- United States

- /

- IT

- /

- NasdaqGM:BLZE

Backblaze, Inc.'s (NASDAQ:BLZE) 26% Cheaper Price Remains In Tune With Revenues

Backblaze, Inc. (NASDAQ:BLZE) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 77%, which is great even in a bull market.

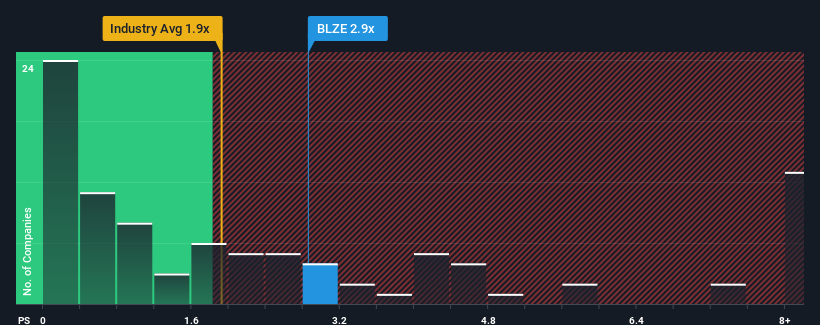

Although its price has dipped substantially, you could still be forgiven for thinking Backblaze is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in the United States' IT industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Backblaze

What Does Backblaze's P/S Mean For Shareholders?

Recent times have been advantageous for Backblaze as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Backblaze's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Backblaze would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Pleasingly, revenue has also lifted 93% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 8.8% growth forecast for the broader industry.

In light of this, it's understandable that Backblaze's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Backblaze's P/S

Backblaze's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Backblaze shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Backblaze (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Backblaze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:BLZE

Backblaze

A storage cloud platform, provides businesses and consumers cloud services to store, use, and protect data in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026