- United States

- /

- Software

- /

- NasdaqGS:BLKB

Does Blackbaud’s New Cloud Launch Signal a Shift in Its 2025 Stock Valuation?

Reviewed by Bailey Pemberton

- Ever wondered if Blackbaud’s stock is hiding untapped value, especially after all the buzz and recent moves in tech? You’re not alone, and today we’re diving in to see what’s really going on with its price tag.

- Blackbaud jumped 5.4% in the last week and 7.5% over the past month. However, the stock is still down 7.8% this year and 8.5% over twelve months, which suggests changing investor sentiment or the start of a turnaround story.

- The recent launch of Blackbaud’s new cloud-based solutions for nonprofits has caught industry attention and is shining a spotlight on the company's evolution and innovation. This fresh momentum provides the ideal backdrop to revisit where the stock might be headed from here.

- Currently, Blackbaud has a valuation score of 3 out of 6, meaning it checks the undervalue box on half of our key metrics. We will break down how different valuation approaches can offer perspective and reveal an even sharper strategy for finding real value at the end of this article.

Find out why Blackbaud's -8.5% return over the last year is lagging behind its peers.

Approach 1: Blackbaud Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors understand what the business could be worth based on expected future cash generation, rather than just current earnings or assets.

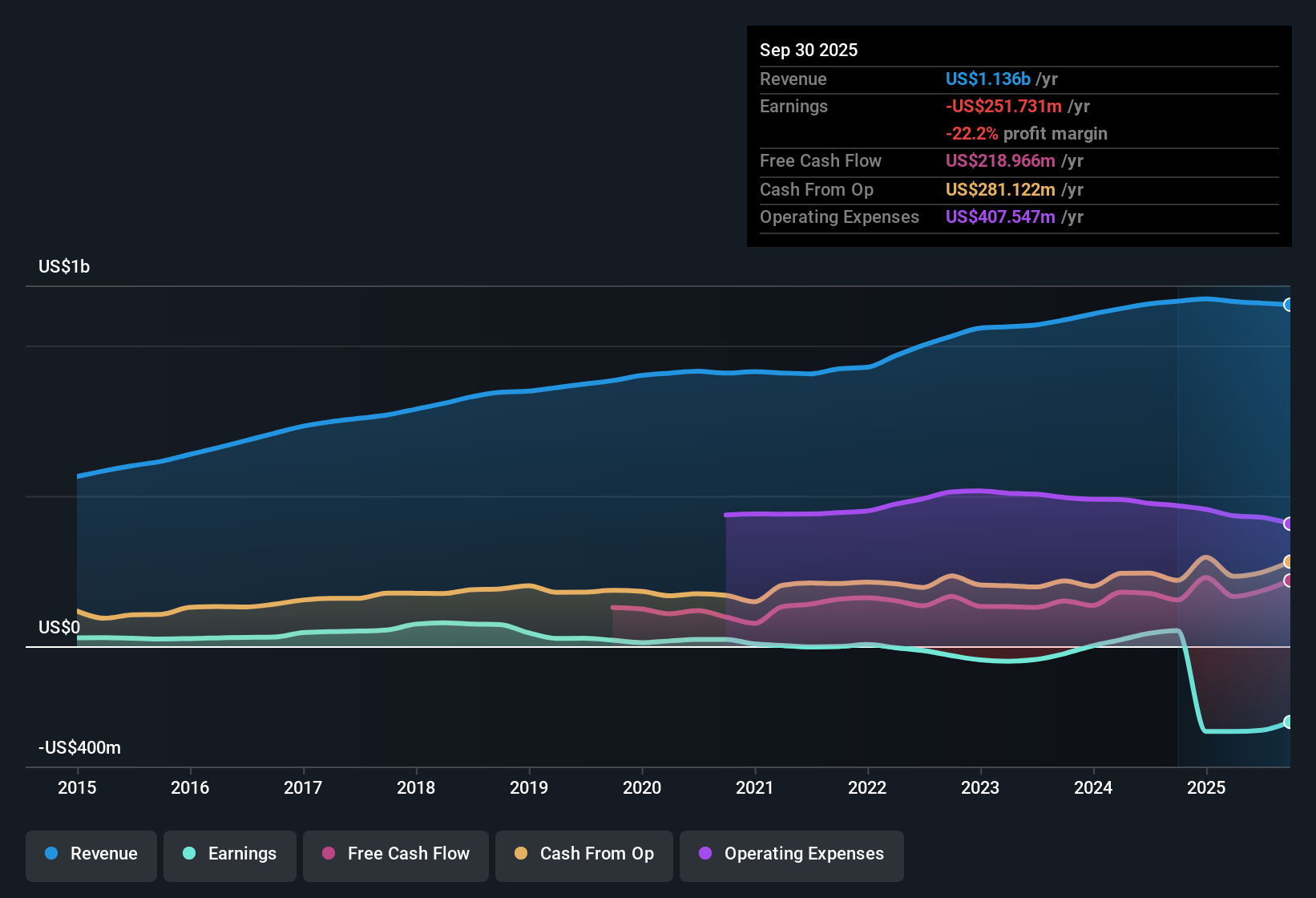

For Blackbaud, the most recent Free Cash Flow (FCF) stands at $178.8 million. According to analyst estimates and Simply Wall St’s model, FCF is projected to steadily grow and reach $283.6 million by 2029. Beyond this period, further projections are extrapolated based on modest annual growth assumptions.

