- United States

- /

- Software

- /

- NasdaqGS:AVPT

A Fresh Look at AvePoint (AVPT) Valuation After Major Confidence Platform Upgrade

Reviewed by Simply Wall St

AvePoint (AVPT) just rolled out a major update to its Confidence Platform, introducing multi-SaaS data protection, new backup options for widely used business apps, and features to monitor the lifecycle of AI agents. The launch also includes an Operational Efficiency Command Center, which is designed to help organizations keep their data governance both centralized and streamlined as multi-cloud needs increase.

See our latest analysis for AvePoint.

AvePoint’s feature-packed product rollout comes as the stock continues to show strong long-term momentum, with a 24.6% total shareholder return over the past year and an impressive 244% three-year gain. While there has been some short-term volatility, recent product innovations have helped build enthusiasm around the company’s growth potential and its role in the evolving SaaS security landscape.

If product expansions like this spark your interest, now is a perfect moment to discover See the full list for free.

With AvePoint’s shares trading at a discount to analyst targets and strong long-term results, the question is whether the recent innovations unlock further upside or if Wall Street has already considered the company’s future growth prospects.

Most Popular Narrative: 30% Undervalued

AvePoint’s current share price remains well below the narrative’s fair value estimate, even after the recent rally and improved revenue projections. This positions the stock as having meaningful upside according to the most widely discussed data-driven view.

The accelerating enterprise adoption of AI tools like Microsoft Copilot, along with increasing security and data governance challenges, is positioning AvePoint's data management and governance solutions as mission-critical. This is driving robust customer expansions and higher spending per customer, serving as a catalyst for sustained revenue growth and stronger net retention rates.

Want to know which blockbuster assumptions are fueling this bullish outlook? The narrative hinges on aggressive revenue expansion, dramatic profit margin leaps, and a future profit multiple higher than most industry heavyweights. Find out what’s powering this gigantic fair value calculation and how it stacks up against Wall Street’s expectations.

Result: Fair Value of $21.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Microsoft and slow progress expanding beyond their ecosystem could limit AvePoint’s growth and threaten its future market relevance.

Find out about the key risks to this AvePoint narrative.

Another View: What the Price Ratio Reveals

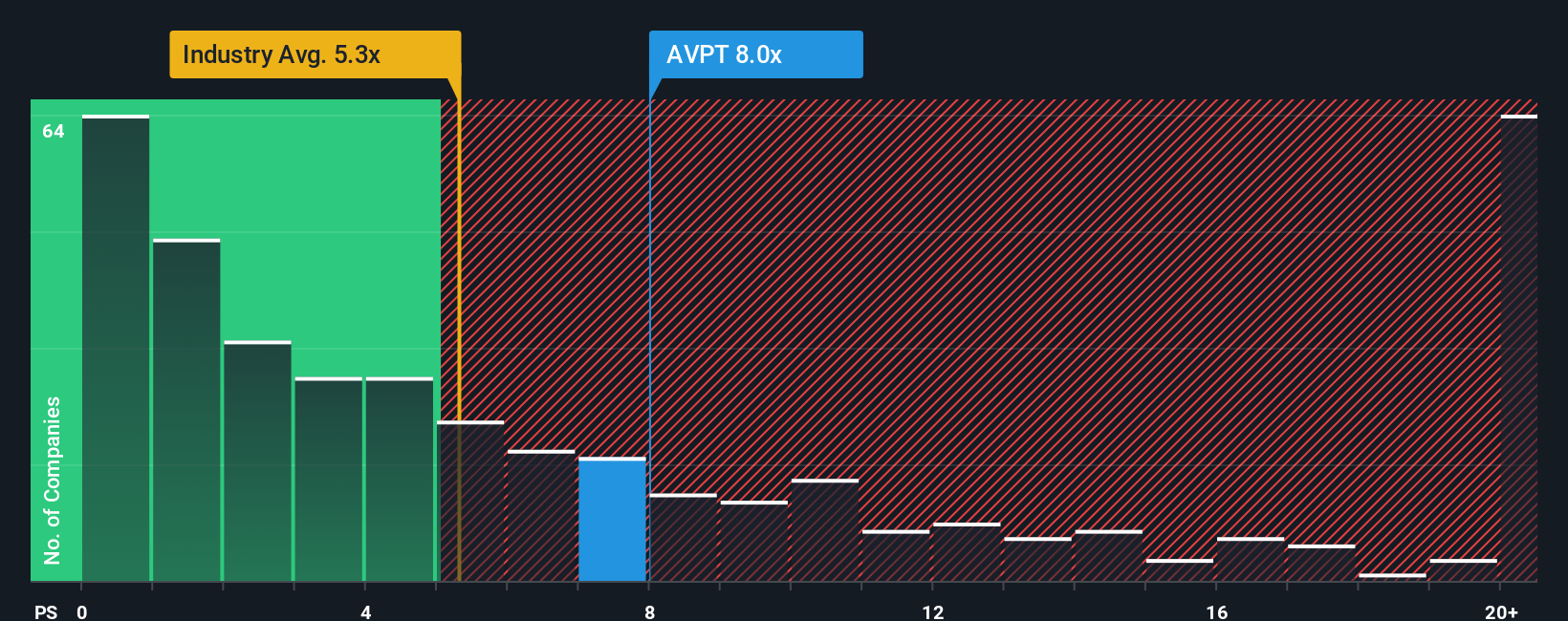

When we look at AvePoint using its price-to-sales ratio, the story shifts. At 8.5 times sales, AvePoint looks pricey compared to both its US software peers at 6.8 times and the wider industry at 5.3 times. The fair ratio the market could move toward is 6.4 times sales, suggesting investors are currently paying a premium. Does this mean the growth narrative is too optimistic or is there hidden value yet to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AvePoint Narrative

If you see things differently or want to dig into the data on your own terms, building a narrative that fits your view takes just a few minutes. Do it your way

A great starting point for your AvePoint research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your investment potential by tapping into these powerful stock ideas. Don't let opportunity pass you by; your next smart move could be just a click away.

- Tap into rising cash flow and uncover value by checking out these 876 undervalued stocks based on cash flows packed with companies trading below their true worth.

- Zero in on market-beating yields and steady income when you browse these 17 dividend stocks with yields > 3% featuring top stocks with impressive dividends over 3%.

- Get ahead of the curve and seize growth in AI innovation with these 27 AI penny stocks spotlighting businesses transforming industries through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives