- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY): Evaluating Valuation After Q2 Revenue Growth and AI-Focused Infrastructure Initiatives

Reviewed by Simply Wall St

Bentley Systems (BSY) is back in the spotlight after its recent Q2 earnings report revealed steady growth in both total revenues and annual recurring revenue. Beyond the headline numbers, what has caught the market’s attention is Bentley’s active push into artificial intelligence, as highlighted by its public pledge to advance AI education for America’s youth. The combination of expanding subscription revenue and a strong commitment to digital infrastructure suggests that the company is not only keeping pace with industry trends, but actively shaping them.

Momentum around Bentley Systems has quietly built over the past year, with the stock delivering a 17.8% return and climbing 13% in just the past three months. Recent shareholder moves and headline-grabbing initiatives, such as equipping students with AI tools and deepening its digital twin platform, have reinforced a narrative of steady leadership and evolving opportunities within infrastructure software. These factors, paired with consistent revenue gains, are making investors sit up and watch for what comes next.

The question now is whether investors are looking at a buying opportunity, or if all this future growth is already reflected in Bentley’s current valuation.

Most Popular Narrative: 8.1% Undervalued

Bentley Systems is seen as undervalued according to the most widely followed narrative, which highlights ongoing digital transformation and infrastructure investment as key tailwinds for the company’s financial prospects.

"Sustained global investment in infrastructure, driven by government initiatives in the US, UK, EU, and high-growth regions like India and the Middle East, continues to expand Bentley's addressable market. This supports durable double-digit ARR and revenue growth. Large-scale productivity challenges, such as the shortage of skilled engineers, are forcing the sector to accelerate digital transformation and are elevating demand for Bentley's AI-driven, cloud-based, and digital twin solutions. These trends may drive both revenue expansion and a higher-margin product mix."

Want to know what’s powering Bentley’s above-market fair value? The narrative hints at massive changes in recurring revenue, evolving profit margins, and an expectation for industry-defying growth. Unpack the critical financial assumptions and see what justifies this premium. Some numbers might surprise even seasoned investors.

Result: Fair Value of $59.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts toward automation and growing competition from cloud-native rivals could challenge Bentley’s growth prospects and put pressure on its recurring revenues in coming years.

Find out about the key risks to this Bentley Systems narrative.Another View: Market Signals a Higher Bar

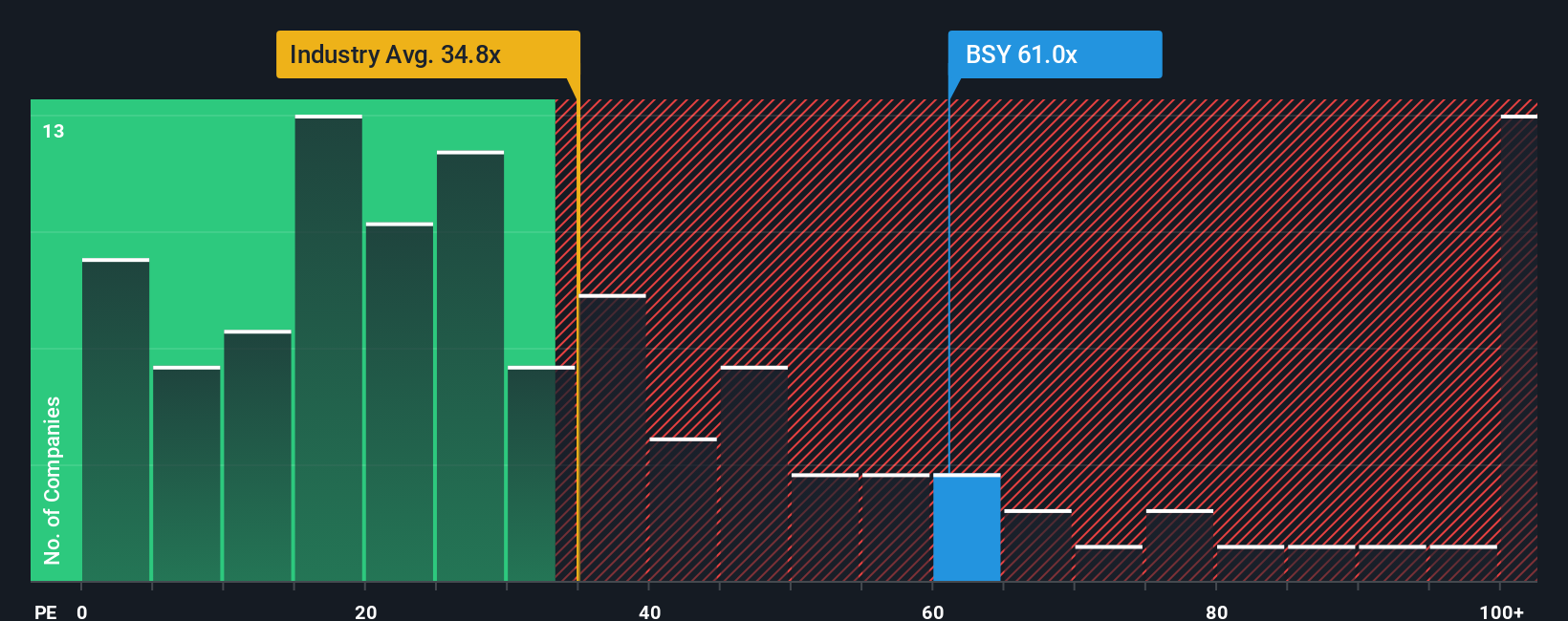

Looking at the company through common valuation ratios paints a challenging picture. The market price is well above typical levels for the sector, which suggests investor expectations might already be stretched. Does this reveal optimism or risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you have a different perspective or want to dig into the details yourself, you can craft your own take on Bentley in just a few minutes. Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let your next winning investment slip away. Unlock a world of potential with targeted stock ideas designed for growth, innovation, and resilience. Here are three powerful ways to supercharge your research right now:

- Access high-growth opportunities by jumping on undervalued stocks based on cash flows and find stocks trading well below their intrinsic value, ripe for a turnaround.

- Capitalize on the AI revolution by following AI penny stocks, where you’ll find tech companies pioneering artificial intelligence breakthroughs before the mainstream catches on.

- Maximize your earning potential with steady dividend stocks with yields > 3% that offer strong yields and consistent returns. This approach can help build wealth in various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026