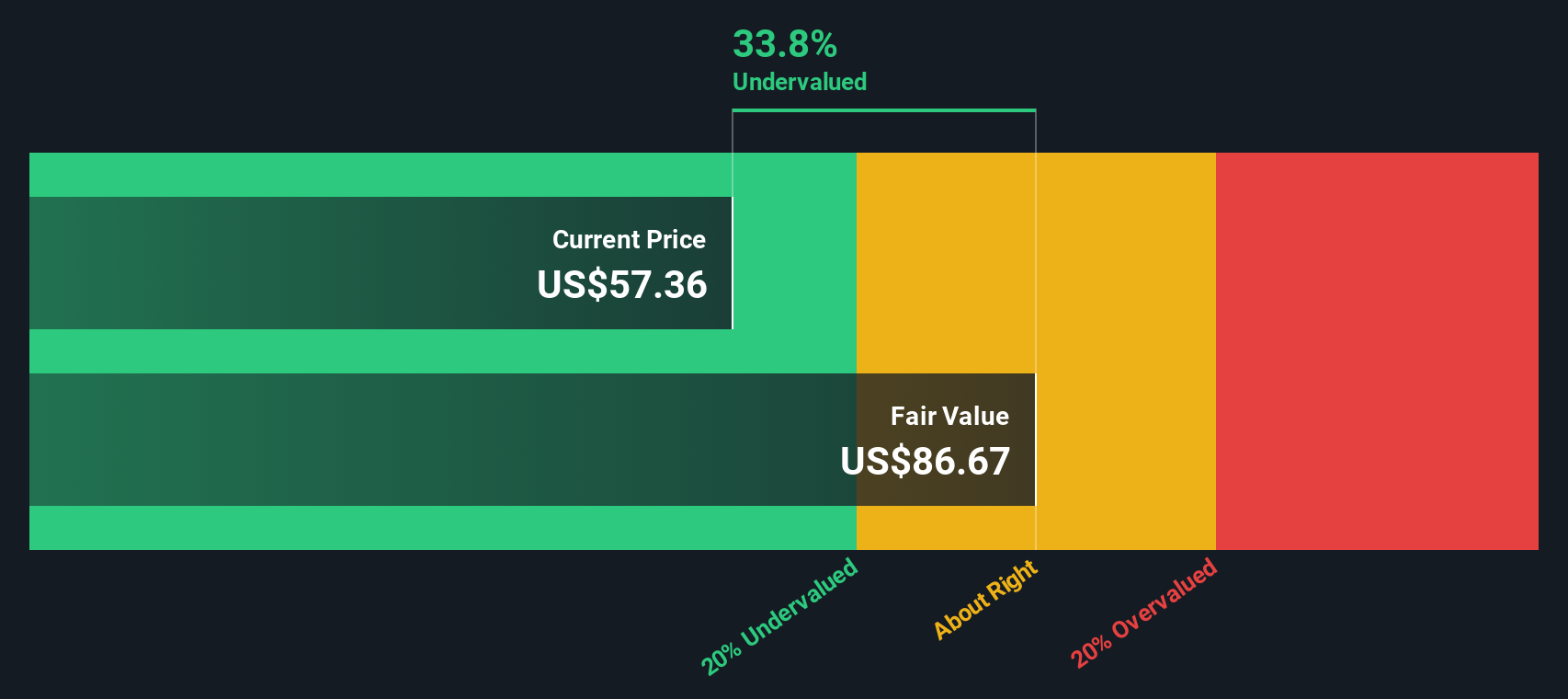

The DCF analysis uses these cash flow forecasts to calculate an intrinsic value for Blackbaud of $84.77 per share. Compared to its current price, this implies the stock is trading at a 19.8% discount. This means the shares appear to be undervalued by the model’s calculation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Blackbaud is undervalued by 19.8%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Blackbaud Price vs Sales

The price-to-sales (P/S) ratio is a useful valuation metric, especially for companies like Blackbaud where profitability may fluctuate from year to year. It allows investors to compare the market's value of the company to its total sales, offering a perspective that is less susceptible to accounting treatments or short-term swings in net income. This makes it an effective way to gauge if the market is paying a fair price for the company's revenue, even if profits are uneven.

