- United States

- /

- Software

- /

- NasdaqGS:BSY

Does Bentley Systems’ (BSY) AI Education Pledge Signal a Shift in Its Competitive Positioning?

Reviewed by Simply Wall St

- Bentley Systems recently announced it has signed the White House's Pledge to America's Youth: Investing in Artificial Intelligence (AI) Education, pledging to provide AI tools and training to empower future American innovators.

- This move highlights Bentley's expanding influence in shaping the next generation of engineers and underlines its commitment to advancing AI-driven transformation across critical infrastructure industries.

- We'll examine how Bentley's partnership with the White House on AI education could shape its investment narrative and future industry positioning.

The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Bentley Systems Investment Narrative Recap

To be comfortable holding Bentley Systems, an investor needs to believe in the company’s central role in advancing digital transformation and AI adoption in infrastructure sectors, where solutions like digital twins, powered by AI, address both productivity and sustainability. The company’s recent pledge with the White House to promote AI education is more of a long-term brand and pipeline builder than an immediate catalyst, and does not materially alter near-term earnings momentum or mitigate the most pressing risks, such as margin pressure from intense competition and high R&D costs.

Of the recent announcements, Bentley’s launch of new AI tools for civil site design and the integration of Carbon Analysis capabilities into iTwin Experience in July 2025 stands out. This step is directly relevant, as it positions Bentley at the forefront of AI-powered engineering solutions, an area with mounting competitive interest and central to the main catalysts investors are watching for ongoing growth.

Yet, even as Bentley expands its AI capabilities, investors should not overlook growing competitive threats and the risk that agentic AI and automation could disrupt core revenue streams if user-based software pricing loses relevance...

Read the full narrative on Bentley Systems (it's free!)

Bentley Systems' narrative projects $1.9 billion revenue and $443.2 million earnings by 2028. This requires 9.7% yearly revenue growth and a $188.9 million earnings increase from $254.3 million today.

Uncover how Bentley Systems' forecasts yield a $59.08 fair value, a 10% upside to its current price.

Exploring Other Perspectives

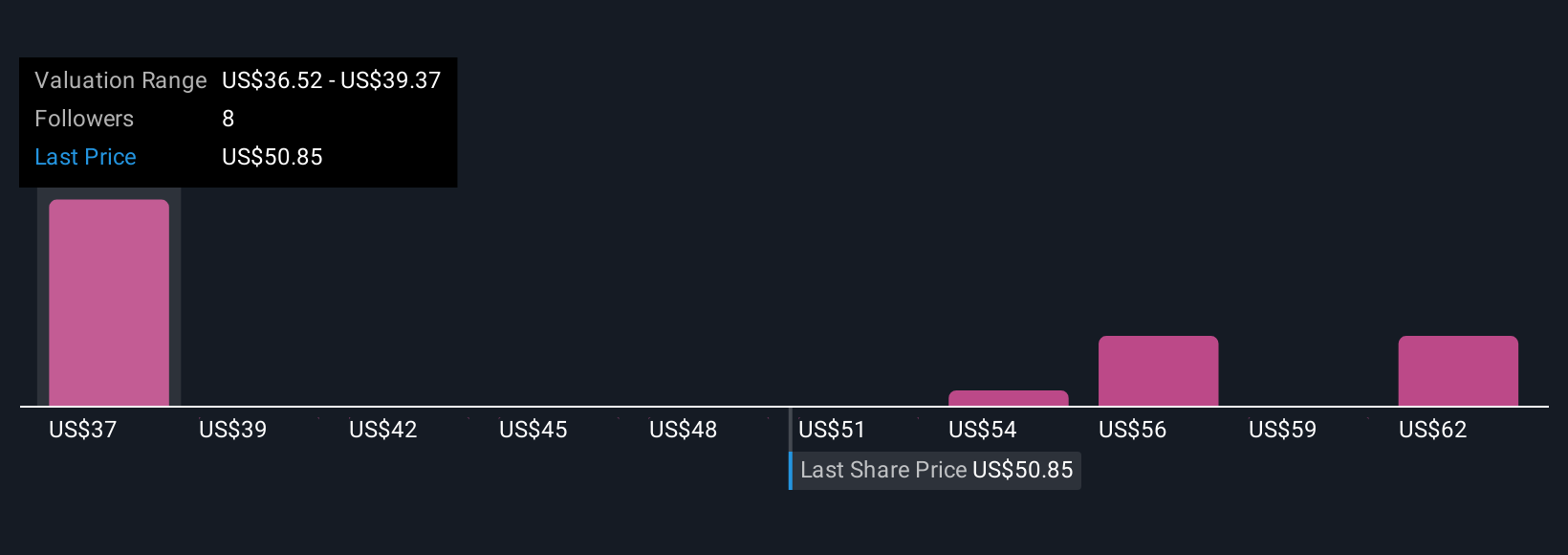

Four Simply Wall St Community members estimate Bentley’s fair value from US$40.52 to US$65, highlighting broad differences in growth expectations. The rising importance of AI-driven transformation shows why individual outlooks can vary widely, consider reviewing several perspectives before making up your mind.

Explore 4 other fair value estimates on Bentley Systems - why the stock might be worth 25% less than the current price!

Build Your Own Bentley Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bentley Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bentley Systems' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026