- United States

- /

- Software

- /

- NasdaqCM:BLIN

We Think Shareholders Are Less Likely To Approve A Pay Rise For Bridgeline Digital, Inc.'s (NASDAQ:BLIN) CEO For Now

In the past three years, the share price of Bridgeline Digital, Inc. (NASDAQ:BLIN) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 16 September 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Bridgeline Digital

How Does Total Compensation For Ari Kahn Compare With Other Companies In The Industry?

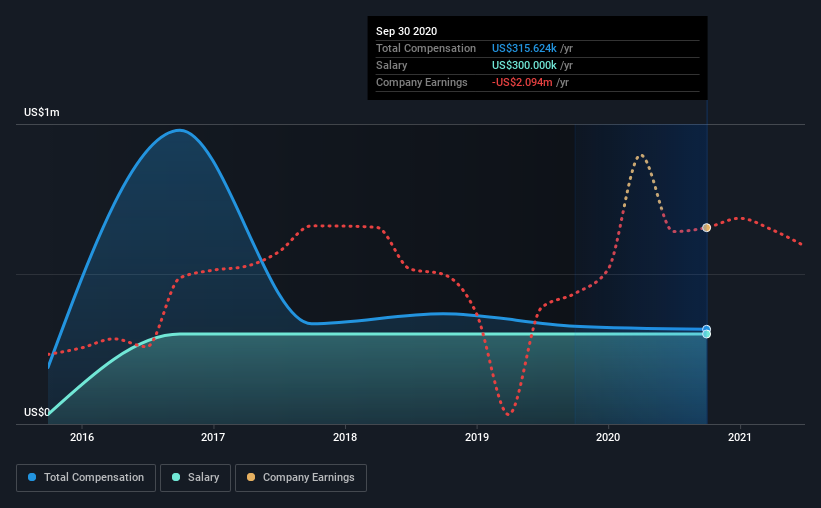

According to our data, Bridgeline Digital, Inc. has a market capitalization of US$40m, and paid its CEO total annual compensation worth US$316k over the year to September 2020. That's a slight decrease of 3.2% on the prior year. We note that the salary portion, which stands at US$300.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$360k. So it looks like Bridgeline Digital compensates Ari Kahn in line with the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$300k | US$300k | 95% |

| Other | US$16k | US$26k | 5% |

| Total Compensation | US$316k | US$326k | 100% |

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. Bridgeline Digital pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Bridgeline Digital, Inc.'s Growth Numbers

Bridgeline Digital, Inc.'s earnings per share (EPS) grew 115% per year over the last three years. It achieved revenue growth of 8.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bridgeline Digital, Inc. Been A Good Investment?

Few Bridgeline Digital, Inc. shareholders would feel satisfied with the return of -91% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Ari receives almost all of their compensation through a salary. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Bridgeline Digital you should be aware of, and 1 of them is a bit unpleasant.

Important note: Bridgeline Digital is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Bridgeline Digital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bridgeline Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BLIN

Bridgeline Digital

Operates as a marketing technology company in the United States, Canada, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives