- United States

- /

- Software

- /

- NasdaqCM:BTCT

We Don’t Think BTC Digital's (NASDAQ:BTCT) Earnings Should Make Shareholders Too Comfortable

Shareholders were pleased with the recent earnings report from BTC Digital Ltd. (NASDAQ:BTCT). However, we think that investors should be cautious when interpreting the profit numbers.

See our latest analysis for BTC Digital

A Closer Look At BTC Digital's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

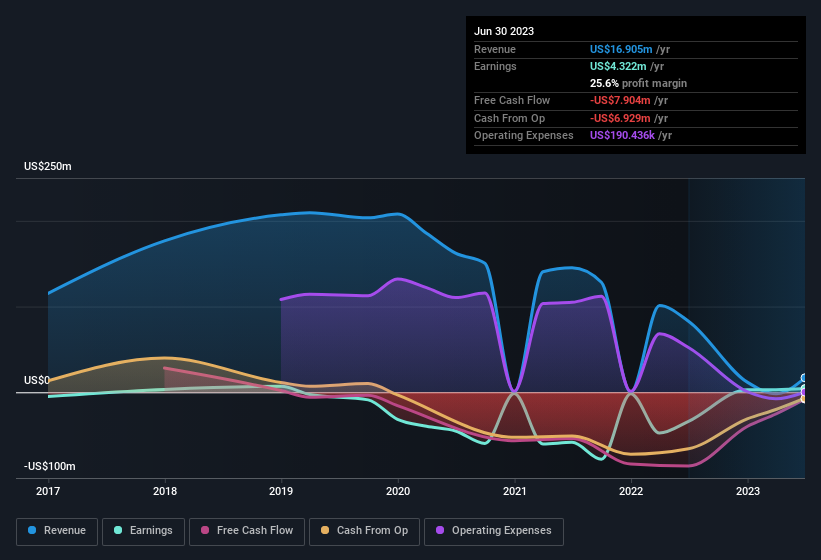

For the year to June 2023, BTC Digital had an accrual ratio of 0.88. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of US$4.32m, a look at free cash flow indicates it actually burnt through US$7.9m in the last year. We also note that BTC Digital's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of US$7.9m. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of BTC Digital.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, BTC Digital issued 79% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of BTC Digital's EPS by clicking here.

A Look At The Impact Of BTC Digital's Dilution On Its Earnings Per Share (EPS)

Three years ago, BTC Digital lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if BTC Digital's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On BTC Digital's Profit Performance

In conclusion, BTC Digital has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). On reflection, the above-mentioned factors give us the strong impression that BTC Digital'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 4 warning signs with BTC Digital, and understanding them should be part of your investment process.

Our examination of BTC Digital has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if BTC Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTCT

BTC Digital

A crypto asset technology company, engages in bitcoin mining business in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026