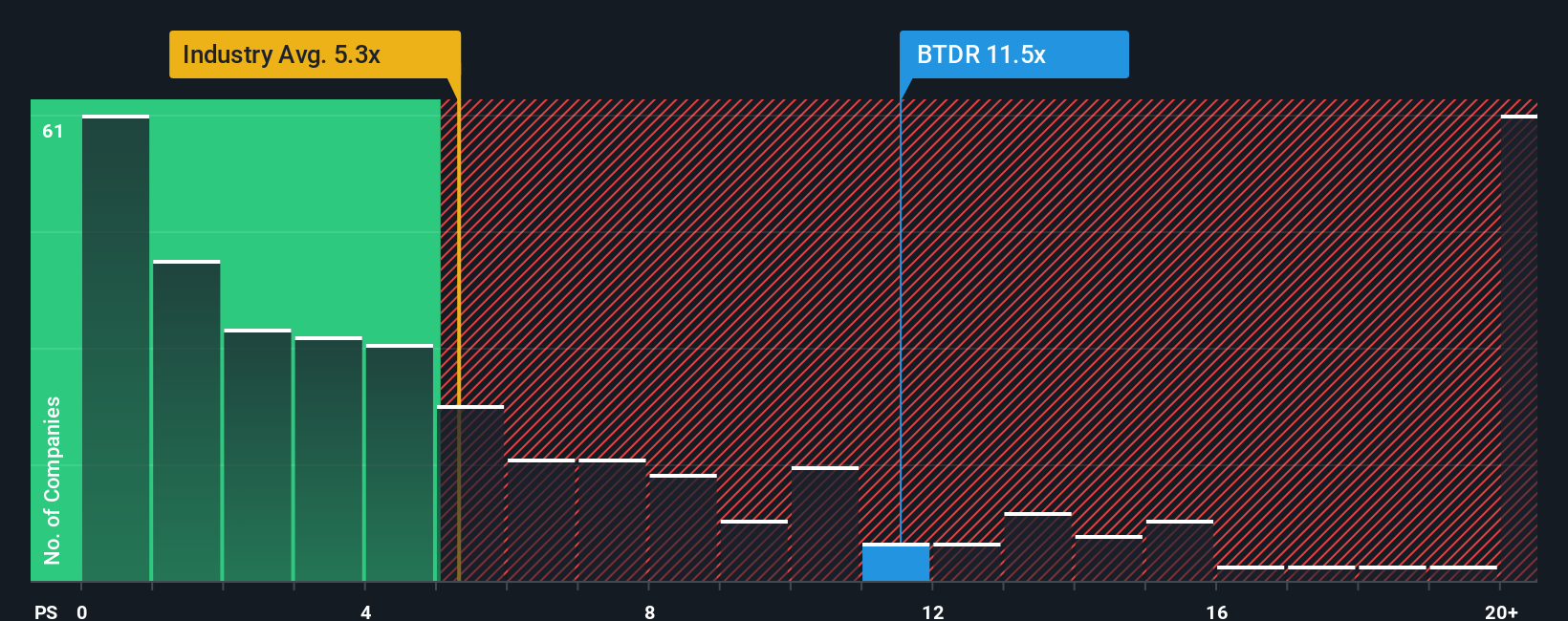

Another angle on valuation: revenue multiples send a different message

While the narrative and intrinsic value work suggest Bitdeer Technologies Group is trading at a steep discount to fair value, the revenue multiple tells a more cautious story. The shares change hands at a P/S ratio of 6.7x, compared with 4.2x for the wider US Software industry and 3.8x for direct peers, yet the fair ratio sits higher at 10.2x. In practice, that means the stock already carries a premium to current peers, even if you think the market could eventually move closer to that fair ratio. This raises the question of how much comfort investors can really take from the apparent upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If you prefer to weigh the numbers yourself or see a different story in the data, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Bitdeer?

If Bitdeer has caught your attention, do not stop there. Use this momentum to check a few focused stock ideas that might better fit your plan.

- Spot potential value gaps by scanning these 876 undervalued stocks based on cash flows to compare current prices with underlying cash flow potential.

- Zero in on income opportunities by reviewing these 13 dividend stocks with yields > 3% that could suit a yield focused approach.

- Get ahead of emerging themes by checking these 18 cryptocurrency and blockchain stocks that are tied to digital asset and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Near-Restart Producer Mexico Silver Miner

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web