- United States

- /

- Software

- /

- NasdaqGS:BRZE

Braze (BRZE) Valuation Check After Expanding BrazeAI Decisioning Studio to Google Cloud Marketplace

Reviewed by Simply Wall St

Braze (BRZE) just expanded its AI footprint by listing BrazeAI Decisioning Studio on Google Cloud Marketplace, giving enterprises a cleaner way to deploy its 1:1 personalization engine directly inside existing Google Cloud setups.

See our latest analysis for Braze.

The timing of this move is important, coming after a tough stretch where the share price return is down 31.16 percent year to date despite a modest 6.37 percent 1 month share price return, suggesting sentiment could be stabilizing even as longer term total shareholder returns remain mixed.

If this kind of AI driven growth story interests you, it is worth exploring other names riding similar themes through high growth tech and AI stocks for more potential opportunities.

Yet with the stock still well below analyst targets despite solid double digit growth and a flagship AI launch on Google Cloud, are investors looking at an overlooked compounder, or is the market already baking in the next leg of growth?

Most Popular Narrative: 33.8% Undervalued

With Braze’s fair value estimate sitting above the 29.87 dollar last close, the most widely followed narrative is leaning toward a sizable upside.

Braze's acquisition of OfferFit is expected to enhance AI driven optimization capabilities and lead to revenue growth through deal size expansion and differentiation in the market. This investment should drive better earnings and net margins as OfferFit's sophisticated AI solutions integrate into Braze's platform.

Curious how this story justifies a richer future earnings profile and a premium multiple on a still loss making business? The key assumptions hide in the projected revenue runway, margin lift, and share count path. Want to see the full playbook behind that upside case, and how quickly the model thinks Braze can scale into those numbers?

Result: Fair Value of $45.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration hiccups with OfferFit and rising data sovereignty costs could erode margin gains and challenge the upbeat revenue and valuation assumptions.

Find out about the key risks to this Braze narrative.

Another View: Market Ratio Sends a Different Signal

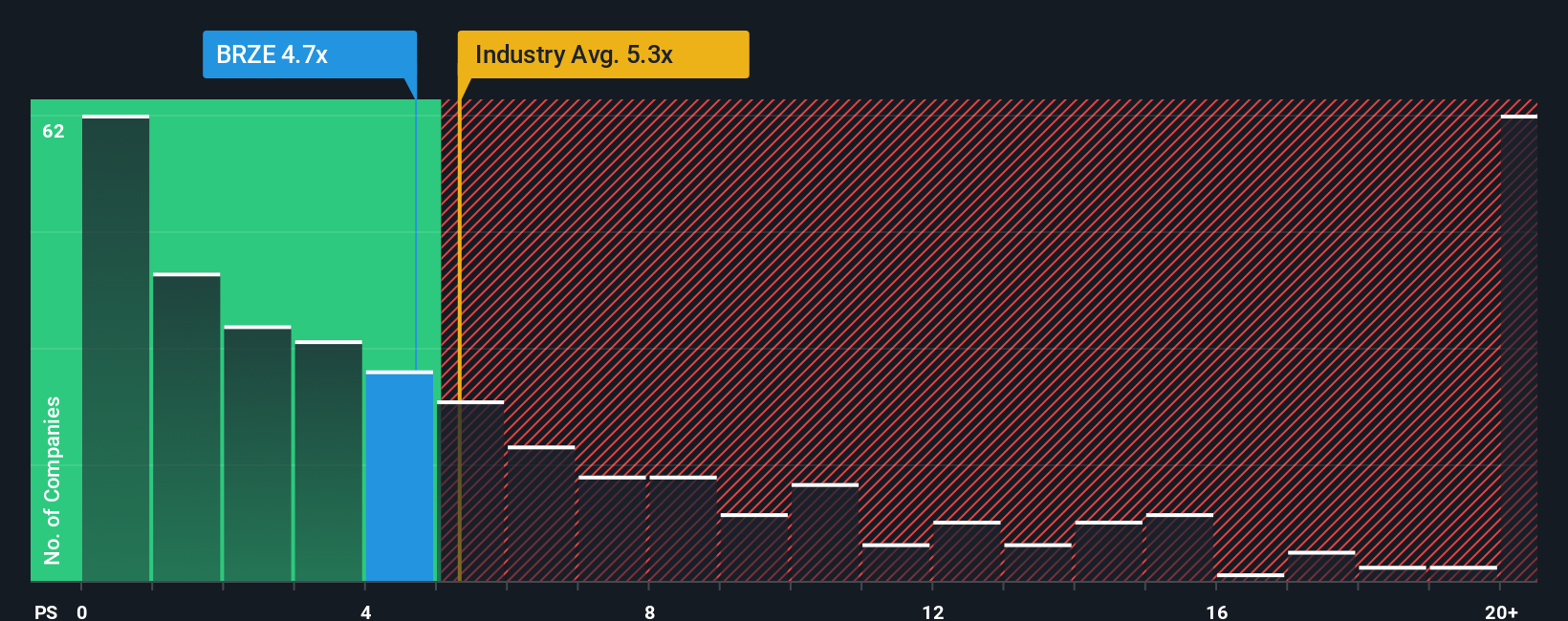

While the narrative suggests upside, the market’s own yardstick tells a tighter story. Braze trades at a price to sales of 5.1 times versus the US software average of 4.9 times and a fair ratio of 4.8 times, which points to a modest premium that leaves less room for error if growth or margins slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Braze Narrative

If this framework does not quite match your view, or you prefer your own deep dive into the numbers, you can easily craft a personalized take in minutes, Do it your way.

A great starting point for your Braze research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to quickly spot other stocks that match your strategy before the market moves without you.

- Capture potential multi-baggers early by reviewing these 3571 penny stocks with strong financials, which pair small share prices with improving fundamentals and momentum.

- Tap into structural tailwinds in automation and data by scanning these 26 AI penny stocks that are positioned at the heart of the AI adoption wave.

- Consider higher yield potential by checking these 15 dividend stocks with yields > 3%, which focus on income above 3 percent while still maintaining fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Braze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRZE

Braze

Operates a customer engagement platform that provides interactions between consumers and brands worldwide.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026