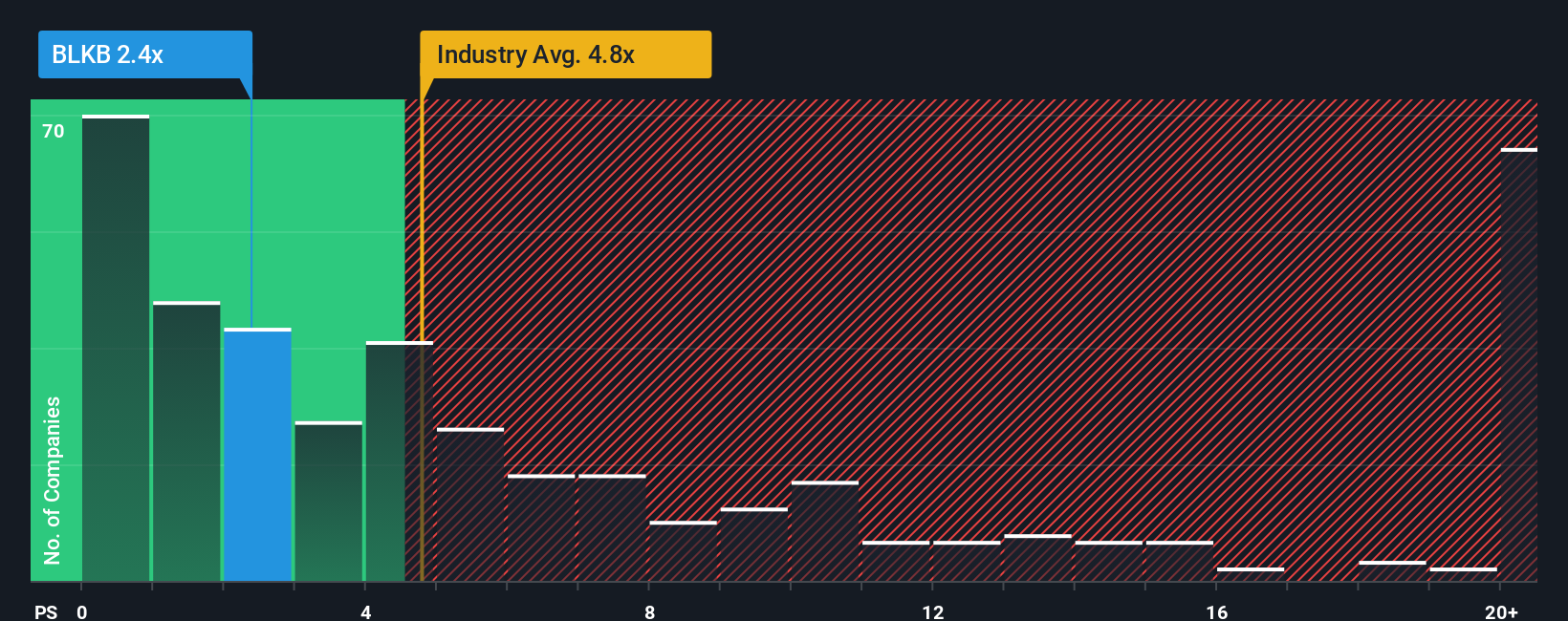

Growth expectations and perceived risks play a big role in what constitutes a fair P/S ratio. Higher expected sales growth or lower risk typically justify a higher multiple, while lower growth or increased risk drag it down. For context, Blackbaud’s current P/S ratio sits at 2.84x, which is below both the software industry average of 5.24x and its peer average of 3.29x.

Simply Wall St goes further by calculating a "Fair Ratio" for each company. For Blackbaud, the Fair Ratio is 2.63x. This proprietary metric factors in much more than just industry averages or what peers are trading at. It incorporates Blackbaud’s sales growth outlook, profit margins, risks, industry dynamics, and market capitalization, giving a truly tailored view of valuation.

Comparing Blackbaud’s actual P/S ratio of 2.84x to its Fair Ratio of 2.63x suggests that the stock is valued about right. The difference between the two is small, indicating the share price currently reflects the company’s prospects and risks quite accurately.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackbaud Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible tool that lets you anchor your view of a company like Blackbaud to a story—your own perspective about how its future will unfold—instead of just numbers on a page.

With Narratives, you connect the company’s story (what's driving its growth, risks, and possibilities), your forecasts for things like revenue, profit margins, and growth rates, and the assumptions behind your estimated fair value. This bridges the gap between what you believe about Blackbaud’s potential and the financial models that shape buying and selling decisions.

Narratives are built right into Simply Wall St’s Community page, used by millions of investors. They allow you to easily compare your fair value estimate to the current market price, so you can quickly decide how Blackbaud fits into your investment strategy based on your story for the company. In addition, as news or earnings updates come in, Narratives are automatically refreshed with meaningful context, helping you stay agile and up-to-date.

For example, one investor may believe Blackbaud’s new AI initiatives will drive significant future earnings and set a fair value at $85 per share, while another, more cautious investor might worry about competition and assign a value closer to $65. Your Narrative helps you cut through the noise and invest with conviction.

Do you think there's more to the story for Blackbaud? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackbaud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BLKB

Blackbaud

Engages in the provision of cloud software and services in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives